NZ Media Releases

An Insight Into Kiwis' Financial Wellbeing

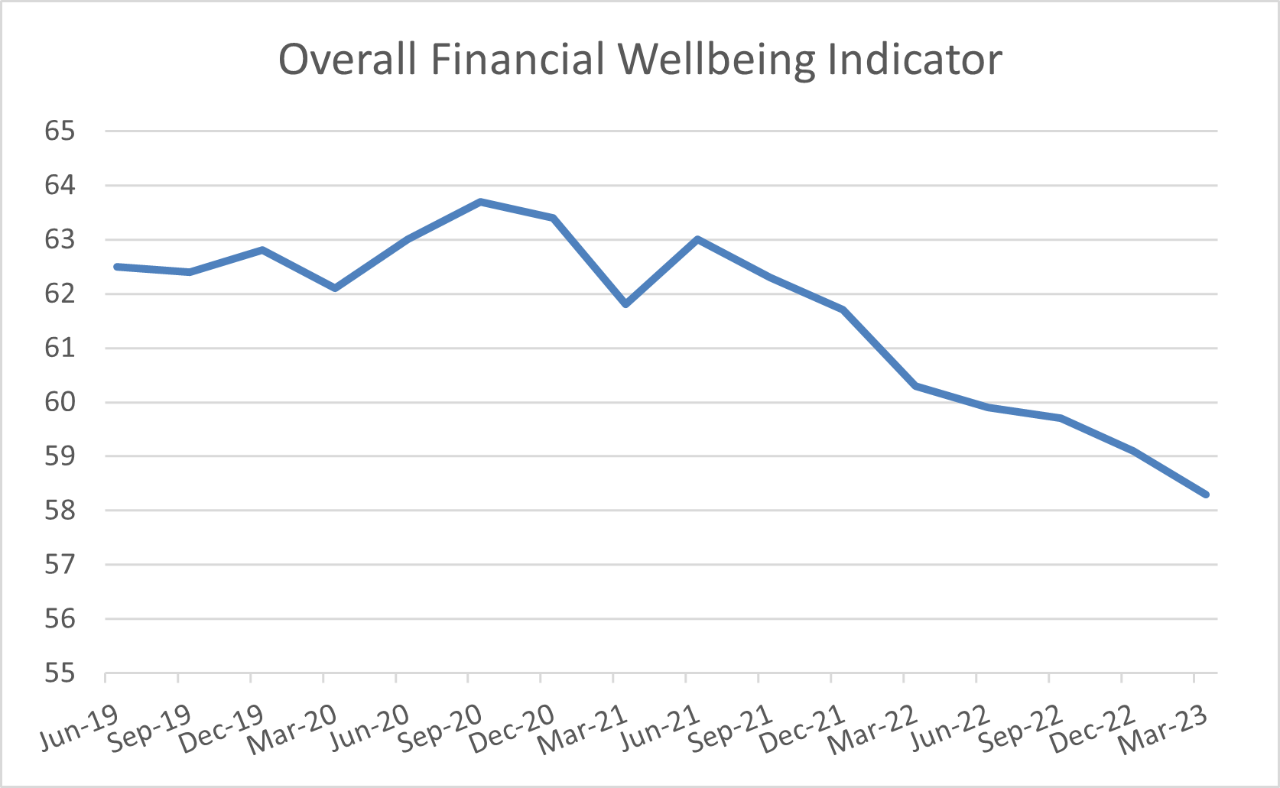

New Zealanders’ view of their financial wellbeing weakened in the first three months of the year, according to a survey by the country’s biggest bank.

The ANZ NZ Financial Wellbeing Indicator score fell to 58.3 in the March quarter, from 59.1 in the December 2022 quarter. That was the lowest level we have recorded since we started tracking in June 2019.

Financial wellbeing is defined as a person’s ability to comfortably meet their financial commitments now and into the future.

ANZ partnered with Roy Morgan to produce the Financial Wellbeing Indicator. It is an overview of the personal financial wellbeing of New Zealanders and is intended to act as a ‘pulse check’ on how Kiwis are feeling about their financial wellbeing.

Financial wellbeing is defined as a person’s ability to comfortably meet their financial commitments now and into the future.

The FWB Indicator is made up three key components – feeling comfortable, ability to meet commitments and resilience.

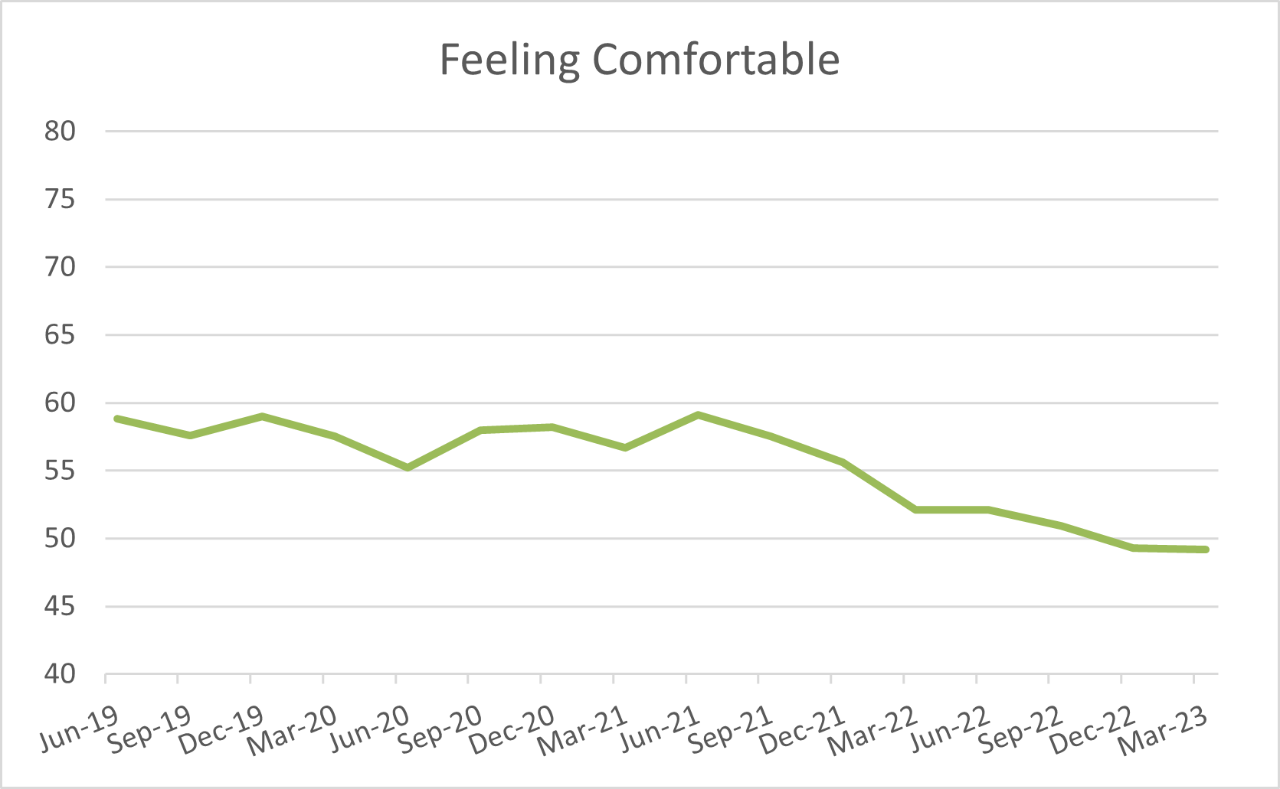

Feeling Comfortable

The Feeling Comfortable indicator fell by just 0.1 per cent in the quarter to 49.2 per cent, down from 49.3 per cent. While things did not get any better, they didn’t get a lot worse leaving the score at its lowest point.

Looking at events over the quarter, in February the Reserve Bank of New Zealand increased the Official Cash Rate (OCR) by 50 points, from 4.25 per cent to 4.75 per cent. A year earlier in February 2022 the OCR was just 1.0 per cent.

The increase in interest rates has set the tone for the last year as the Reserve Bank tries to lower the inflation rate by reducing demand.

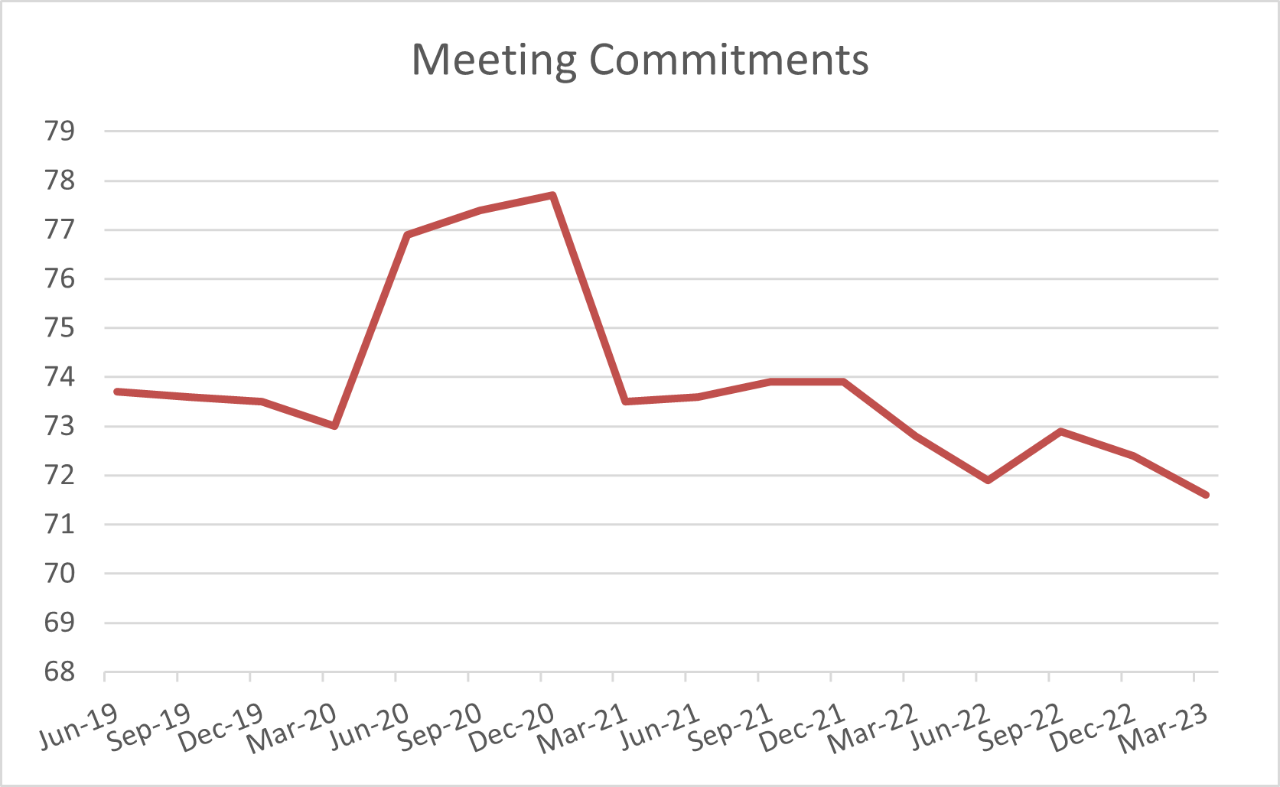

Meeting Commitments

This measure fell further in the March quarter to a new low of 71.6 (from 72.4 in the previous quarter).

Rising prices put increasing pressure on people’s ability to meet their financial commitments. Adding to that, the dramatic weather events had the impact of pushing up the prices of fruit and vegetables even further, making the issue front of mind for anyone doing the family grocery shop.

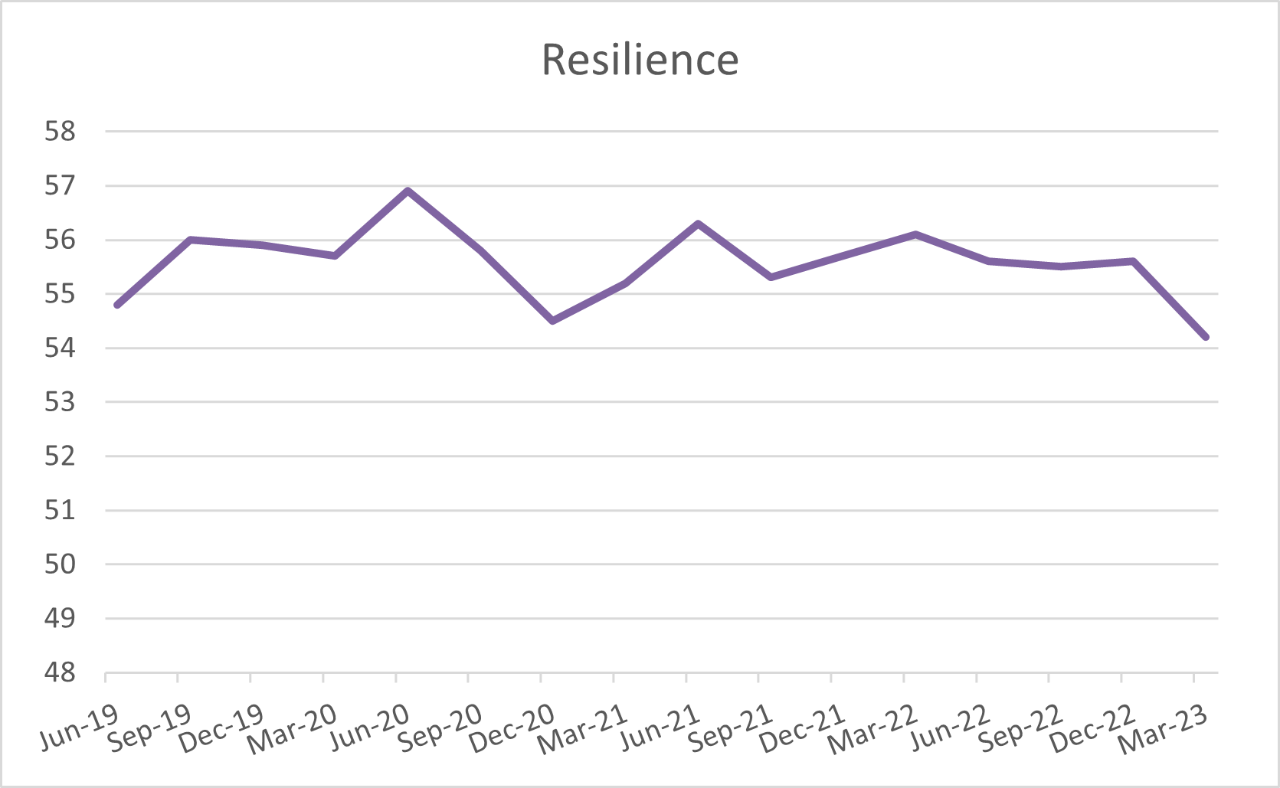

Resilience

This component also fell in the quarter – sharply, down to 54.2 from 55.6.

Consumer confidence levels lifted in January before falling again in both February and March as the country reeled from the impacts of Cyclone Gabrielle in February. Resilience was an often-used word, but it was in increasingly short supply.

There was also a sharp fall in the average level of savings, dropping from $50,355 to $46,152 in the March quarter.

The average savings figure can be lifted by a relatively small number of large deposits. Looking instead at the median savings amount it too fell, but only slightly, from $5,330 to $5,310.

The March quarterly survey groups the New Zealand population into four categories.

21 per cent of people were considered to have no worries (financial wellbeing score >80-100). This compared to 22 per cent in the March 2022 quarter.

43.6 per cent were doing OK (financial wellbeing score >50-80), down from 46.1 in the March 2022 quarter.

21.4 per cent were getting by (financial wellbeing score >30-50), compared to 19.9 per cent in March 2022.

14 per cent were considered struggling (financial wellbeing score 0-30), compared to 12 per cent in March 2022.

The ANZ Financial Wellbeing Indicator Score provides a time-series measure of New Zealanders' financial wellbeing.

ANZ has partnered with Roy Morgan to replicate key financial wellbeing questions from the 2021 ANZ Financial Wellbeing Survey. This robust, quarterly snapshot of the personal financial wellbeing of New Zealanders identifies key questions from that survey and applies them to proxies within the weekly Roy Morgan Single Source survey of 7,000 New Zealanders annually.

You can find the 2021 report here.

RELATED ARTICLES

NZ Media Releases

Watch Wāhine Win: Research reveals role ethnicity and gender play in women's success

NZ Business