NZ property market in question

The outlook for the New Zealand property market has shifted abruptly in the last few months, as the country moved to contain the spread of COVID-19. With the economy taking a major hit and now facing a slow recovery, what does this mean for the property market? How are first home buyers affected? And which regions are the most vulnerable?

ANZ Senior Economist Liz Kendall answers the big questions.

How might the crisis affect the property market?

We’re likely to see property market data jumping all over the place in the period covering the lockdown and the easing of restrictions.

For example, in April, house sales fell 75% m/m, according to REINZ. New listings were so sparse in April that realestate.co.nz did not do a normal data release.

There will be some bounce back in transactions in May, with more sales able to occur in Level 2 and 3. But the size of the bounce is uncertain, and will depend on whether demand picks up.

This means it is difficult to determine general price trends, and price movements can be quite erratic.

Over April, prices fell a modest 1.1% m/m but downturns in prices tend to lag sales, and it will take some months for a weaker trend to be evident

We expect that both sales and price data will be whippy for a while, but that a softening in housing demand will become clear over time and that could lead to a significant downturn in house prices.

How much will house prices fall?

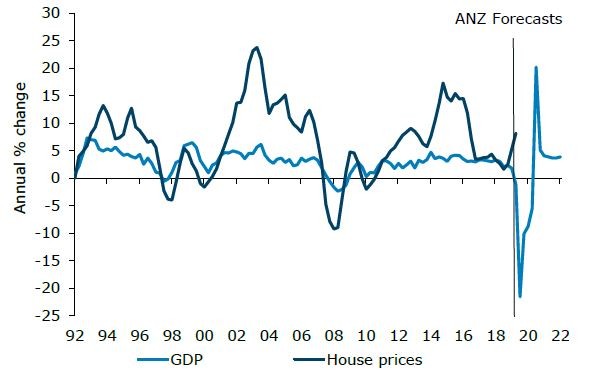

We continue to expect house prices will fall 10-15% over the year, with a number of factors influencing housing demand.

These include the expectation:

- unemployment and business failure rates will increase

- company and household income will drop, despite government support

- for some it will be difficult to cover debt-servicing costs, even with low interest rates

- there remains huge uncertainty, which in itself will put off some buyers

- there will be more short-term rentals available, along with completion of new builds currently in progress

- some homeowners will experience financial distress and mortgage delinquencies will rise, leading to fire sales

- migration will be lower

- future demand for housing will be weak, impacting house prices today

- banks are likely to be cautious, with lower asset values and worse income prospects hampering the availability of lending

- households will be cautious about taking on more debt, even though interest rates are expected to remain low for a very long time.

House prices and GDP - Source: REINZ, Statistics NZ, ANZ Research

Is it a good opportunity for first home buyers?

Whether or not it makes sense to enter the property market – or purchase another house – always depends on personal circumstances.

The current situation could provide an opportunity for first home buyers to enter the market when houses are more affordable and interest rates low.

However, the outlook is highly uncertain and it is always very difficult to pick the bottom of the cycle.

And it’s not just about house prices and interest rates; much will also depend on credit availability, income prospects, and the like.

For some, low mortgage rates may make purchasing more affordable and new opportunities may arise for some buyers with low equity, given that low loan-to-value restrictions have been removed.

Plus, lower rates of migration and reduced demand more generally may reduce competition in the market. These same factors may also encourage existing owner-occupiers to upsize.

But for some first home buyers, getting into the housing market may now unfortunately be harder.

KiwiSaver balances may be lower, there may be more hoops to jump through to get credit, and employment prospects may have changed.

And although opportunities may present themselves, we expect purchasers to be fairly cautious overall. The economic and property outlook is very uncertain, sentiment is weak, and job security has deteriorated.

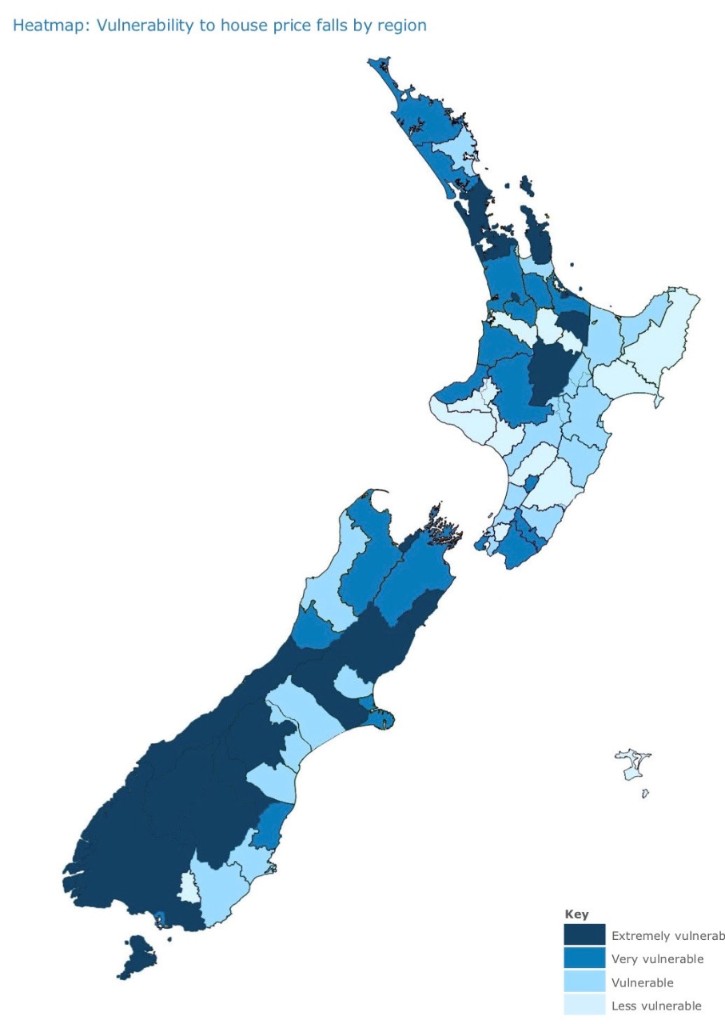

What regions are most vulnerable to house price falls?

It’s hard to predict what regions will be most affected by weakness in the housing market.

There is likely to be a lot of volatility in housing market data for a time, particularly in smaller regions, given that already-low transactions there could make price signals even more erratic.

We expect that house prices will fall 10-15% with downside risk, but regions will be impacted differently.

We don’t have regional house price forecasts, but those regions that are more vulnerable to falls are:

- Those regions that are significantly exposed to international tourism, since this will not recover for a long time.

- Regions that tend to attract new immigrants and students from overseas (although people reskilling will provide a partial offset in university centres).

- Areas that have seen high rates of building recently, since the balance between supply and demand of physical housing may change more rapidly in these places.

- Areas that have seen rapid increases in house prices recently, since expectations could change more dramatically.

We have assessed each region according to some of these factors and have assigned a degree of vulnerability to each.

The most vulnerable regions are Queenstown-Lakes District, Mackenzie, Kaikoura, Westland, Taupo and Thames-Coromandel.

ANZ New Zealand Property Focus | May 2020

Our overall assessment of vulnerability is based on a weighting of exposure to tourism, migration and building – all in per capita terms.

ANZ’s May 2020 New Zealand Property Focus report