Online savings: financial education in isolation

“[Completing the financial education modules] online is easier for me as I’m a single mum. I work and I have to look after my kids who are 100 per cent under my care.” – Menuka, Saver Plus participant

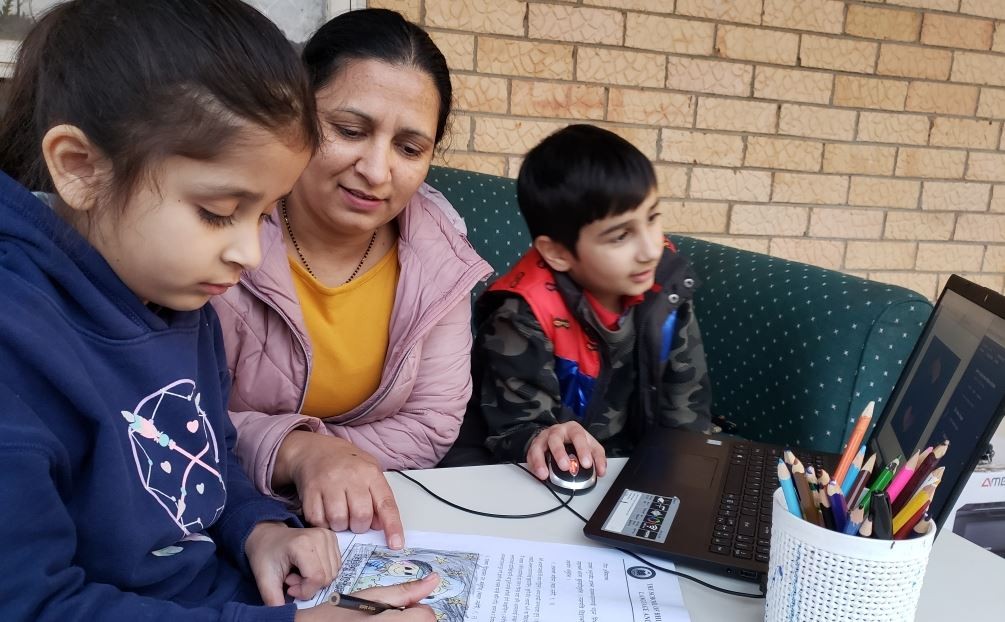

COVID-19 and a new learning opportunity: Menuka and her children, Sebika (5) and Simon (8)

COVID-19 has forced everyone, everywhere to rethink the way they do things. And a lot of those things are now done digitally.

From staying connected with friends, family and colleagues via video conference, keeping fit with the help of an app or collecting a meal curb side from of a favourite restaurant, there’s no doubt we’re now living in a more digital world. For some, this shift online has delivered unexpected benefits.

Single mother of two Menuka is a participant in matched funds and financial education program Saver Plus. She’s a big advocate and now she says being able to access the program online throughout this period has enabled her children to sit alongside her and participate in the program too.

Transitioning online

Menuka’s children Sebika (5) and Simon (8) are members of the generational cohort some refer to as “Gen Alpha” - anyone born after 2010. They have grown up using technology in every area of their lives.

When Saver Plus moved to delivering its program online in order to meet public health recommendations for social distancing, Menuka was delighted at her children’s enthusiasm to participate.

While the family could build their financial skills together in the comfort of their own home, being online also allowed Menuka to complete the modules when it best suited her. “Online is easier for me as I’m a single mum. I work and I have to look after my kids who are 100 per cent under my care,” she says. “Sometimes it was a bit hard to manage the time to go out and attend the training.”

Dollar for dollar matching

Developed by the Brotherhood of St Laurence and ANZ in 2003, Saver Plus is a free program that assists people build their financial knowledge, establish a savings habit and save for their own or their children's education.

“It’s a wonderful program which really helps people feel much more in control of their lives and think that in hard times, they stick to that even when they have an out, a very generous out, is great testament to the value of this work,” says Executive Director of the Brotherhood of St Laurence, Conny Lenneberg with ANZ CEO Shayne Elliott on a webcast update to staff.

Participants of the program open an ANZ savings account, set a savings goal and save towards it regularly over 10 months while attending MoneyMinded financial education sessions. Upon reaching their goal participants receive $1 from ANZ for every $1 saved, up to $500, which must be spent on education.

Since its inception more than 45,000 Australians have participated in Saver Plus, collectively saving more than $24 million.

In the past, the MoneyMinded financial education sessions have predominantly been delivered as face-to-face workshops by community organisations across Australia. The change to online delivery however, has brought additional benefits to participants and their families.

“We’ve been pleasantly surprised by how readily our participants have adapted to online delivery over the past few months. We’re in discussions with our community partners, especially BSL, on how we can adapt the program post COVID-19 without accidentally excluding those who cannot easily access online modules,” says Janet Liu, Senior Manager Financial Inclusion.

Sole parents and financial wellbeing

According to the 2019 MoneyMinded Impact Report, in Australia 67 per cent of MoneyMinded participants are female and 47 per cent are sole parents.

Source: MoneyMinded Impact Report

Menuka, who works school hours as a Bilingual School Service Officer (BSSO), kept her children home for two weeks at the beginning of the pandemic. “I was really scared during this situation. I didn’t have anyone to help me throughout the day,” she says. “I kept sending my children [to school] even though I was scared and I kept going to work even though I was scared. Managing time was very hard.”

A financial literate Gen Alpha

Menuka says completing the online MoneyMinded modules with her children propelled her son Simon into thinking about different ways to save money. “Spending leaks were a real focus for Simon. He identified that buying a chocolate or lollypop every time we go to the shops is a spending leak,” she says. “He knew it was unnecessary.”

“Simon actually said to me ‘Let’s not buy too much. It’s ok sometimes, but not every time. Then we can save that money’” Menuka recounts. “He’s been talking about his dream of a two storey house for years. Now he sees how we can save for that house.”

RELATED STORIES

Communities

Finance, wellbeing and helping everyone do and be

Communities