Scams leap during COVID

The number of scams reported to ANZ by its customers, or identified by the bank’s systems, increased by 91% in the year to the end of September 2021, compared to the previous twelve months.

“Fortunately, the total amount of money customers lost fell” says Ben Kelleher, ANZ NZ’s Managing Director, Personal Banking.

“We’ve put a lot of work into stopping customers from being caught in scams and it’s good to see that having an impact. But the figures show how vigilant we all need to be.”

“The lockdowns have been a perfect opportunity for fraudsters, with more people at home and on their devices.” - Ben Kelleher, ANZ NZ’s Managing Director, Personal Banking.

ANZ has fraud monitoring systems and a dedicated team which reviews banking activity around the clock.

The bank also works closely with others in the industry to respond to new and emerging scams.

“The lockdowns have been a perfect opportunity for fraudsters, with more people at home and on their devices.”

“And the run up to Christmas always sees a rise in attempted scams.”

In many cases, the bank is alerted only after people have given away their confidential personal or financial details online.

“By the time customers realise what has happened and alert us, the money is often gone and it can be impossible to recover.”

“We all like to think we are too savvy to be fooled, but all of us are potential victims,” says Mr Kelleher.

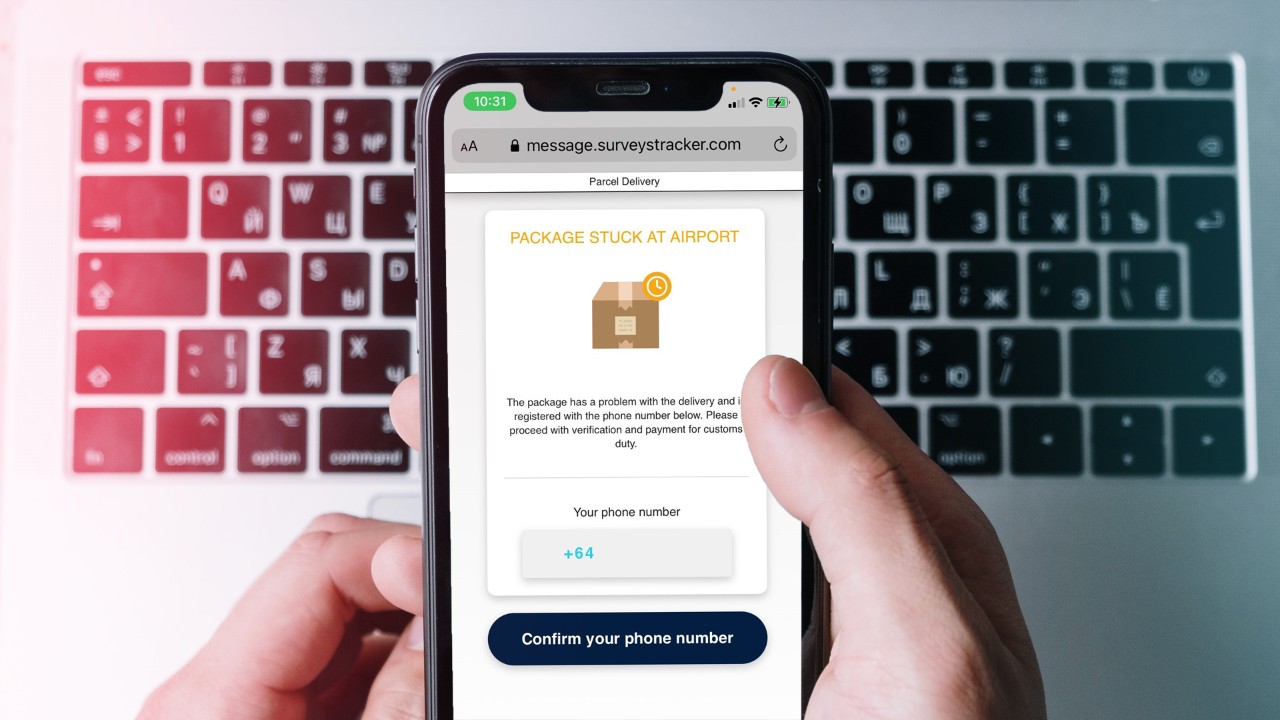

He says ANZ has seen a recent increase in one scam involving a text message that refers to the delivery of a parcel.

“During lockdown a lot of us have been ordering more goods online so we are getting more parcels sent to us than usual,” says Mr Kelleher.

“And at first glance some of these texts might seem legitimate, but people need to be really careful.”

The text messages sometimes say there is a parcel that has been stopped at the airport and the recipient of the text needs to confirm their identity and pay customs duty.

“We’d advise people not to respond or click on any links in a text message, without first being sure of the authenticity of the text.

You can verify the authenticity of the company by checking their official website and contacting them directly.”

While text message scams are on the rise, phone frauds remain the most common types of scam experienced by ANZ’s customers.

“That’s been the case now for several years” says Natasha McFlinn, ANZ Senior Manager for Fraud Strategy.

“A caller will pretend they’re from a bank or a well-known organisation like your phone company or the Police and tell you there is a problem with your internet connection or your device.”

The fraudsters will offer to help “fix the problem” by getting people to download software or an app, which allows them to connect to a person’s device from another location.

“Once they have done that they are able to access everything that’s stored on the device, including online banking details or security codes.

People are becoming more aware of the scams, but the fraudsters are constantly adapting their methods.

“We've seen them move recently to calling people and saying they have detected unauthorised card transactions. They then say they need you to provide all your credit card details, security codes and copies of your driver’s licence.”

“It’s difficult for banks to stop these scams, because fraudsters will directly call, email or text the customer. They will either try to get people to give them access to their bank accounts and devices, or, they will try to get the customer to send money to them directly.”

ANZ began seeing a rise in attempted scams during the first Covid-19 lockdown last year, part of a global increase in cold-call scams and other attempted fraud during this period.

That’s why ANZ has created a series of five videos for International Fraud Awareness Week (November 14 – 20).

The videos focus on five common scams: phone scams, email scams, text scams, romance scams and investment scams.

“Fraud Awareness Week is a good opportunity to remind ourselves about how we all need to take care with our personal and financial information, both online and when speaking to other people.”

There are some things people can do to protect themselves from scammers:

Be very cautious with sharing personal or financial information over the phone, by email or text message.

If you’re unsure whether someone is from the organisation they say they are, hang up and call the organisation back on their published phone number. Only put personal or banking information into a website if you are certain it is genuine.

Never allow anyone who calls you out of the blue to have remote access to your devices.

You should be wary of any calls you’re not expecting, particularly those wanting you to take urgent or confidential action, or those who say you have a problem with your computer, internet or bank account that they can help fix.

Keep your PINS, passwords and security codes secret

Don’t give these to anyone, even if you are contacted by someone that says they are from the bank, a phone company or the Police. The longer your password is the stronger it will be. Try using a phrase, like the lyrics to your favourite song. You should use two-factor authentication for your accounts wherever possible.

Be wary of romance scams

Fraudsters take advantage of people looking for romantic partners. They may use a fictitious name, or take on someone else’s identity by using photos found online , and they often claim to work overseas and intend on moving to New Zealand. You should be wary if the relationship moves quickly, they tell you stories about why they need money from you, or they won’t meet you in person.

Watch out for investment scams

Fraudsters will cold-call or contact people, offering investments with high rewards and little risk. They might say the offer is “top secret” or only available for a limited time and they generally won’t provide much information in writing. The Financial Markets Authority says New Zealanders should only deal with locally-registered entities. Do not be rushed, be sceptical and ask lots of questions.

Generally, you should also:

- Avoid using your internet banking password for anything else and make sure you do not save it to your browser.

- Keep your device operating system, apps and anti-virus software up to date.

- Report any scam calls you receive directly to your telecommunications provider.

For more information go to https://www.anz.co.nz/banking-with-anz/banking-safely/