2020 is shaping up as yet another important year in the current bull market run. Whether it’s the threat to slowing global growth, all-important elections, central bank policy or the rise of environmental and social issues – namely climate change – the next 12 months look to be busy both here and abroad. Here are five things our team is looking at the start of 2020:

1. Modest bounce in global growth

It’s been more than ten years since the last recession and as the global economy continues to grow at a moderate rate – the International Monetary Fund estimates the global economy grew at 3% in 2019. Following the China and US trade conflict of 2019, we believe it’s unlikely they’ll strike a comprehensive trade deal, which if true, will continue to hinder global growth.

In 2020 central banks are projected to remain accommodative, and when monetary policy is exhausted, fiscal stimulus is looking increasingly likely. A number of countries including New Zealand, the UK and Japan, intend to increase government spending – and there’s pressure for other countries to do more. Popular targets include improving infrastructure, tackling climate change and reducing inequality.

2. Interest rates to remain low

This time last year some central banks, including the US Federal Reserve, were hiking interest rates. Fast forward 12 months, and the tables have turned. A rise in geopolitical uncertainty and lacklustre growth led to central banks cutting rates.

Interest rates are now near or at neutral levels, and we see the prospect of future rate cuts in 2020 slowing, if not ending. However, central banks will remain accommodative to support global economies.

Regionally, we see Australia most likely to cut rates, exacerbated by terrible natural disasters. In New Zealand, the prospect of further cuts has fallen following a bounce in business confidence and the government’s recent NZ$12 billion infrastructure investment announcement.

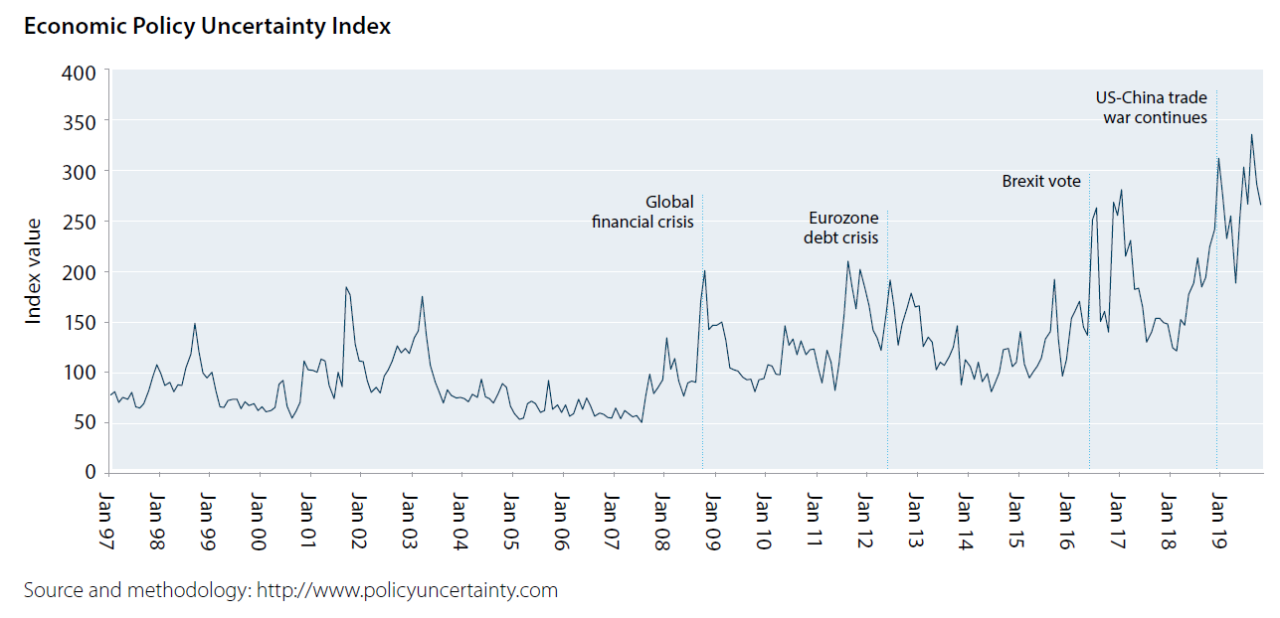

3. Geopolitical risks to keep market volatility elevated

Rising geopolitical unrest across the globe continues to be a strong theme heading into 2020.

Hong Kong pro-democracy protests plunged the local economy into recession in 2019. Should the US get embroiled further in the conflict, we see this weighing on trade relations with China.

Another substantial geopolitical risk out of Europe, at least from an economic perspective, is Brexit. After the Conservative Party and Boris Johnson’s victory in December 2019, the break-up from the EU could happen by end of January 2020. This will not end economic and political uncertainty, with trade deals and negotiations set to complicate matters. Given this, we expect ongoing volatility in UK assets as it navigates its way to a smooth exit from the EU.

4. Elections

Against the backdrop of growing partisanship, the 2020 US Presidential Election could be a significant risk to global markets in 2020.

President Donald Trump’s victory in 2016 caught most pundits by surprise, but his pro-business policies and corporate tax cut aided – to some degree at least – the stock market rally. Since he won the election on 8 November, 2016, the S&P 500 has risen more than 50% to the end of 2019.

However, President Trump is a polarising figure. His hard-line views on immigration and trade relations, to name a few, have torn the Democrats and Republicans further apart. In doing so, the base of the Democratic Party is being tested with a rise in popularity of far-left figures – two of whom are running to face Trump in the 2020 general election: Vermont Senator Bernie Sanders and Massachusetts Senator Elizabeth Warren.

5. Climate Change conversation to grow louder

One of the biggest movements of 2019 was the mounting pressure on countries to address climate change initiatives. Destruction in the form of wild fire, floods and rising sea levels will weigh on capital.

Aside from the political dialogue, concerns also pose a risk to economic issues. Countries whose climate change targets fall short of international expectations could face trade implications and stalled agreements.

An ongoing challenge for investors as we head into 2020 will be measuring portfolio exposure to climate-change-related companies, which have downside risks given the heightening regulatory environment.

Still a lot to be optimistic about

There’s no doubt that 2020 will offer up periods of uncertainty and market volatility. However, there is still a lot to be optimistic about both at home and abroad. We are particularly encouraged by the strength in labour markets and strong consumer spending.

Still, we recognise economies work in cycles and asset prices are susceptible to volatility through periods of uncertainty. With that being said, economic cycles can provide opportunities through mispriced assets, and with ANZ’s active management approach and long-term focus, we are confident this philosophy will deliver reliable returns for our investors, over the long term.

Download the full ANZ Investments 2020 Market Outlook report.

This information is issued by ANZ New Zealand Investments Limited. The information is current as at 16 January 2020 and is subject to change. The information is general in nature and does not take into account your personal objectives, needs and financial circumstances. You should consider the appropriateness of the information, having regard to your personal objectives, needs and financial circumstances. This information is not to be construed as personal advice, and should not be relied upon as a substitute for professional advice. Although all the information in this document is obtained in good faith from sources believed to be reliable, no representation of warranty, express or implied is made as to its accuracy or completeness. Past performance is not indicative of future performance. The value of investments may rise or fall and the repayment of subscribed capital is not guaranteed. ANZ New Zealand Investments Limited is the issuer and Manager of the ANZ KiwiSaver Scheme, ANZ Default KiwiSaver Scheme, OneAnswer KiwiSaver Scheme, ANZ Investment Funds, OneAnswer Single-Asset Class Funds and OneAnswer Multi Asset Class Funds. A copy of each of the ANZ KiwiSaver Scheme OneAnswer KiwiSaver Scheme, ANZ Default KiwiSaver Scheme, ANZ Investment Funds, OneAnswer Single-Asset Class Funds, OneAnswer Multi Asset Class Funds guide and product disclosure statement is available at anz.co.nz or on request from any branch of ANZ. Investments in ANZ KiwiSaver Scheme, ANZ Default KiwiSaver Scheme, OneAnswer KiwiSaver Scheme, ANZ Investment Funds, OneAnswer Single-Asset Class Funds and OneAnswer Multi Asset Class Funds are not deposits in ANZ Bank New Zealand Limited, Australia and New Zealand Banking Group Limited or their subsidiaries (together “ANZ Group”), nor are they liabilities of ANZ Group. ANZ Group does not stand behind or guarantee ANZ New Zealand Investments Limited. Investments are subject to investment risk, including possible delays in repayment, and loss of income and principal invested. ANZ Group will not be liable to you for the capital value or performance of your investment.