NZ Consumer

Property Focus - Lend Me a Hand

Liz Kendall

ANZ Senior Economist

David Croy

ANZ Senior Strategist

Sharon Zollner

ANZ Chief Economist

The housing market and new mortgage lending are bright spots in an economy otherwise facing an enormous amount of uncertainty.

Low mortgage rates are lending a hand, and monetary policy is expected to provide even more stimulus, with the OCR expected to go negative next year alongside a bank Funding for Lending Programme (FLP).

We expect the OCR will be lowered by 50bps to -0.25% in April, and that the FLP will strengthen pass-through to retail rates.

The impact of the combined policies is uncertain, but short-term fixed mortgage rates could dip below 2% next year.

Further declines in mortgage rates will help to shore up the housing market, spending and confidence. But that’s set to go up against a range of dampening factors that are likely to become more evident by year end.

Because of this, we expect that lower mortgage rates will provide a cushion but won’t propel the housing market significantly.

That said, there are offsetting forces and a ‘muddle through’ is possible. More broadly, risks to the economic outlook are tilted to the downside and it is possible that the OCR moves even lower than we currently expect.

Credit growth has softened

The RBNZ has been conducting significant monetary stimulus in order to stabilise the economy and shore up employment and inflation. Part of the mechanism through which this works is by supporting asset prices and credit expansion.

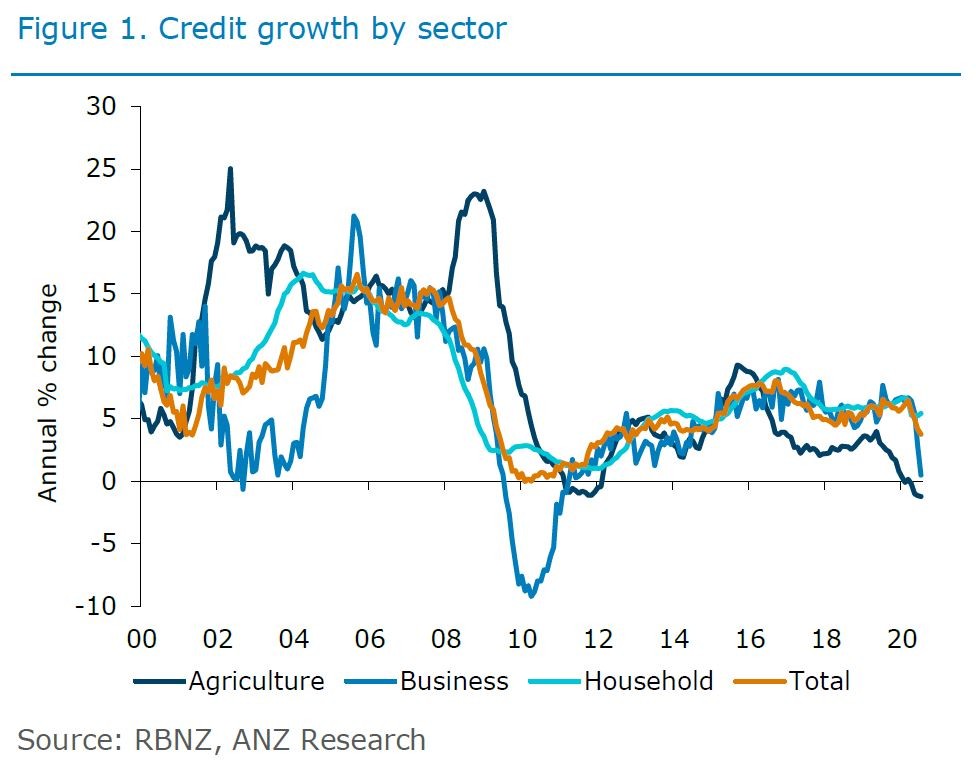

So far, lower interest rates – along with other factors – have kept the housing market resilient, but overall credit growth has softened (figure 1).

Household credit growth has been supported. But business lending has fallen 2.8% in recent months, following a temporary increase in March. And agricultural lending has been gradually softening over the past year and is now down 1.2% y/y.

Business lending is likely to come under further pressure in coming months. Some firms have used credit lines to help them through trying times, but generally businesses are reluctant to invest and are cautious about taking on debt.

The end of the wage subsidy and other pressures (such as weaker demand, regulatory changes and skill shortages in some areas) will only intensify these trends, particularly as the impact of the current downturn becomes more acute as the year ends.

Meanwhile, banks are likely to be cautious about lending to certain industries where risks are elevated.

This is typical recession behaviour; businesses tend to be reluctant to borrow and invest until they have more certainty, especially about future demand. Certainty tends to come as activity improves and firms are nolonger operating with excess production capacity – but that will take quite some time.

That’s why giving the economy a solid kick-start through monetary and fiscal stimulus is so important – it can create feedback mechanisms through spending, incomes and confidence that help stabilise the economy and lead to job creation and investment in time.

New mortgage lending a bright spot

New mortgage lending has recovered after a lockdown induced dip in March in April, reflecting resilience in the housing market.

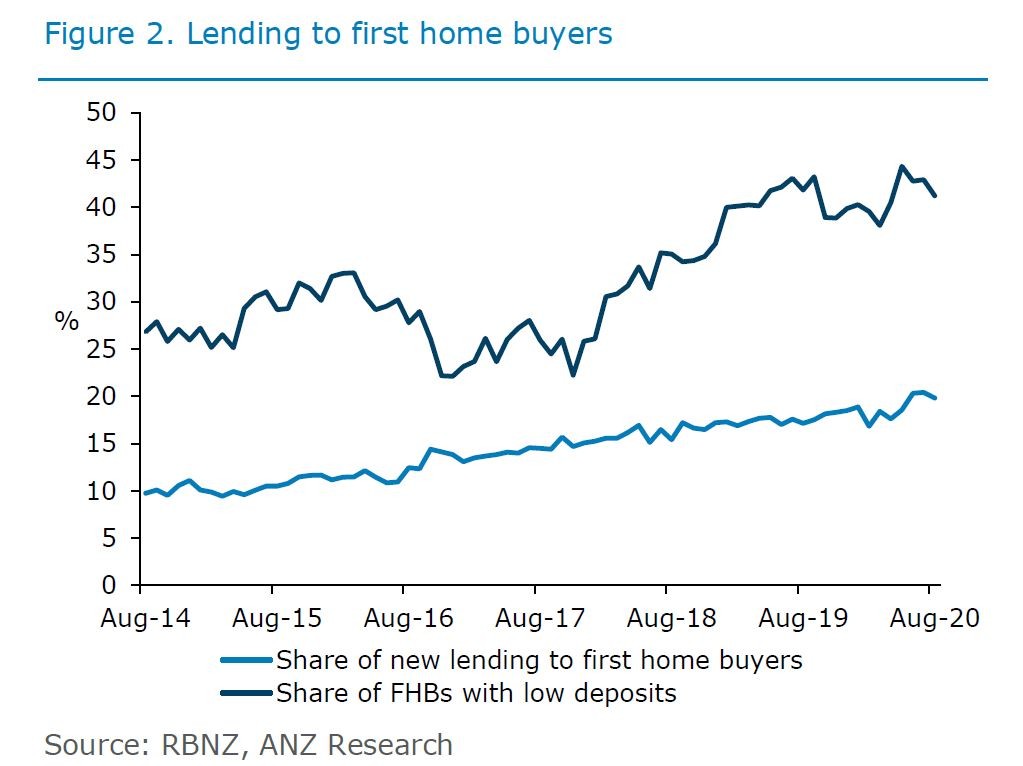

New lending to borrowers with lower deposits (higher loan-to-value ratios) has ticked up only modestly since April from 10% of mortgage lending to 11%, reflecting a compositional shift as lending to first home buyers has increased a little (figure 2).

Although new lending has been strong, when one looks at net flows (taking into account principal repayment and the like), credit growth has been stable and not excessive.

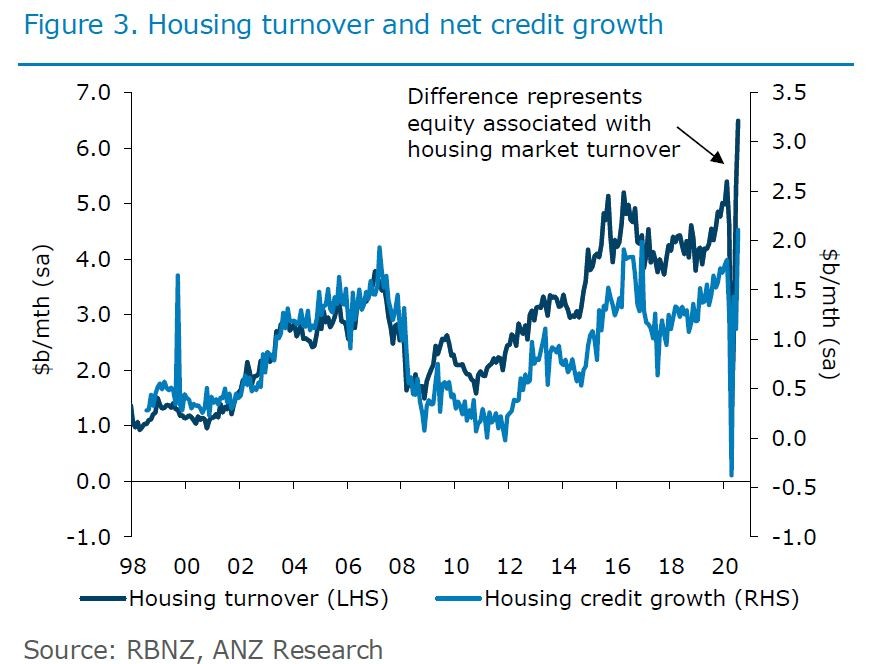

Realised equity gains (between buyers and sellers) associated with housing turnover have been pretty stable on average in recent months (figure 3).

What this means is that although new buyers will be taking on more debt, in aggregate households are not significantly “leveraging up”, at least so far.

As the housing market has recovered post-lockdown, some households appear to have used the opportunity to shore up their financial positions. Some borrowers may be paying back more principal and some sellers may be shoring up their equity.

This, alongside increased first home buying, appears to have been broadly offsetting, and risk-taking associated with recent strength in the housing market does not appear excessive – so far.

The possibility that lower interest rates alongside a removal of loan-to-value ratios spur excessive risk taking and exacerbate financial stability risks is certainly something of which to be vigilant.

This could require the reinstatement of loan-to-value ratio restrictions (or other macro-prudential policy) in time, but on the other hand, a significant move towards increased risk aversion would stymie activity, so it’s a balancing act.

The loan-to-value restrictions were removed to encourage credit creation in the economic downturn and to facilitate mortgage deferment schemes, and it’s worked.

But it is unclear whether their removal will prove permanent or temporary, with the RBNZ set to review them again in April next year.

Housing market supporting economy

The resilience we have seen in the housing market has surprised us in that it has occurred in spite of acute economic disruption and uncertainty. For now, the market is supported. And to the extent that this is driven by lower interest rates, monetary policy appears to be doing its job.

Based on historical modelling, a ~0.8 percentage point fall in mortgage rates (as we have seen) might boost house prices by 2-2.5%, all else equal. But the rebound we have seen in house prices has been much swifter than the usual pass-through of lower mortgage rates (which can take up to a year).

This is consistent with the fact that other factors have also been at play, such as the wage subsidy scheme, mortgage deferment, loosening in LVRs, pent-up demand, money that might have gone on overseas holidays being freed up, and possibly unusual seasonal effects due to the timing of the lockdown.

This boost to the housing market will provide support for the economy going forward. Housing market turnover directly encourages spending, new home building and renovations, with flow-on impacts.

It also helps shore up confidence, particularly amongst consumers, but also amongst small business owners reliant on their homes for collateral.

Solid asset values make households and banks view lending transactions favourably, helping to support spending further.

By contrast, when asset values fall this can lead to a vicious cycle of reduced housing demand, forced sales, retrenched spending, and tightening in credit conditions – the RBNZ’s easier policy stance can help stem off the risk of this happening, and has so far been effective at doing so.

With the economy facing serious headwinds, this is not the moment to abruptly fix New Zealand’s housing affordability problem via a house price crash.

That said, we do think the housing market could see a temporary wobble as the economic and confidence impacts of the current crisis become more evident late this year and into next year.

Rising unemployment is expected to cause some income strains and uncertainty that will weigh on the market, though this is expected to be quickly responded to with a negative OCR and Funding for Lending Scheme in April next year. This will see mortgage rates eventually fall further.

Debt-servicing costs falling

We talked about the fall in the cost of home ownership for new purchases in our last ANZ Property Focus. This fall has been supporting the housing market directly.

In addition to this, the RBNZ’s easing of monetary policy is also supporting the economic recovery and spending by contributing to expectations that interest rates will remain low – and go even lower if our forecasts are right – and that incomes will be supported through a range of channels.

Monetary easing also directly alleviates cash flow pressures by lowering debt-servicing costs for firms, households and the Government, supporting spending and confidence, quite independent of developments in the housing market.

For households, the direct impact on debt-servicing costs depends in part on the composition of mortgage borrowing.

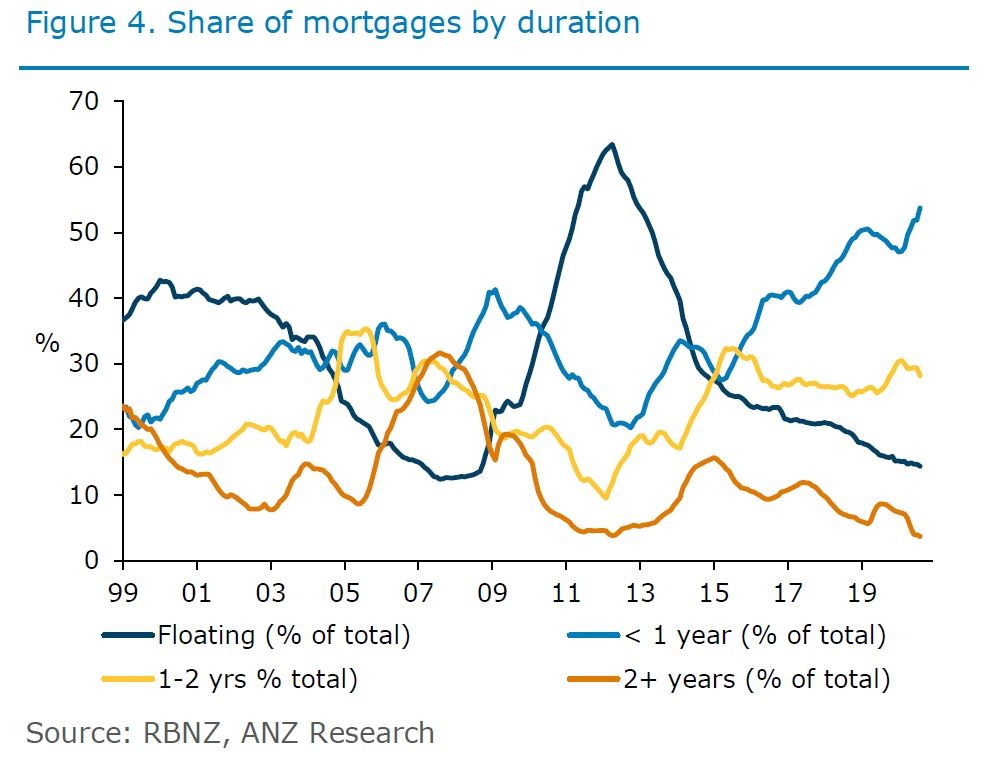

About 14% of mortgage borrowing is on a floating mortgage rate (figure 4), so aside from new transactions, only a small portion of borrowers will see the effects of a lower mortgage rate flow through to their cash flow quickly.

Over time, the share of mortgage borrowing on floating rates has decreased steadily, but the portion of mortgage debt that is fixed for one year has increased substantially, to 54% currently.

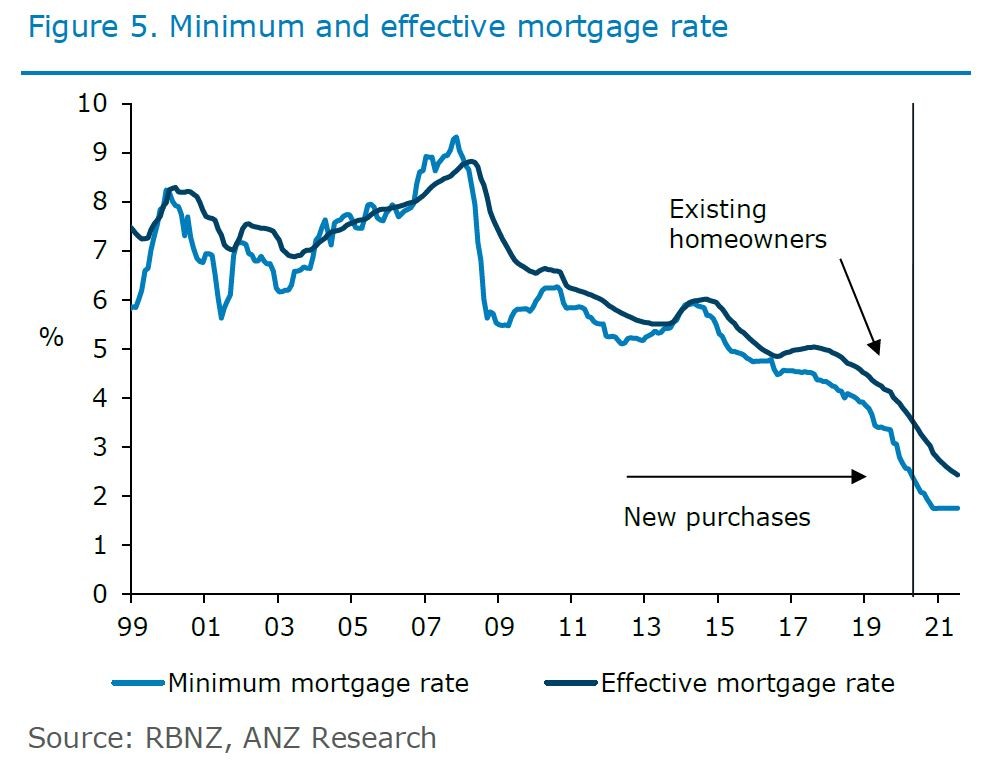

As fixed portions have rolled off, the effective mortgage rate faced by existing borrowers has dropped steadily (figure 5) and is set to fall further.

Another trend that has occurred over time is a move from standard to special mortgage rates, with more borrowers taking up specials. As standard rates have become less relevant, the margins between standard and special rates have increased.

Reflecting this trend, we have moved to forecasting fixed special rates rather than standard rates (see Mortgage Rate Forecasts).

Mortgage rates to fall further

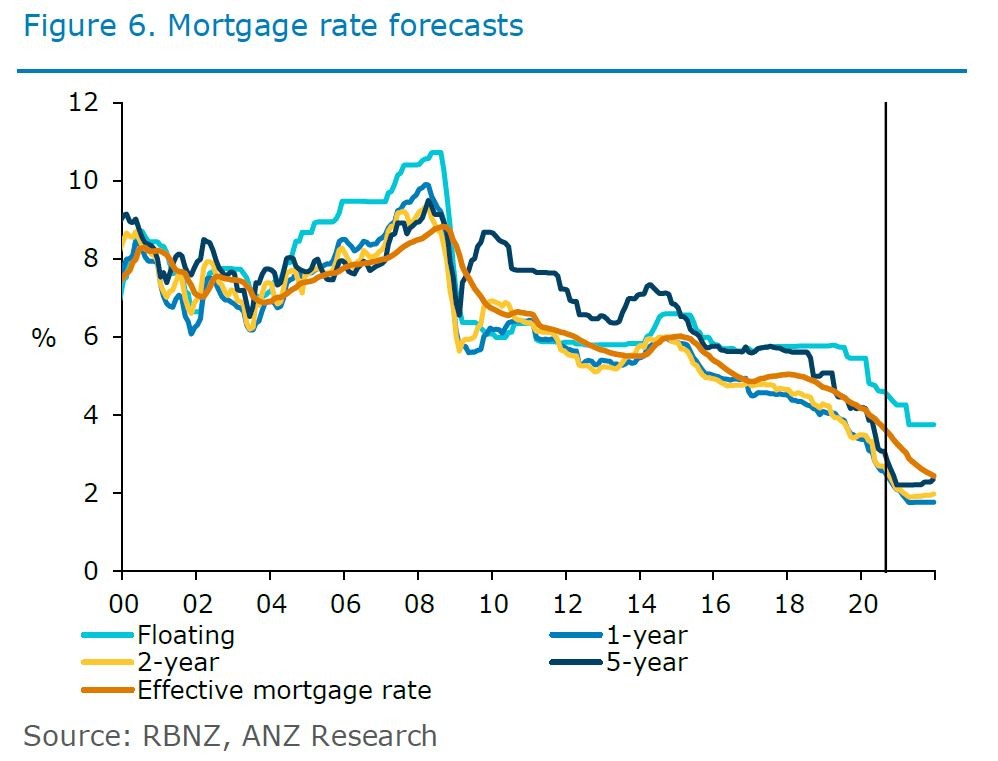

Mortgage rates have fallen 60-110bps this year as the OCR has fallen and the RBNZ has embarked on QE.

But we think that mortgage rates are poised to fall significantly further (figure 6), based on our expectation that the RBNZ will introduce a negative OCR in April next year.

An FLP would go hand in hand with a negative OCR and the RBNZ intends to implement one before year end. This would encourage new lending and help to ensure that retail interest rates can move even lower.

We don’t know exactly what impact these policies combined will have on mortgage rates, but the direction is clear. No, your bank won’t be paying you to borrow, but rates could get a lot cheaper.

Notwithstanding considerable uncertainty, looking forward we now expect shorter-end mortgage rates to fall below 2%, with the 1-year rate expected to trough at 1.75% in April next year.

If mortgage rates continue to decline as we expect, we could see further declines in the order of 60-90bps and total falls from pre-COVID levels of up to 200bps.

Although we don’t expect the trough in mortgage rates to occur until next year, we are forecasting continued gradual declines between now and then. This assumes some compression in margins between lending and wholesale rates as the impact of QE and expectations of a negative OCR continue to percolate through.

At this stage we are only expecting one 50bp cut in the OCR in April, taking it to -0.25%. Given that the RBNZ intends to implement an FLP well before this, it is possible that the RBNZ might choose to adopt a more gradual approach to taking the OCR lower (eg pausing at 0%, or waiting until the May Monetary Policy Statement to cut).

But with economic risks skewed to the downside, and their “least regrets” approach, we also can’t rule out that the OCR might go even lower than we currently expect, in time. This would pose further downside risk to mortgage rates.

Cushion not a trampoline; risks to downside

So far, the impact of lower mortgage rates on the housing market has passed through reasonably quickly and still-lower mortgage rates will provide further support, particularly once the OCR goes negative.

But as we enter the challenging period ahead we see lower rates as a cushion, supporting the market, rather than a trampoline propelling it into the stratosphere.

All else equal, a further fall in mortgage rates as we expect might boost house prices 2-2.5%, but this is going to be competing against other dampening factors that expected to pass through to the housing market in time.

These factors are yet to become fully apparent, but that doesn’t mean the impacts have been avoided. So far, lower mortgage rates and other factors have provided a faster-acting boost.

We can’t know for sure how much of a dampening force increasing income strains and weaker net migration will be.

Forecasting the housing market is difficult at the best of times, and how a range of offsetting factors net out and impact behaviour will determine the outlook for the housing market from here, along with the underlying economic outlook, which itself is also uncertain.

It’s possible that the housing market can get through the period ahead unscathed, given the support expected from even lower rates, but at this stage we expect some wobbles will emerge, with dampening forces to weigh in time.

Risks to the economic outlook are tilted to the downside, and that’s a key reason why the RBNZ has adopted a “least regrets” approach to policy, providing monetary stimulus in a front-loaded manner.

Downside risks and the slow economic recovery ahead mean that more stimulus may be needed, even if a housing market downturn is avoided, but particularly if it isn’t.

Relative to our expectations, more stimulus might be achieved by the RBNZ taking the OCR even lower than -0.25%, a loosening of the FLP, or by expanding quantitative easing to include new assets.

But while monetary policy is working, it is not designed to cure all ills, and it does push some problems down the track rather than solve them, in terms of increasing debt. Fiscal policy needs to pivot towards supporting growth too.

Whether – and how effectively – this can be achieved will be a key factor, among others, in determining whether the RBNZ ultimately needs to do more.

RELATED ARTICLES

NZ Consumer

What Negative Interest Rates Could Mean for You

NZ Consumer