NZ Business

Optimism rises in financial wellbeing survey

People were feeling more optimistic in the final months of last year, according to a financial wellbeing survey by New Zealand’s biggest bank.

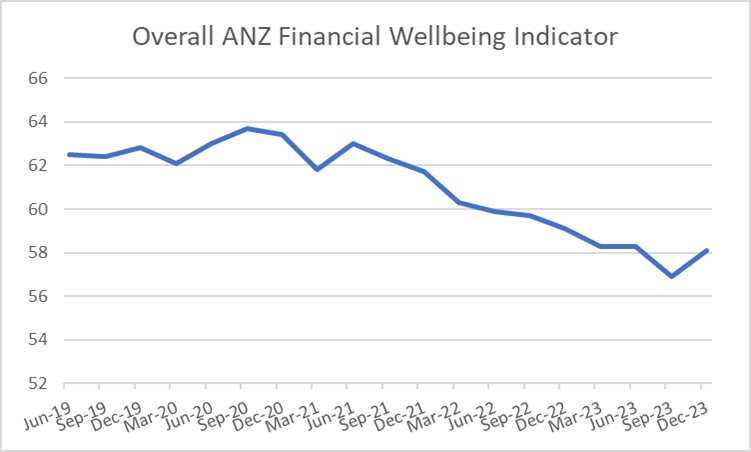

The ANZ Financial Wellbeing Indicator (FWI) score lifted to 58.1 in the December quarter, up from 56.9 in the prior three months.

This is still below the levels we saw earlier in 2023. But it is a move in the right direction.

The ANZ FWI provides an overview of the personal financial wellbeing of New Zealanders and is intended to act as a ‘pulse check’ on how Kiwis are feeling about their financial wellbeing.

It is made up of three key indicators – ability to meet financial commitments (like paying rent, a home loan, or other bills), feeling comfortable and resilience.

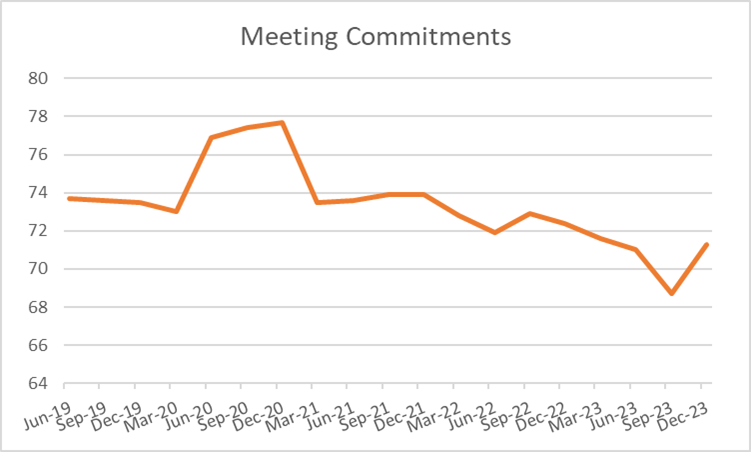

Meeting financial commitments

Peoples’ assessment of their ability to meet their financial commitments lifted from 68.7 in the September quarter to 71.3 in December. The figure is above the June number of 71.0.

There were several economic indicators that might explain some of the rise in optimism.

The rate of inflation falling, albeit slowly, so people may not be feeling as pinched as they were.

Recent employment data has indicated that while unemployment lifted, it was a very modest increase of 0.1 per cent to 4 per cent.

And Stats NZ reported that the average ordinary time hourly earnings, as measured in the Quarterly Employment Survey (QES), increased by 6.9 percent over 2023 to $40.84.

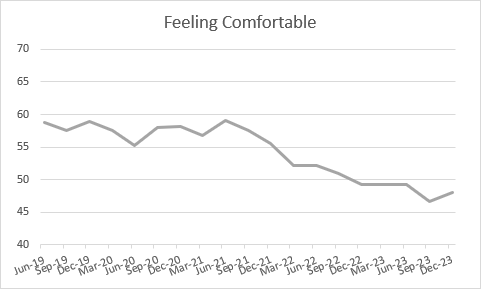

Feeling Comfortable

This metric fell to a low of 46.6 in Sept 2023, but recovered marginally to 48.0 in the December quarter.

House prices, for many people their largest asset, have stopped falling, which will have helped.

Improved market performance and the resulting impact on KiwiSaver balances may also have had a role to play.

ANZ has also seen significant lifts in business confidence as measured by our own Business Outlook survey.

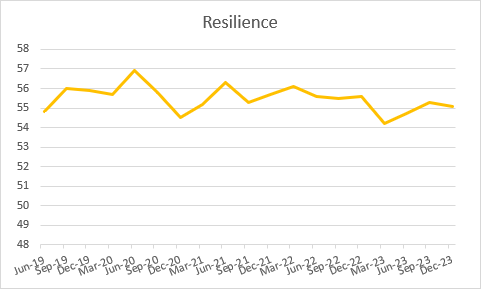

Resilience

Pleasingly the Resilience measure has remained comparatively steady over the last few years. Median savings balances have remained around the $5,000 mark, a level they rose to during the second half of 2020 as covid lockdowns reduced spending.

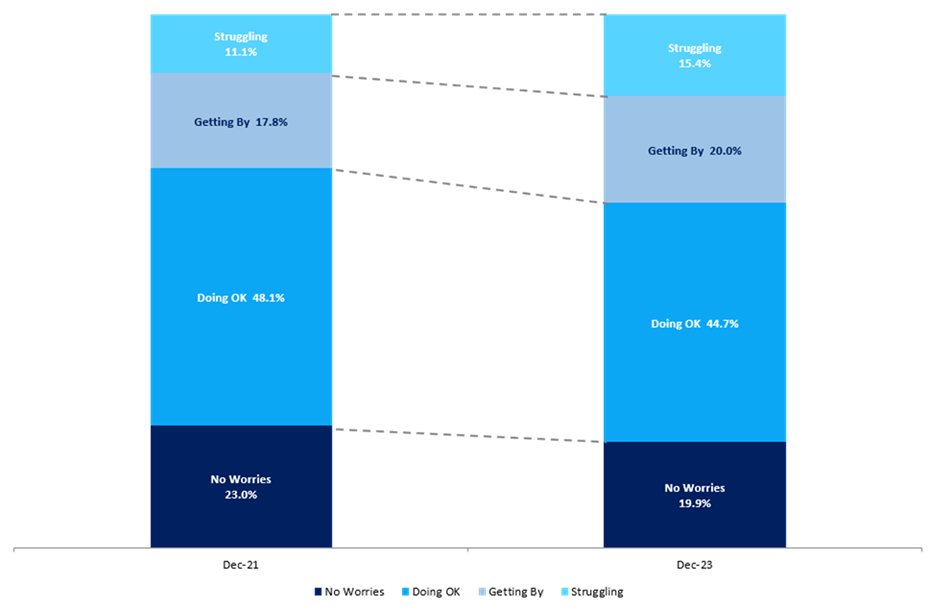

ANZ’s Financial Wellbeing research groups people into four segments: no worries, doing ok, getting by, and struggling.

19.9 per cent of people were considered to have no worries (financial wellbeing score between 80-100). This was close to the figure of 19.8 per cent in the previous quarter but was sharply down from 23 per cent per cent two years earlier in the December 2021 quarter.

44.7 per cent were doing ok (financial wellbeing score between 50-80), down from 48.1 two years earlier.

20 per cent were getting by (financial wellbeing score between 30-50), compared to 17.8 per cent in the December 2021 quarter.

15.4 per cent were struggling (financial wellbeing score 0-30), compared to 11.1 per cent in the December 2021 quarter.

Improving financial wellbeing

A person’s financial wellbeing is influenced by a complex range of factors including their socio-economic circumstances, behaviour traits, attitudes towards money and their stage of life.

Some of these factors are beyond a person’s control. But there are two behaviours that can have a particularly strong influence on improving a person’s sense of financial wellbeing – active saving and not borrowing to pay for everyday expenses.

Developing a regular savings habit and having at least $1000 put aside can materially improve a person’s feeling of financial wellbeing.

Having a savings buffer can help give you a sense of control, especially when something unexpected – and potentially expensive - happens, like a car breaks down or an appliance needs replacing.

Almost 55 per cent of ANZ customers have a savings buffer in place, meaning they have at least $1000 in their bank account.

Approximately 20.6 per cent of ANZ customers are active savers, meaning they are regularly contributing into a savings account. Saving can be hard to do when we have high inflation and rising interest rates.

Anyone who has concerns, or who wants to talk about their finances, should contact ANZ.

ANZ has a range of information to help people manage their finances on our financial wellbeing hub.

The ANZ Financial Wellbeing Indicator Score provides a time-series measure of New Zealanders' financial wellbeing.

ANZ has partnered with Roy Morgan to replicate key financial wellbeing questions from the 2021 ANZ Financial Wellbeing Survey. This robust, quarterly snapshot of the personal financial wellbeing of New Zealanders identifies key questions from that survey and applies them to proxies within the weekly Roy Morgan Single Source survey of 7,000 New Zealanders annually.

You can find the 2021 report here.

RELATED ARTICLES

NZ Media Releases

ANZ Investments reaches major milestone - over 100,000 KiwiSaver members helped into their first home

NZ Media Releases