Pacific workers picking financial skills, fresh produce

“In some cases, workers earn more than 10 times what they would in their home countries. It is estimated that money sent back to the Pacific from overseas can make up around 25 per cent of a household's disposable income.”

The Australian agriculture industry, particularly the fresh produce sector, has always had a heavy seasonal labour requirement. For decades, this has been filled by a balance of domestic, backpacker and overseas work programs.

When COVID-19 hit in 2020, border closures restricted international visitors and prevented people moving between states in Australia. Farmers were left with crops and no one to pick them and sadly plenty of perfect produce had to go to waste.

The Federal Government’s Pacific Labour Scheme helps to fill regional and rural labour shortages when the recruitment of Australian workers has been unsuccessful, by connecting Aussie businesses with labour from nine Pacific Islands and Timor Leste.

Workers gain valuable experience, see what Australia has to offer and earn Australian award wages while helping our farmers harvest crops during peak seasons.

It’s a win-win solution for Aussie farmers and Pacific workers.

Help from our Pacific neighbours

For Aussie farmers, critical food crops are harvested and processed by diligent, skilled workers who have an opportunity to earn incomes to support their families and communities back home.

In some cases, workers earn more than 10 times what they would their home countries. It is estimated that money sent back to the Pacific from overseas can make up around 25 per cent of a household's disposable income.

Learning new financial skills

Workers arriving from the Pacific are required to complete 14 days of mandatory quarantine when they arrive in Australia, before they are able to start work.

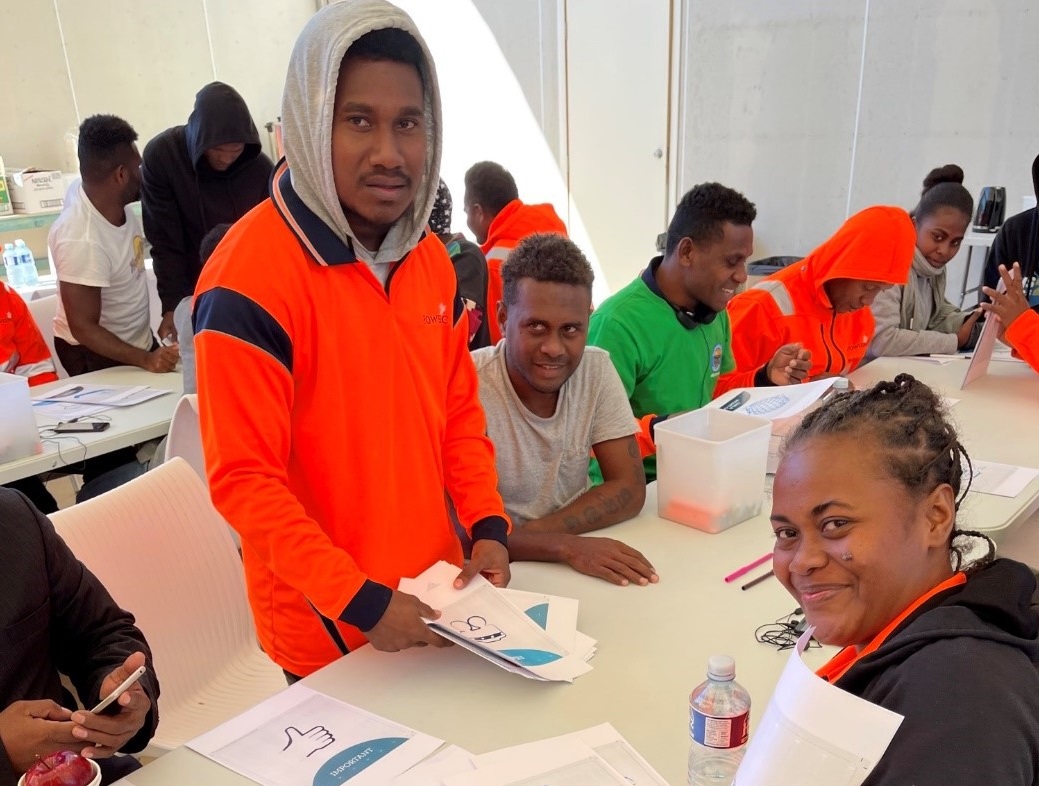

Putting the 14 days to good use, arrivals from the Pacific took part in ANZ’s financial education program, MoneyMinded, delivered by Powerpac, an approved provider of the Federal Government’s Pacific Labour Scheme.

The program is designed to help participants make informed decisions about their money and focuses on budgeting, saving and building money skills.

“For some seasonal workers it’s the first time they’ve had a bank account so programs like MoneyMinded - that ensure hard earned money is efficiently saved and utilised - are really valuable,” says Powerpac CEO, Kasey Rudd.

Kasey undertook accreditation for MoneyMinded while studying for her MBA and running Powerpac.

“The MoneyMinded program is extremely well-designed and the concepts have been contextualised for Pacific Islanders," she says.

"We used MoneyMinded as a springboard to talk to the workers about many issues.”

“I really learned a lot from the MoneyMinded training today. Thanks to our trainer this gives us ideas on how to prioritise what we spend money on,” MoneyMinded participant Jay says. “We need to analyse what is very important, important and not important.”

As well as helping fill labour gaps in regional areas that struggle to attract and retain sustainable reliable labour, the Pacific Labour Scheme workers live within the towns they work in, becoming a part of the community and contributing to the area in which they live.

It is estimated as many as 500 Pacific Island workers will complete the program while in quarantine this year.

As part the partnership with Powerac, ANZ supports businesses that pay and treat their workers fairly in line with its commitments.

RELATED ARTICLES

NZ Community

Helping seasonal workers unpack their finances

Financial literacy