New Zealand

Strong employment rate helps Kiwis' financial wellbeing

The high employment rate has helped New Zealanders remain financially resilient in the three months to June, according to a financial wellbeing survey by the country’s biggest bank.

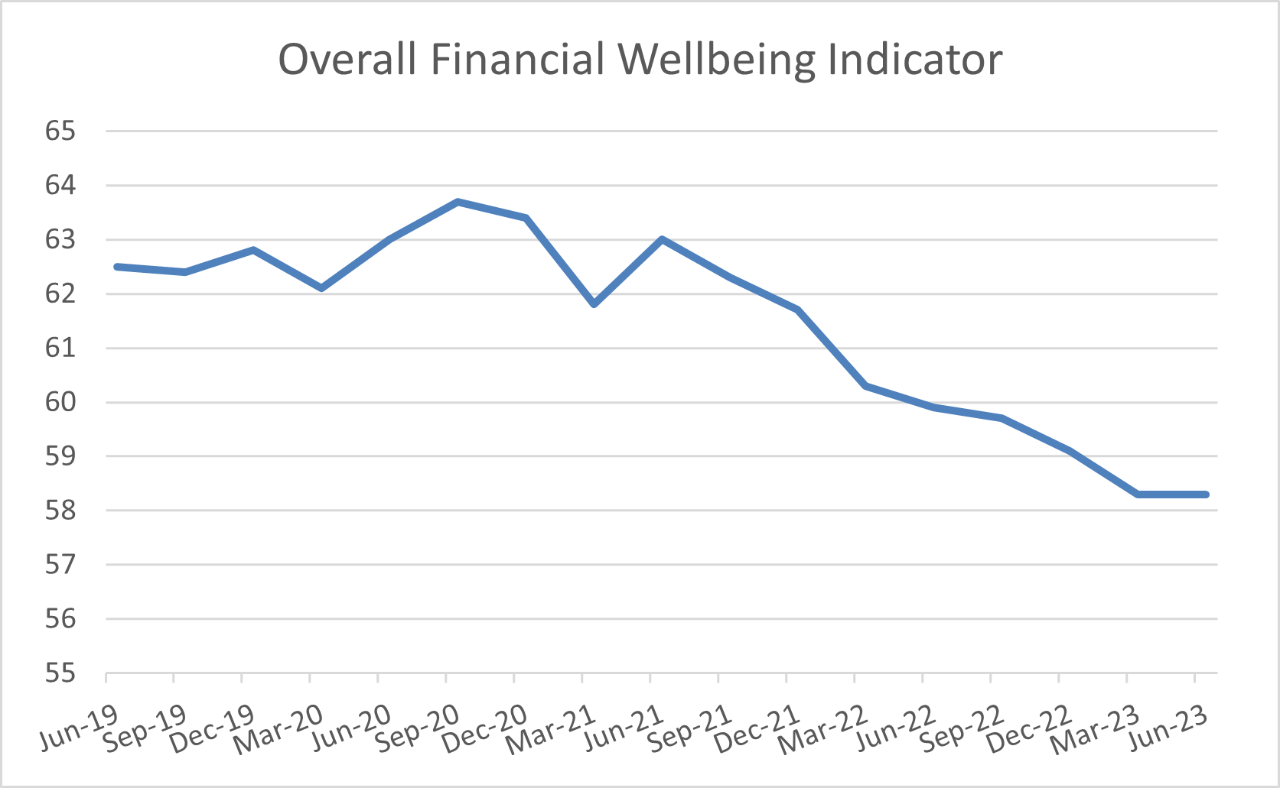

The ANZ Financial Wellbeing Indicator score held steady at 58.3 in the three months to June.

This was the first quarter since June 2021 that the score has not fallen.

But sentiment remains the lowest it’s been since ANZ started regularly tracking New Zealander’s financial wellbeing back in June 2019.

The ANZ FWI provides an overview of the personal financial wellbeing of New Zealanders and is intended to act as a ‘pulse check’ on how Kiwis are feeling about their financial wellbeing.

It is made up of three key indicators – feeling comfortable, ability to meet commitments and resilience.

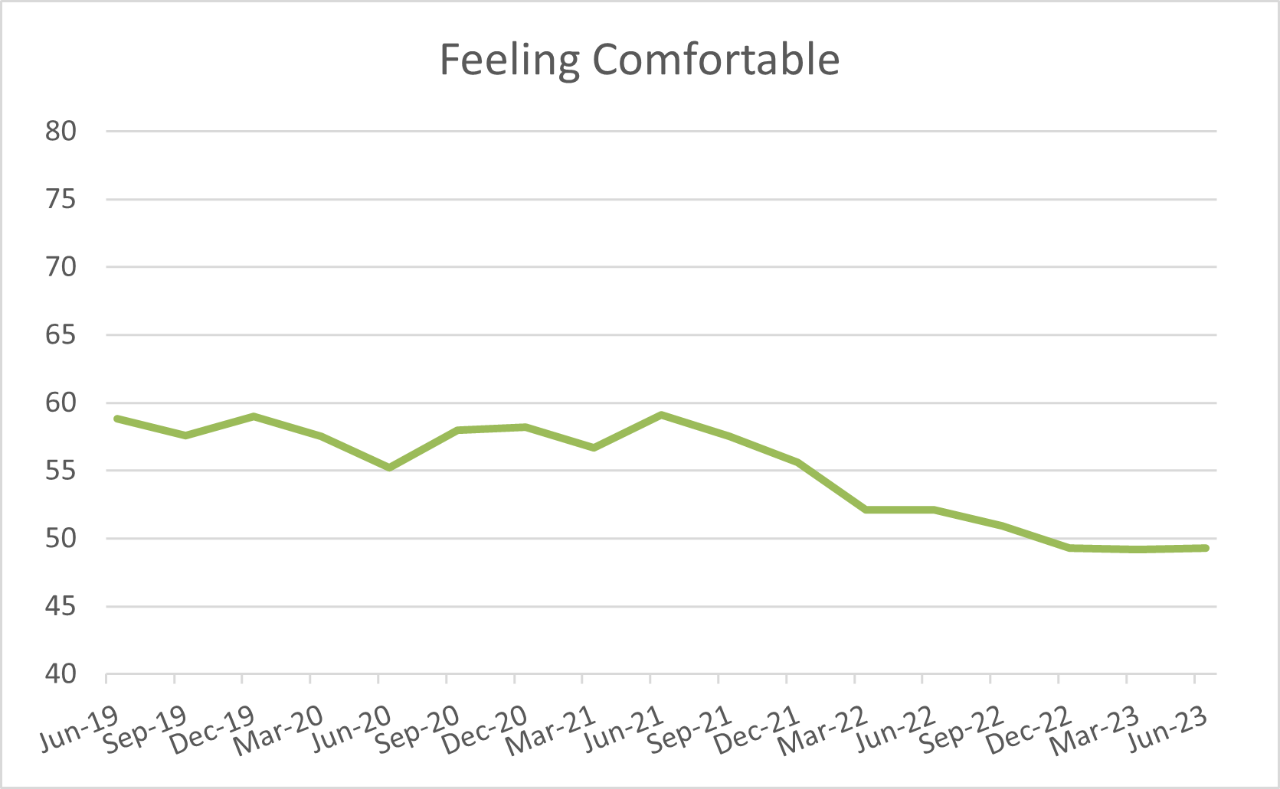

Feeling Comfortable

The Feeling Comfortable measure was flat in the June quarter – again at a record low level of 49.2.

The slide in house prices – the biggest single asset for many New Zealanders - appeared to be tapering off towards the end of the quarter. At the same time investment markets were largely back in positive territory – meaning KiwiSaver balances increased rather than declined.

For many there was little sign of things getter better – but they didn’t appear to be getting worse.

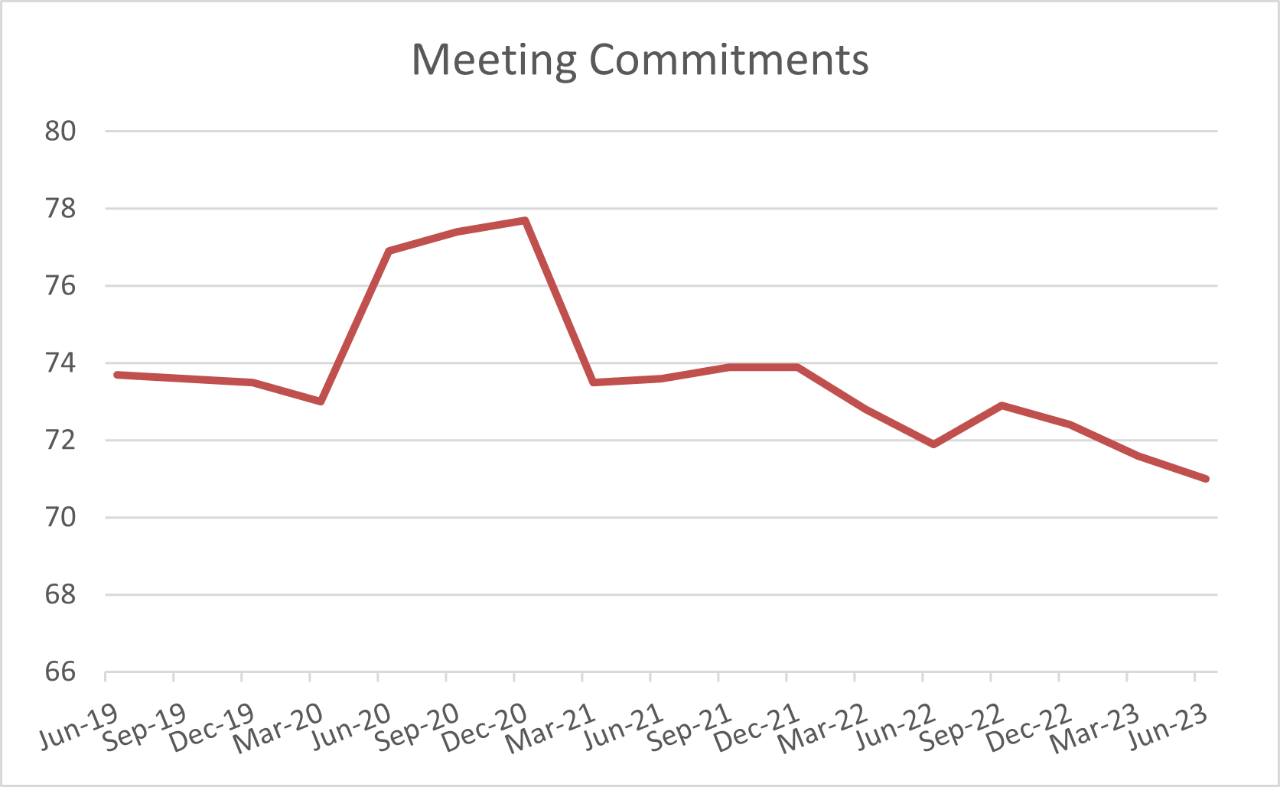

Meeting Commitments

The second component of the score measures people’s ability to meet commitments.

This fell to a new low of 71.0, down from 71.6 in the March quarter.

With higher interest rates and cost-of-living increases many households are feeling the pinch.

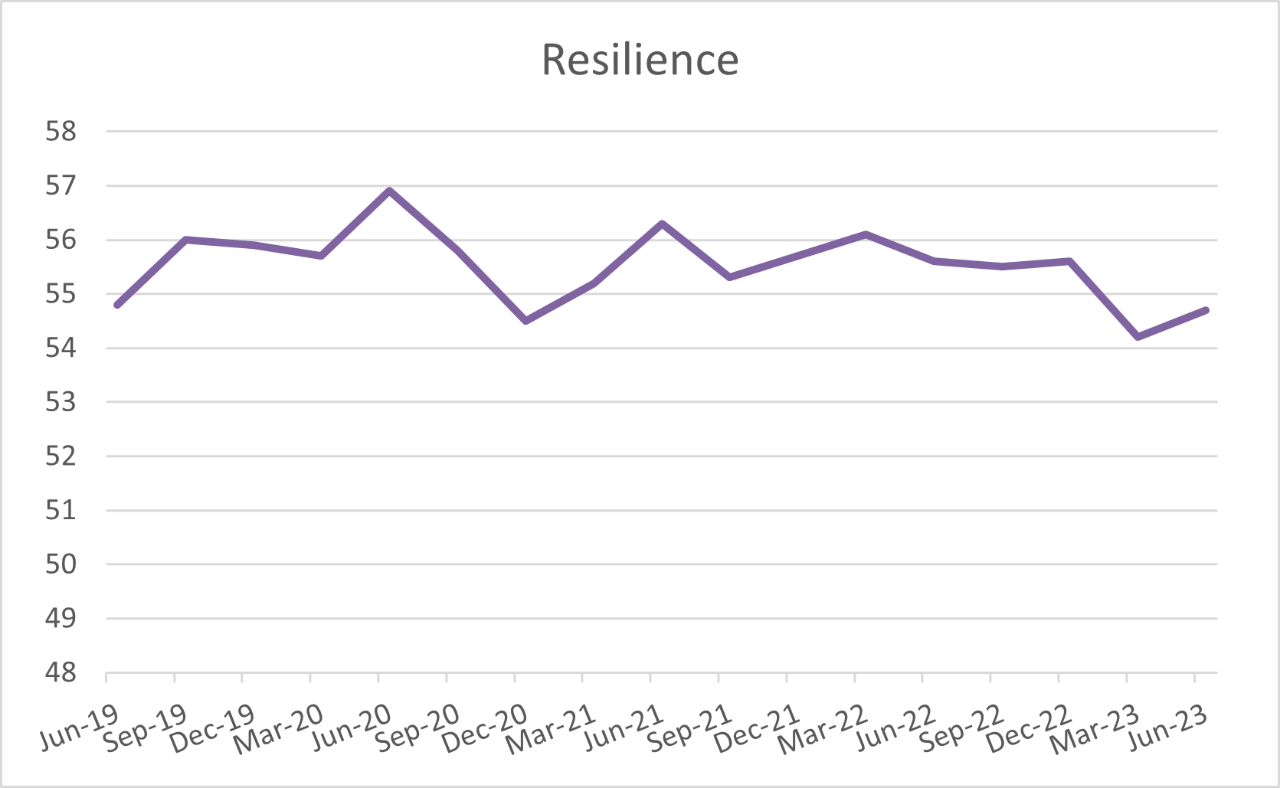

Resilience

The Resilience measure lifted in the quarter to 54.7, up from 54.2 in the March quarter. It was this lift that prevented the overall FWB Indicator score from falling.

One of the factors that helped to hold the resilience level up was the comparatively high employment rate. The Labour Force Participation Rate hit 72.3 per cent in March 2023.

Along with high employment rates, it appears that savings levels also held up well.

The average level of savings is up to over $50,000 in the quarter ended June 2023.

However, the savings figures may not be telling the full picture. That’s because a small number of very large deposits lifted the average.

If we instead look at the midpoint on the range of savings balances it’s much lower, at $4,220. That was substantially down from the $5,310 seen in the previous quarter.

The June quarterly survey groups the New Zealand population into four categories.

20.7 per cent of people were considered to have no worries (financial wellbeing score >80-100). This compared to 19.6 per cent in the June 2022 quarter.

44.5 per cent were doing OK (financial wellbeing score >50-80), down from 49.4 in the June 2022 quarter.

19 per cent were getting by (financial wellbeing score >30-50), compared to 20.9 per cent in June 2022.

15.7 per cent were considered struggling (financial wellbeing score 0-30), compared to 10.1 per cent in June 2022.

A person’s financial wellbeing is influenced by a complex range of factors including their socio-economic circumstances, behaviour traits, attitudes towards money and their stage of life.

Some of these factors are beyond a person’s control. But there are two behaviours that can have a particularly strong influence on improving a person’s sense of financial wellbeing – active saving and not borrowing to pay for everyday expenses.

“We know from our research that developing a regular savings habit and having at least $1000 put aside can materially improve a person’s feeling of financial wellbeing,” said Ben Kelleher, ANZ Managing Director for Personal.

“Having a savings buffer can help give you a sense of control, especially when something unexpected – and potentially expensive - happens, like your car breaks down or an appliance needs replacing.”

Almost 55 per cent of ANZ customers have a savings buffer in place, meaning they have at least $1000 in their bank account.

Approximately 21.5 per cent of ANZ customers are active savers, meaning they are regularly contributing into a savings account.

“We understand saving can be really hard to do when we have high inflation and rising interest rates.”

ANZ is urging anyone who has concerns, or who wants to talk about their finances, to contact the bank.

“People shouldn’t be nervous about talking to their bank. Whether you are looking to get ahead, or get through, we’re here to support customers with the various options available to them."

ANZ has a range of information to help people manage their finances on our financial wellbeing hub.

The ANZ Financial Wellbeing Indicator Score provides a time-series measure of New Zealanders' financial wellbeing.

ANZ has partnered with Roy Morgan to replicate key financial wellbeing questions from the 2021 ANZ Financial Wellbeing Survey. This robust, quarterly snapshot of the personal financial wellbeing of New Zealanders identifies key questions from that survey and applies them to proxies within the weekly Roy Morgan Single Source survey of 7,000 New Zealanders annually.

You can find the 2021 report here.

RELATED ARTICLES

NZ Community

Finding Their Voice - the charity helping students boost their confidence through public speaking

NZ Community