NZ Consumer

Antonia Watson: Economic recovery supports half-year result

Antonia Watson

CEO

ANZ NZ Ltd

Announcing ANZ NZ’s half-year results today has given me cause to reflect on just how resilient many areas of New Zealand’s economy have been in the face of COVID-19.

It has been a challenging and fluid period for many businesses and, although the full impact of the pandemic has yet to play out, we are fortunate to have seen sectors such as housing, construction and agriculture generally fare better than expected.

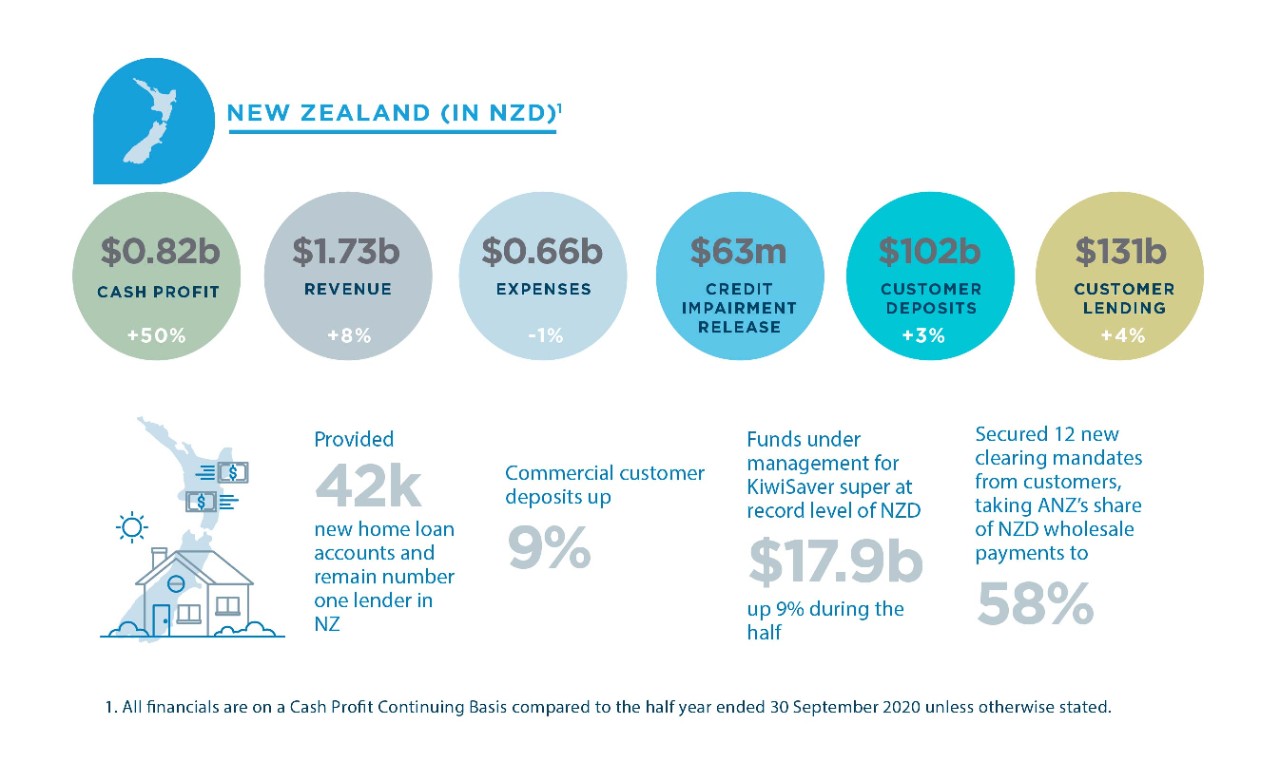

Our result – a statutory net profit after tax (NPAT) of NZ$930 million for the six months to 31 March 2021 - to some extent reflects the resilience of these businesses.

Their performance means we have been able to release about a quarter of the additional credit provisions we had put in place since the start of the pandemic to cover possible bad debts.

"Those industries that rely on overseas visitors, such as education, hospitality and tourism.. have been disproportionately affected by the pandemic, and we have been proud to work closely with many of them through these difficult times."

Antonia Watson, CEO, ANZ NZ Ltd.

While there’s room for optimism, we also know the impact on the economy has been uneven.

We have seen first-hand the challenges facing our customers in those industries that rely on overseas visitors, such as education, hospitality and tourism.

These businesses have been disproportionately affected by the pandemic, and we have been proud to work closely with many of them through these difficult times.

As the country’s biggest bank, ANZ NZ has also had an important role to play working with the Government and regulators to help business and retail customers manage their cash-flows and borrowings during the pandemic.

We have implemented key Government-led initiatives, such as home loan deferrals and the Business Finance Guarantee Scheme, as well as a major programme of reduced fees, charges and interest rates.

ANZ NZ offered various forms of assistance to customers including temporary deferral of principal and interest repayments, replacing principal and interest with interest only repayments, and extensions of loan maturity dates.

All these initiatives have play an important role in helping the country get through the last year or so.

As these relief packages have been phased out, it has been heartening to see that only a small number of customers have continued to need assistance.

The Reserve Bank of New Zealand’s use of its policy tools, including large-scale asset purchases and the funding for lending programme, has also kept interest rates lower and has supported access to credit for borrowers.

We’ve seen New Zealand’s housing market defy expectations due to historically low interest and deposit rates, reduced loan-to-valuation ratio requirements and existing issues with supply and demand.

As a result we saw our home lending increase $5.8 billion over the six months to 31 March 2021 and in December we were the first bank to require a 40 per cent deposit from residential property investors as a step to bring balance to the housing market.

It is in everyone’s interests for residential property prices to be sustainable long term, and for home ownership to be accessible to as many people as possible.

This strong increase in home lending is partly reflected in a 42% increase in ANZ NZ’s cash NPAT for the six months to 31 March 2021 of NZ$962 million.

It has been an extraordinary 18 months to be CEO and a huge test of our capability as a bank, but I am proud of the way in which we have consistently worked to help Kiwis get ahead in their lives.

Despite the challenges facing so many people, I believe we have able to help make it easier for them to save and stay on top of their money, buy and own homes, start and grow their businesses, protect their families and possessions, and prepare for retirement.

These are all vital parts of a strong and sustainable economy and essential for all New Zealanders to thrive in a post-COVID environment.

RELATED ARTICLES

NZ Insights

Uneven Results - The Economic Impacts of COVID-19 on Women

NZ Consumer