NZ Media Releases

Essential ANZ workers step up for customers in Level 4

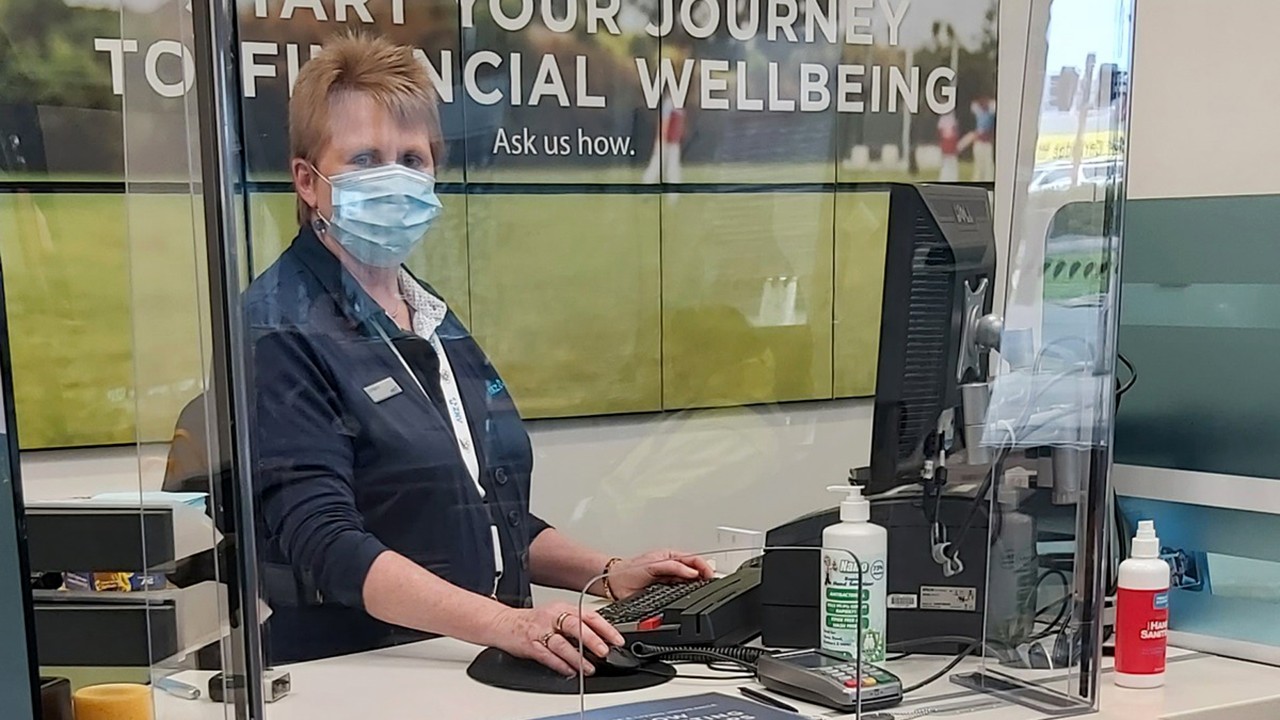

A number of ANZ branches around the country have re-opened on Tuesdays and Thursdays, with limited hours and tight Covid-19 controls in place.

A total of 64 branches will be open in Level 3 and 4 between 10-12pm, to help customers who cannot do their banking any other way.

Those services will include simple withdrawals and deposits, Essential Service business banking which cannot be done using Fast Deposit, issuing replacement EFTPOS cards, and assisting vulnerable customers with setting up phone or internet banking.

ANZ is asking customers not to visit a branch if they are unwell or awaiting the results of a COVID test, if they have visited a location of interest, or if they are able to do their banking through one of ANZ’s self-service options.

More information on the branches and services available can be found here.

ANZ staff have already been stepping up to help those most in need in Level 4, including about 60 essential registered seasonal workers in Marlborough, Tasman and Otago, who were unable to access their salaries.

ANZ Richmond Branch Manager Peter Herrick said his staff were glad to be able to assist this vulnerable group, and that strict Covid-19 control procedures were put in place for customers and staff.

“We were really happy to help – it’s about getting behind the community where you can, and these workers had no alternative means of accessing their salaries, having only recently arrived in the country with no bank accounts or cards,” Mr Herrick said.

“We had robust Covid-19 precautions in place, not only for the safety of the customers, but for our staff as well.”

“We had robust Covid-19 precautions in place, not only for the safety of the customers, but for our staff also."

Digital banking adoption increasing fast – especially in seniors

Alert Level 4 has put even more emphasis on the ability to work and manage things remotely, but latest transaction data from ANZ suggests there continues to be a rapid change in the way Kiwis are choosing to bank, regardless of lockdowns.

Since last year, ANZ has seen an 11% increase in the number of customers registered for its digital channels - like ANZ Internet Banking and the goMoney mobile app - with the largest increase in customers aged over 65.

An additional 205,000 customers have signed up to one of those channels, increasing from 1.8 million customers a year ago to 2.05 million now, with 1.6 million of those having logged in at least once in the past 90 days.

As a result of the shift towards banking digitally and as our customers become more familiar with self-service options, there has been a 25% reduction in staff-assisted simple transactions, like deposits, withdrawals and statement requests, through our Branch and Contact Centre teams.

Our branches, in particular, have seen a 38% reduction in over-the-counter transactions from pre-COVID levels, with less than 1% of the bank’s total value of transactions now processed face-to-face at a branch.

ANZ New Zealand Managing Director Personal Banking Ben Kelleher outside the ANZ Wairau Valley branch.

ANZ Managing Director Personal Banking Ben Kelleher said while ANZ continues to look at options for people to safely do their banking in a branch if they can’t access the internet or use the contact centre, the move towards banking online was heartening to see.

“We know the people turning up to our branches are often the ones deemed to be more vulnerable to the virus, with many of them elderly - having them going out during a pandemic isn’t ideal,” Mr Kelleher said.

“Each time we enter a lockdown or change alert levels, I’m reminded of the essential role digital technology plays in our lives, and how important it is for all New Zealanders to have the confidence and ability to connect online.”

A range of how-to guides, available here, have been created to make banking online, over the phone, or using ANZ’s network of Smart ATMs just that little bit easier - from making payments, checking statements, ordering a replacement bank card, to depositing or withdrawing cash, the guides provide easy-to-follow steps.

RELATED ARTICLES

NZ Media Releases

ANZ reintroduces Covid relief measures for business customers

NZ Business