NZ Consumer

Battening Down The Hatches?

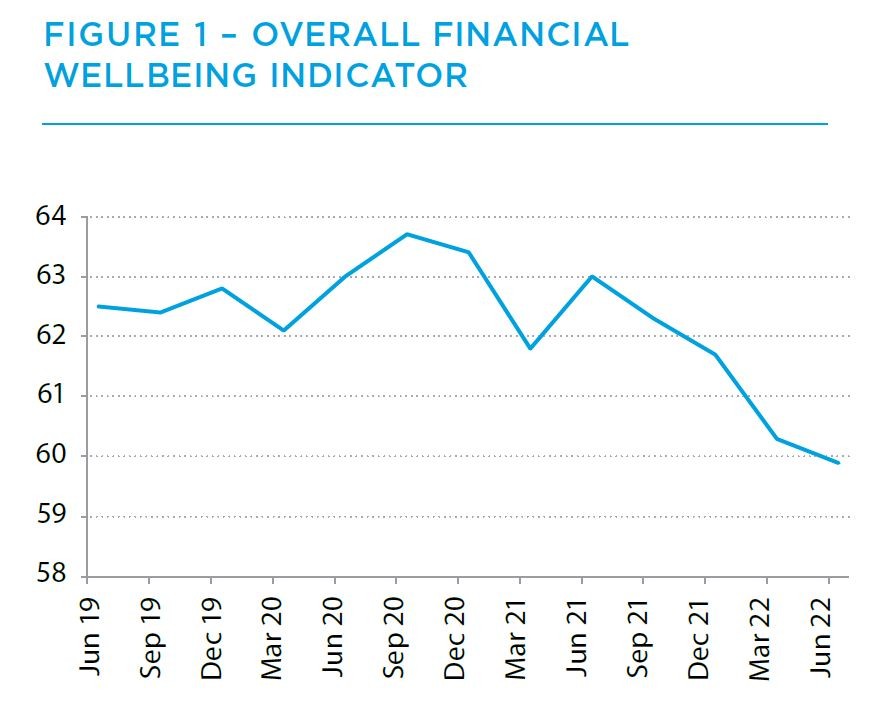

This report covers the period ending 30 June 2022. For those who have been following the news it may come as no great surprise that the Indicator Score has fallen further.

It now sits at 59.9, which is the lowest point since we started tracking back in 2019.

The past three years have been anything but ordinary. Over 2019 when we started tracking the Indicator Score it sat between 62 and 63 with only fairly minor variations, which is what we would expect.

Then of course Covid struck, and despite the economic disruption of lockdowns and closed borders, the overall wellbeing metric improved.

Large-scale Government support for those whose incomes were affected cushioned the impact for many and prevented a

sharp rise in unemployment, and one financial silver lining of the lockdowns was an increase in saving.

However, over the past year we have seen a fairly dramatic decline. To ascertain what is driving this, we examine each of the three components of the Indicator Score in more detail.

ABOUT THE FINANCIAL WELLBEING INDICATOR SCORE SERIES

The ANZ Financial Wellbeing Indicator Score provides a time-series measure of New Zealanders’ financial wellbeing.

ANZ has partnered with Roy Morgan to replicate key financial wellbeing questions from the 2021 ANZ Financial

Wellbeing Survey.

This robust, quarterly snapshot of the personal financial wellbeing of New Zealanders identifies key questions from that survey and applies them to proxies within the weekly Roy Morgan Single Source survey of 7,000 New Zealanders annually.

You can find a copy of the 2021 report here.

LOOKING AT THE COMPONENTS OF THE FINANCIAL WELLBEING INDICATOR SCORE

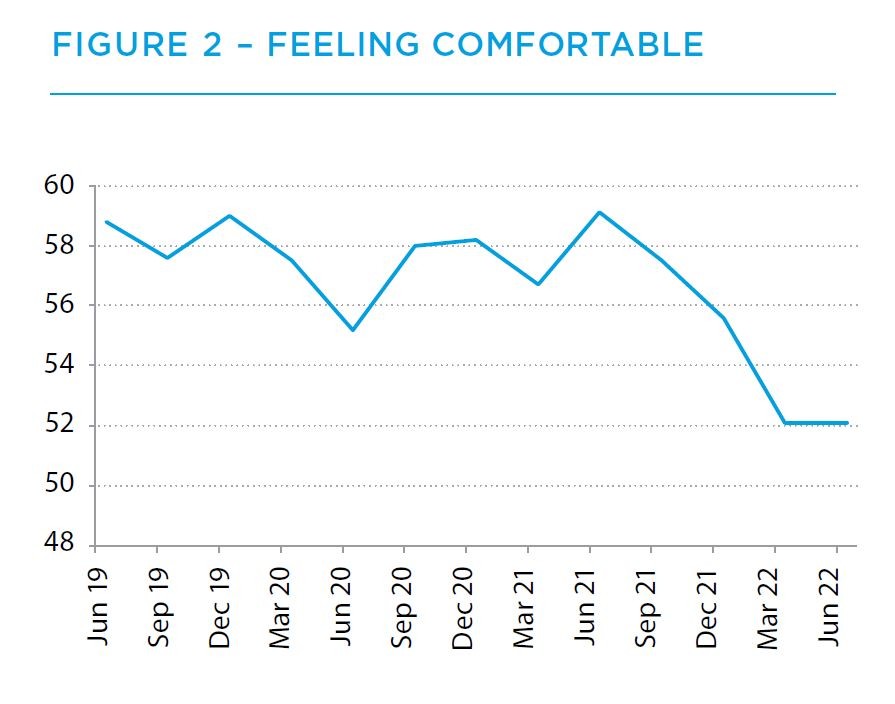

1. Feeling comfortable.

The first component of the score measures the degree to which people are feeling comfortable about their economic situation.

Over the latest quarter this has held steady, although at a low level following a drop in Q1.

The fall in the first quarter came as no real surprise as we started to see asset values fall.

Share markets around the world started to weaken (for example the S&P 500 fell 4.6% in Q1 2022) and the impact of falling markets was reflected in many people’s KiwiSaver balances.

At the same time house price growth came to a halt, with the peak in prices seen around November 2021. Since then they have fallen in most parts of the country, and continue to do so.

As well as seeing their net wealth decline, things on the international front took a dramatic turn for the worse with the Russian invasion of Ukraine.

Closer to home Covid 19 infection levels soared to a high of 17,552 new cases on 6 March, disrupting both work and personal lives.

But although we can’t pinpoint the causes with any accuracy, the largest impact may have come from the sharp rise in the cost of living. Prices have soared, with CPI inflation hitting 7.3% in the year to June, a rate not seen in decades.

Particularly for those on lower incomes, getting by abruptly became a lot harder. All up, the dive in the proportion of people feeling comfortable is unsurprising.

On a positive note, the last quarter has not fallen further.

Sharemarkets recovered some lost ground and KiwiSaver balances have followed suit. Wage growth has lifted substantially, with average hourly earnings hitting 7.05%.

But of course there’s a huge range of outcomes hidden by that average, and not everyone will have seen their purchasing power restored.

So from a financial wellbeing point of view what should people be doing? For KiwiSaver most of us can’t access those funds until we turn 65, so at times it’s best to just not look at your balance.

Make sure your fund type matches your risk appetite, and whenever possible continue to contribute. One way to look at it is that the fall in markets means you are buying many shares more cheaply than you could at times last year.

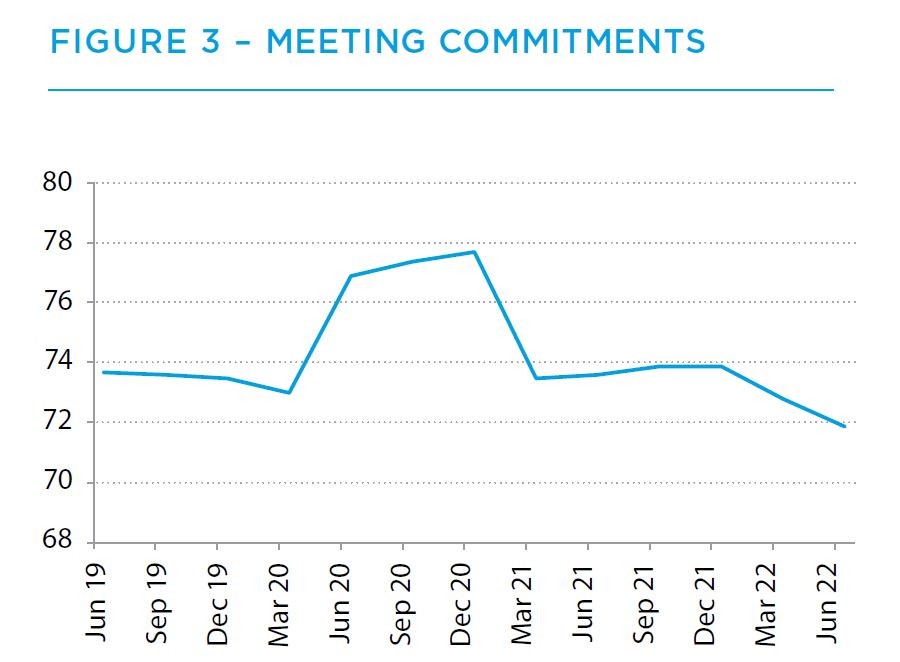

2. Meeting commitments

The measure of peoples’ ability to meet their commitments fell again in Q2, after the fall in Q1. We have seen a spike in inflation with the cost of many things rising.

While as discussed above, wages have risen sharply too, the reduction in our ability to meet commitments suggests that rises in income have not matched these increased costs for many people.

In response to the rise in inflation the Reserve Bank has aggressively hiked the official cash rate (OCR) and this increase has flowed through into the interest rates that many people pay on their mortgages.

The past few months have seen many households roll off interest rates starting with a two, and onto new rates with fours or fives in front.

The impact on the household budget can be substantial.

One interesting feature of the early days of Covid was the lift in people’s ability to meet commitments. For a lot of people their costs fell while they were at home in lockdown, and international borders were closed.

By March 2021 we appear to have returned to a more normal level before the impact of inflation then started to hit in 2022.

From a financial wellbeing point of view, the most important thing is to not spend more than you earn, and don’t use borrowing to fund everyday expenses.

One of the questions in the Roy Morgan survey asks about people’s attitude to credit. Do they agree with the statement ‘credit

enables me to buy the things I want’? This metric has hit the highest point we have seen since 2017.

For people who can afford credit this is not necessarily a bad thing, but if it means people are turning to credit to cover everyday expenses, this is concerning.

At the same time, we have seen the proportion of people who say they have a credit card continue to decline.

This was down to 48% in June 2022, a significant fall from 59% back in December 2019. Some of the explanation for the seeming disconnect between the two data points may be down to the growth of buy now pay later schemes.

Alarmingly, some people don’t regard these as credit. From a financial wellbeing point of view people need to be clear – they

most certainly are.

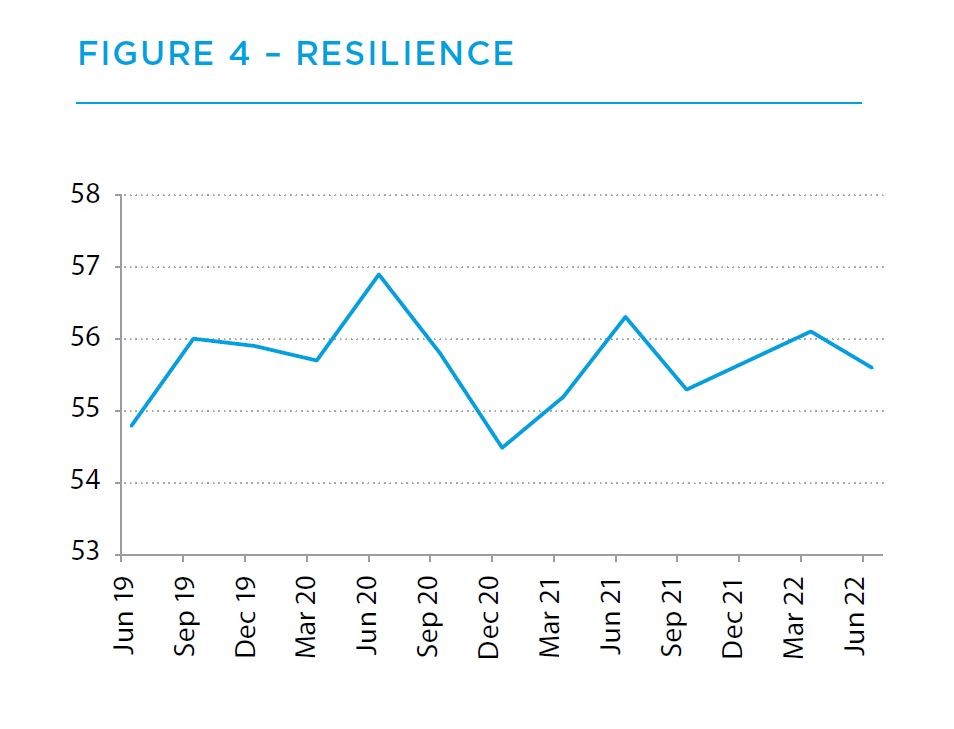

3. Resilience

This component of the score looks at peoples’ ability to withstand an unexpected financial setback. This is the comparative bright note in the recent quarter, with the resilience score holding up pretty well.

This is consistent with commentary by the Reserve Bank in its August Monetary Policy Statement that household balance sheets are “sound”.

The key drivers of resilience are income and savings.

Thankfully, despite the troubled economic times, employment levels remain high. In the survey the proportion of people in full time work is the highest we have ever seen at 46%, while those looking for work is the lowest we have tracked at 3.7%.

Interestingly, the proportion of those aged 65 or older saying they are working either full or part time is the highest we have seen since 2019.

One can debate the balance of desire versus necessity in these employment numbers, but they are certainly supporting incomes.

The survey also tracks savings behaviour. We track the median amount that people have saved in their accounts.

The long-term average is $4,732, while the current median amount is sitting just above that at $4,820. This is good

news, insofar as it suggests that not many people have needed to draw down their savings to meet everyday expenses.

From a financial wellbeing point of view, having a savings buffer to help you weather unexpected expenses, like car repairs or the dentist, is one of the best things you can do.

It means you are much less likely to have to borrow money to cover the costs. It also helps many people sleep a bit easier.

Another way that people build a financial buffer against the unexpected is to pay down their debts faster – in particular their home loan.

We know from internal ANZ data that a significant proportion of our borrowers are ahead of where they need to be, which is something we encourage people to do whenever possible.

IN SUMMARY

Times are tough for many people; there’s no denying it. The Indicator Score is the lowest we’ve seen in the survey’s short history. But a lot of people are in good shape to get through this.

Employment rates are high, savings levels are holding, and a lot of people are paying down their debts more quickly than they need to. These good financial wellbeing behaviours will help them weather the current stormy waters.

RELATED ARTICLES

Financial Wellbeing: Why Your Relationship With Money Really Matters

NZ Consumer