NZ Media Releases

Support available for business banking customers

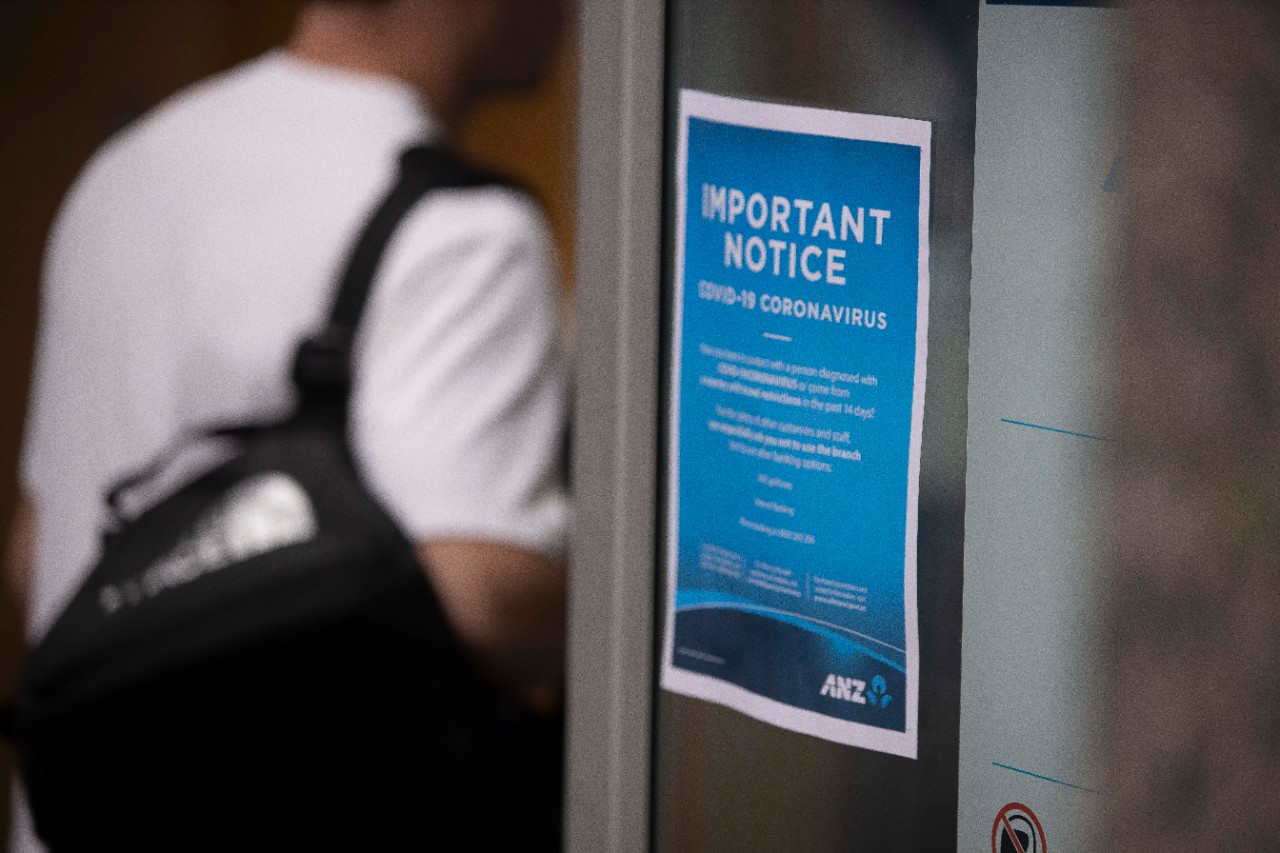

ANZ New Zealand (ANZ NZ) understands many businesses are feeling the economic effects of Covid-19 and has put some support options in place to help business customers through this uncertain period.

Our website outlines the support options available for business customers including the measures below. Conditions and eligibility criteria apply:

- We’ve waived loan restructuring fees.1

- We’ve waived international funds transfer fees when sending money overseas via ANZ Direct Online until 30 June.2

- If you meet certain criteria, you can withdraw business term deposits early, without an interest reduction.3

- We’ve reduced the 6-month and 1-year Business Term Loan Fixed Base Rates by 0.40% p.a.4

- We’ve reduced the floating Business Term Loan Base Rate by 0.75% p.a.4

- We’ve decreased the ANZ Visa Business credit cards purchase interest rate to 9.95% p.a., from 1 April until 30 June.4

- We’ve waived the Contactless debit transaction fees for small business customers, until 30 June.5

Eligible personal and business customers with an ANZ Home Loan or Personal Loan may also be able to apply for a loan repayment deferral. To apply, use our call back form:

https://onlinestore.anz.co.nz/request-a-callback/covid-19-business

https://onlinestore.anz.co.nz/request-a-callback/covid-19-homeloan

We’re also working on loan repayment deferrals for customers with an ANZ Business Loan or ANZ Home Loan on interest only repayments. Loan repayment deferrals are not available on ANZ Flexible Home Loans.

It’s important to remember there are other options that could help reduce repayments at this time, including extending the loan term or switching to interest only repayments. Our bankers will talk customers through the options available that may help customers stay on top of their mortgage.

ANZ customers who have a business banking manager can contact them in the first instance or they can visit our website to request a call back online and a specialised business banker will phone them back as soon as they can. Customers can also call our contact centre (0800 269 296) if they require urgent support. Our contact centre has experienced unprecedented call volumes in the last few weeks so wait times are longer than we’d like.

|

RELATED ARTICLES

NZ Media Releases

ANZ lowers rates to support businesses

NZ Business