A century of banking knowledge

Mark Monaghan and Michael Rose and Anna Corr talk to Andrew Cornell on podcast.

Forty years ago there was no internet banking; indeed no internet. Forget Apple Pay, credit cards were still rare and copper coins were still in use. And banking was based on paper. Lots and lots of paper.

So much has changed in banking over the last 40 years. We’ve seen recessions, stock market crashes, bond market tantrums. And pandemics. Meanwhile, banking has become a technology business – although still with a human face.

With 100 years of banking experience between them, ANZ’s Head of Corporate & Customer Institutional Michael Rose, Head of Research & Analysis, Head of Credit and Capital Management Anna Corr, and Senior Advisor Institutional & Corporate Relationships Mark Monaghan, know banking isn’t just about technology – it’s about building relationships that last.

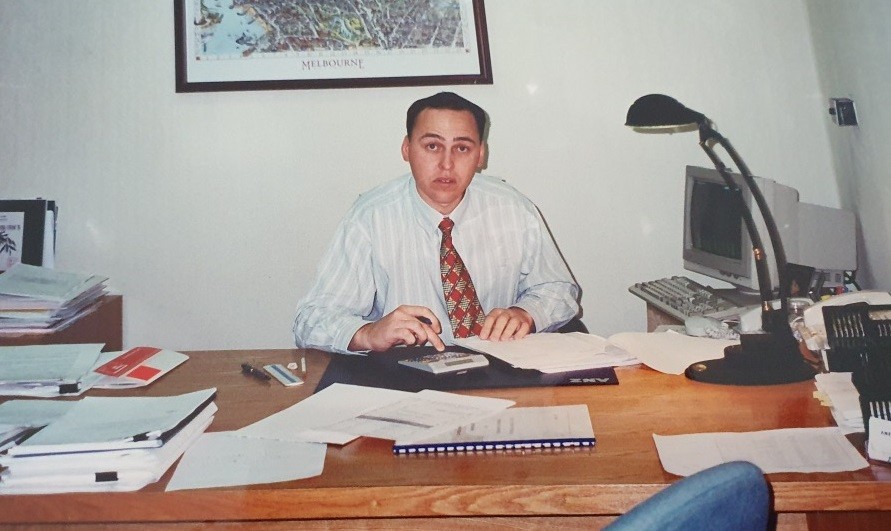

Michael Rose, in his early days of working for ANZ

Under pressure

Their experience spans the ‘87 stock market crash, the ‘92 recession, the Asian crisis in ‘97 and the dot com collapse in 2001. And Mark, Michael and Anna were instrumental in guiding customers and employees through the COVID-19 pandemic.

Talking with her colleagues on podcast, Anna explains that as tragic as a crisis can be, each one is also an opportunity to learn.

“I said to all the (new ANZ) graduates, what happened with COVID-19 was a hugely tragic position, but this is a great learning experience. You don't know all the answers. You're not expected to know the answers, but you've got to have that responsiveness to your client as well as responsiveness to the regulators, to the bank and to the shareholders,” she says.

“When I look at COVID-19, when I look at the GFC [Global Financial Crisis], it was a frenetic pace of responsiveness. We learnt that clients did value us for being able to respond to them and provide them with the certainty of funding. But also when I look back, we had to be much simpler and streamlined because we didn't have the luxury of time. We had to do things a lot faster, a lot more effectively and a lot more efficiently because the requests were coming at us all over the place.”

Michael agrees, while adding each crisis is only a beneficial learning experience if the whole organisation learns from its past and doesn’t repeat the same mistakes.

“How do you maintain corporate memory? Credit to Shayne [Elliott] - he summoned a few experienced people, including Mark [Monaghan] and said, ‘how did we deal with those things in the past?’ so the people that were part of the executive team that hadn't gone through those particular events and journeys didn't make the same mistakes,” he says.

This was something Michael saw reflected across the financial services industry within the pandemic.

“Not just ANZ, but the way all the banks reacted through COVID-19 showed a measure of maturity in the Australian financial system,” he says. “And the customers were very thankful for the way banks didn't panic. And how do you keep learning from these things? How do you keep that corporate memory given people come and go? I think that's a big challenge for the organisation.”

Mark Monaghan and colleagues at ANZ in the mid 1990s

Business of relationships

As technology has become more all-pervasive, banks have become more responsible for how they share insights with partners.

“Information is power,” Michael says. “With platforms and technology, everyone's got information. And the one thing all customers tend to look for – it doesn’t matter if it’s small business, corporate or institutional - because we've got commoditised products, we’ve got hyper competition. They're looking for insights.”

Mark agrees strong relationships are formed when both parties are happy with the outcome.

“The reality is we need to be relevant to them,” he says. “We need to have a plan around each major client and we need to talk them about the things that matter to them and help them. Our jobs pretty simple: to help them make the financial decisions to execute on their strategy. It's not about our strategy. It's about their (strategy), what they need to do to execute that.

“It's really important in the roles of our not just ourselves, but our bankers to really know what's going on inside our client base, what's really happening inside those companies. And that requires the skills of asking the real questions, making sure we get the right answers and of course, make it clear to the client that it is for their benefit as well.”

Anna Corr on her first day at ANZ.

Lessons learned

Reflecting on his years of experience, Michael claims his biggest discovery is learning how to orchestrate positive results for both the customer and the organisation.

“Everyone's got their views about how they should be progressing,” he says. “There are a lot of intelligent people around the bank and people have got views and the different business units and different product areas have got their agendas. So over time, it becomes more a test of how to influence the right outcomes for both the customer and the organisation.”

For Anna, listening and adapting has been her greatest lesson.

“When I first started, I was very forthright in my opinions,” she concedes. “And what I've learnt is to temper that, listen more and not jump in with what I think is the right answer. So I think that's made me as a banker, able to listen, take advice and be ready to sometimes change direction and change my opinion, because there are a lot of smart people around.”

Mark sees banking as a team sport- and it’s not only about how you perform on game day but how you train that makes the team shine.

“I remember someone once said business is like sport. Being in the game is something to enjoy. But you've also got to be incredibly well prepared. And I think that's something I've certainly learnt.”

Mark Monaghan and Michael Rose recently celebrated their 40-year anniversary working with ANZ, and Anna Corr celebrated her 20-year anniversary working with ANZ.

You can listen to the full podcast above.

Related articles

Asia Pacific

Improving outlook in institutional banking

Inside ANZ