NZ Media Releases

Resilience Reflected in Annual Results - Antonia Watson

Antonia Watson

CEO

ANZ Bank New Zealand Ltd

Covid-19 brought unprecedented challenges to our country and consequently for many businesses, including ANZ NZ, and this is reflected in our full-year result.

Despite the difficult year, ANZ’s continued to perform well, demonstrating we can weather challenging economic conditions and play an important role in supporting customers through the crisis

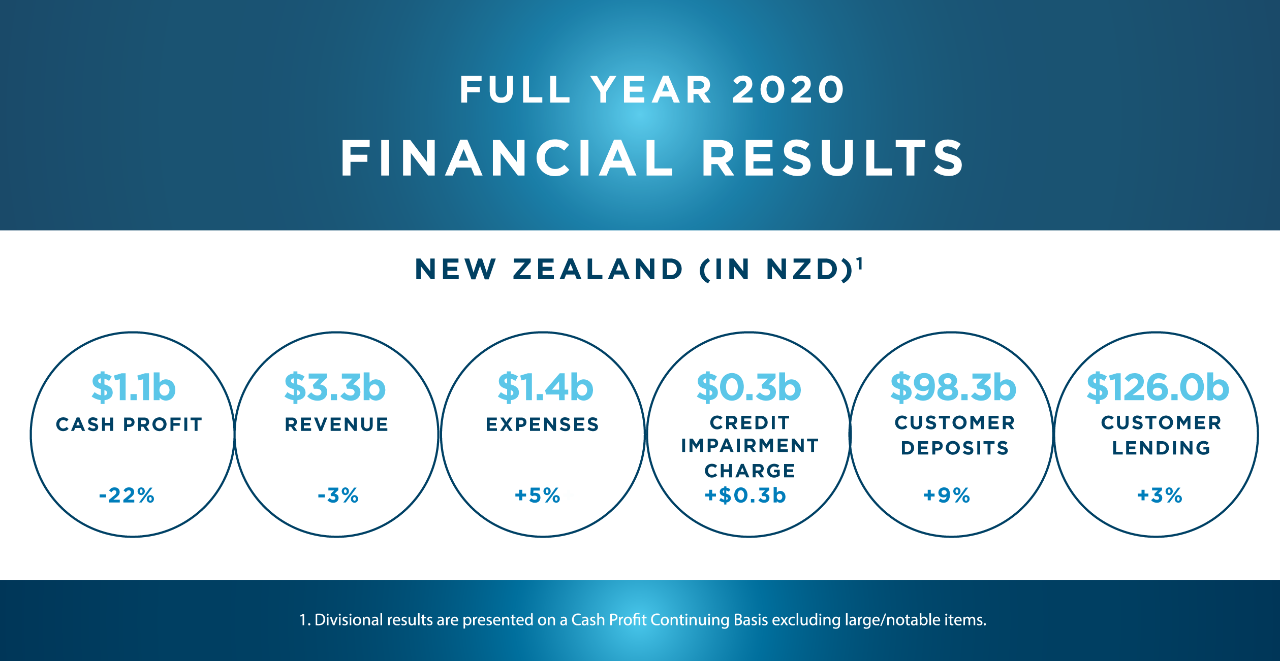

HEADLINE RESULTS

- ANZ New Zealand1 (ANZ NZ) today reported a statutory2 net profit after tax (NPAT) of NZ$1,336 million for the 12 months to 30 September 2020 – a 27% decrease on the 2019 financial year.

- Cash NPAT was NZ$1,371 million, 29% down on the previous year.

As New Zealand’s largest bank, we’ve been in a unique position to assist thousands of businesses through a period of severely curtailed business activity. This has helped stabilise the economy and put the country in a better position to recover once the worst of the crisis is over.

I’m particularly proud of our team here in New Zealand. They’ve done incredible work looking after our customers and supporting their colleagues during what has been the most unusual of times.

Despite such challenging conditions, we’ve been able to continue to lend and provide certainty to customers with an approach that is fair, transparent and consistent so access to credit isn’t a factor that holds them back.

During Covid-19, we worked closely with the Government and regulators to implement Government-led support initiatives, such as home loan deferrals and the Business Finance Guarantee Scheme, as well as a major programme of reduced fees, charges and interest rates, to help customers through the crisis.

So far, we’ve provided financial help to around 43,000 personal, home and business loan customers through repayment deferrals or adjustments covering lending of around $27 billion.

To help the most vulnerable in our communities, we donated a total of $2 million to Women’s refuge, Age Concern New Zealand and the Salvation Army’s food bank network, as well as the Red Cross and a series of local charities in the Pacific. A $1m sports grant system was also established to support more than 400 grassroots cricket and netball clubs and initiatives.

The donations were in addition to our $13 million annual contribution of local sponsorships and donations to sports, arts, cultural and community organisations and events.

While the Covid-19 crisis is far from over - and we all need to remain vigilant – New Zealand has made much better progress in fighting the virus than most countries.

While that’s encouraging there will be many challenges as the country emerges from the high level of response and starts to rebuild.

Key Points

All comparisons are year ended 30 September 2020 compared with year ended 30 September 2019 and on a cash basis unless otherwise noted.

- Statutory profit down 27% at NZ$1,336 million.

- Cash profit down 29% at NZ$1,371 million including impact of one-off items.

- Revenue down 6% including impact of one-off items.

- Charge for expected credit losses increased 305% to $401 million due to changes in the economic environment.

- Expenses increased 10% due to higher regulatory compliance spend and goodwill impairment relating to the intended windup of the Bonus Bonds Scheme.

- Customer deposits up 11% and underlying gross lending increased by 3% (flat at a headline level after the sale of UDC).

- KiwiSaver funds under management grew 11% to $16.4 billion.

- No ordinary dividends paid to the ANZ NZ parent entity in Australia.

1ANZ New Zealand represents all of ANZ’s operations in New Zealand (NZ Geography), including ANZ Bank New Zealand Limited, its parent company ANZ Holdings (New Zealand) Limited and the New Zealand branch of ANZ.

2Statutory profit has been adjusted to exclude non-core items to arrive at cash profit continuing basis, the result for the ongoing business activities of ANZ New Zealand. Refer to Summary of key financial information for details of reconciling items between cash profit and statutory profit.

RELATED ARTICLES

NZ Media Releases

UDC Finance sale to Shinsei Bank completes

NZ Media Releases