NZ Business

Survey shows a hint of financial optimism

As we navigate through the ups and downs of the current financial landscape, there’s a hint of financial optimism emerging among Kiwis.

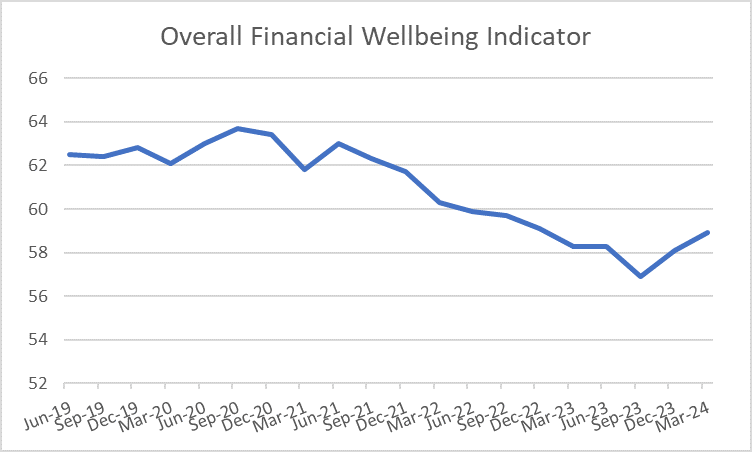

The latest ANZ Financial Wellbeing Indicator (FWI) reveals a modest rise in financial confidence in the first quarter of this year.

The FWI is made up of three key components – our ability to meet financial commitments (like paying rent, a home loan, or other bills), how comfortable we feel about our financial situation and our resilience to sustain financial shocks.

The overall score rose to 58.9 in the March quarter, up from 58.1 in the previous three months. That is well above the low point of 56.9 recorded in the September 2023 quarter.

Here are four key lessons we can learn from the trend.

The FWI Indicator is made up of three key components – our ability to meet financial commitments (like paying rent, a home loan, or other bills), how comfortable we feel about our financial situation and our resilience to sustain financial shocks.

1. The Power of Perception: Feeling Comfortable Matters

One of the standout findings from the ANZ survey is the increase in the 'feeling comfortable' score, which measures how people feel about their financial situation now and over the next 12 months.

This rose to 50.5 in the March quarter, the highest level since September 2022. This rise occurred despite a slight decline in respondents’ assessment of their ability to meet their financial commitments (slipping to 70.8 in the March quarter, down from 71.3 in the prior three months).

It highlights the crucial role that perception and confidence play in our assessment of our financial wellbeing.

This boost in comfort can be attributed to a few factors. For one, the ANZ Consumer Confidence survey showed improvements in January and February, before falling in March.

Additionally, global investment markets experienced an upswing, which positively impacted many KiwiSaver balances. Moreover, the new Government enjoyed a brief period during February where a majority of people believed the country was on the ‘right track’.

The lesson here is clear: while hard numbers like income and expenses are vital, how we feel about our financial future significantly impacts our overall sense of wellbeing.

2. Building Resilience Through Savings

Resilience is another critical component of financial wellbeing, reflecting our ability to cope with future financial events.

The ANZ survey showed a modest rise in this indicator, supported by the highest average and median savings balances seen in the last two to three years. This suggests that many people are making strides in building their financial buffers, despite the broader economic challenges.

The importance of having a savings buffer cannot be overstated. ANZ’s customer data shows 55 per cent of our customers have at least $1000 saved, providing a safety net for unexpected expenses. Regularly saving, even small amounts, can significantly boost your financial resilience and peace of mind.

The takeaway? Developing a habit of saving, no matter how modest, can provide you with a crucial financial safety net, enhancing your ability to weather future financial storms.

3. Uneven Impact: Addressing Financial Inequality

While the overall Financial Wellbeing Index rose, it’s important to recognize that the economic pain is not being felt evenly across all segments of the population.

The Financial Wellbeing Index segments people into four groups called No Worries, Doing Okay, Getting By and Struggling.

Over the last quarter the number of people falling into the ‘Struggling’ segment lifted to 15.8 per cent, the second highest level we have seen since tracking began back in 2019.

At the same time the proportion of those sitting in the ‘No Worries’ category increased to 23.5 per cent, the highest level in the past two and a half years.

This disparity underscores the importance of targeted financial education and support. For those in the 'Struggling' segment, access to resources and financial advice is crucial. ANZ offers a range of tools and information to help individuals manage their finances and improve their financial wellbeing.

The takeaway is that even in times when overall optimism is rising, there’s still a need to address financial inequalities and provide support to those who are struggling. By offering education and resources, we can help more people achieve financial stability and confidence.

Regularly saving, even small amounts, can significantly boost your financial resilience and peace of mind.

4. Active Saving: A Key to Financial Wellbeing

Another positive trend we are seeing right now is our customer data is the number of active savers — those who regularly contribute to a savings account.

Approximately 20.83 per cent of ANZ customers fall into this category.

Active saving plays a pivotal role in improving your feeling of financial wellbeing. By setting aside money regularly, you not only build your savings but also cultivate a sense of control over your financial future. This proactive approach can mitigate the stress associated with financial uncertainties and help you achieve long-term financial goals.

The lesson here is to prioritize saving as a regular financial habit. Whether it’s through automated transfers to a savings account or setting aside a portion of your income, consistent saving can lead to substantial financial benefits over time.

RELATED ARTICLES

NZ Insights

What is 'open banking'?

NZ Media Releases