Smaller exporters hardest hit by rising shipping costs

Susan Kilsby - ANZ Agricultural Economist

The last year has been a tough time for some of our smaller exporters and it looks like getting goods offshore will continue to be a struggle as they face rising shipping costs and dropping capacity, with the situation not likely to improve well into 2022.

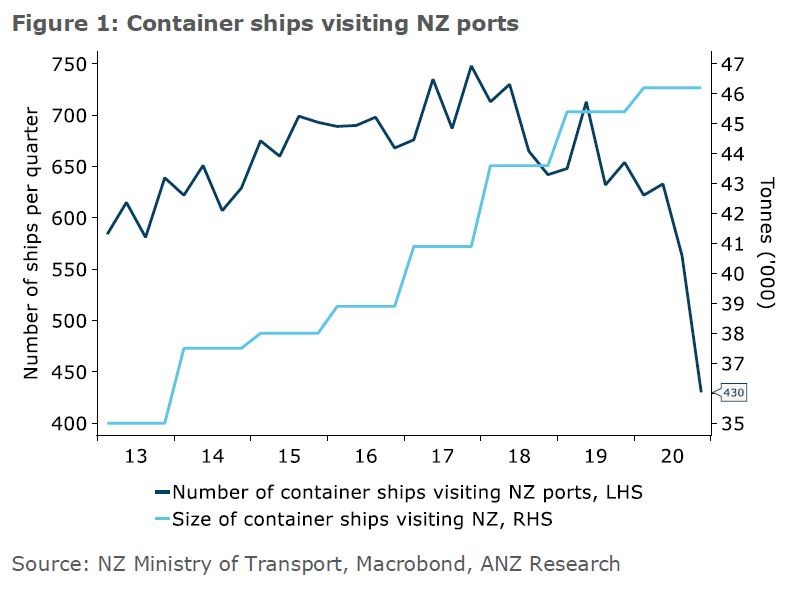

A look at the latest figures shows the number of container ships visiting New Zealand ports has decreased dramatically, with our ports increasingly unable to accommodate the newer and larger ships operating.

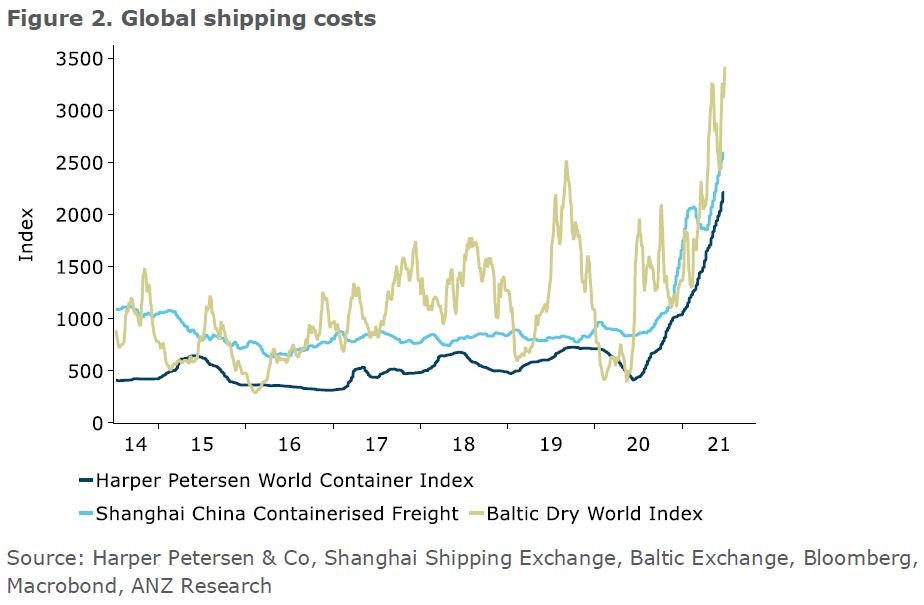

The cost of shipping is also sky high on the back of the Covid-19 pandemic, which caused a number of delays, and subsequent backlogs, at key ports across the globe, while also pushing up demand for goods.

While some larger NZ exporters have supply chain agreements in place with shipping lines, to ensure their goods make it overseas, it’s our smaller exporters that are now struggling the most.

For those trying to send products like fresh produce or meat overseas, it’s a real struggle, and we’ve seen an increasing number of exporters forced to send their products frozen – and accept a lower price.

This has the knock-on effect of putting pressure on our cool store and refrigerated container capacity, with meat and other horticultural produce now being stored for lengthy periods before being shipped.

It seems Europe is particularly pricey to ship to at the moment, with several shipping lines recently advising they will be doubling the cost of sending containers there - bad news for our lamb and wine producers.

Many smaller exporters will unfortunately now be familiar with the experience of having their goods bumped off a sailing, or having a that sailing cancelled completely - which in the shipping industry is known as a ‘blank sailing’.

Aside from the increasing prices, shipping companies have also moved their ships onto the most profitable routes, have dropped some routes completely, and are by-passing certain ports, adding to logistical challenges.

The ports being passed over are often the most-heavily congested ones, where shipping lines need to make tough choices to stay on schedule as port staff struggle with the backlogs.

We are seeing New Zealand ports increasingly unable to accommodate the much larger ships which are sailing today, which limits the number of ports those ships can call at.

Tauranga remains best equipped for larger vessels, and has increased its share of container traffic in and out of NZ considerably over the past decade.

In 2020, 42% of New Zealand’s containers went through Port of Tauranga, whereas a decade ago it accounted for just a quarter of that volume.

At the same time, we’re seeing a decrease in container movements through Ports of Auckland, Centreport (Wellington), and Port of Otago.

And those larger ships are nowhere near compensating for the dropping number of ships visiting our ports – in the fourth quarter of 2020, just 430 visited, which is 34% fewer than the same time period a year before.

So when are things likely to return to normal? It’s hard to say - and possibly out of our control.

Estimates of when global shipping routes and costs will return to ‘normal’ keep getting pushed out, but we believe the chaos is likely to continue well into next year.

The Covid-19 pandemic pushed up demand for goods, and pushed down demand for services like travel, with people opting for a new lounge suite over their now-unfeasible holiday.

A lot of that demand isn’t even coming from New Zealand, but from large countries like the USA, so New Zealand has limited control over getting things back to ‘normal’.

A meaningful drop in demand would be needed before the tangle starts to be sorted out, and we also need to see ports operating more efficiently.

Consumers across the world would need to be more prudent with their spending, or travel and services spending needs to jump back up, which will likely drop the amount of spending on goods that need shipping.

Shipping companies are also making abnormally high returns at the moment, and are flat out to boot, so they really have no incentive to reduce prices to gain market share – they have as much business as they want.

On top of this, global trade is forecast to lift 8% in 2021, and a further 6% in 2022, which suggests there won’t be a let-up in demand for shipping any time soon.

In the meantime, vaccinating all port staff against COVID-19 will help eliminate some of the risk of further port shutdowns – not just here, but across the globe.

This article first appeared on Stuff.co.nz