NZ Insights

Financial wellbeing improves despite Covid-19

New Zealanders’ overall financial wellbeing has improved slightly since the beginning of the Covid-19 pandemic; with an increase in the number of people who say they are can meet their financial commitments.

That’s according to the latest ANZ Financial Wellbeing Indicator.

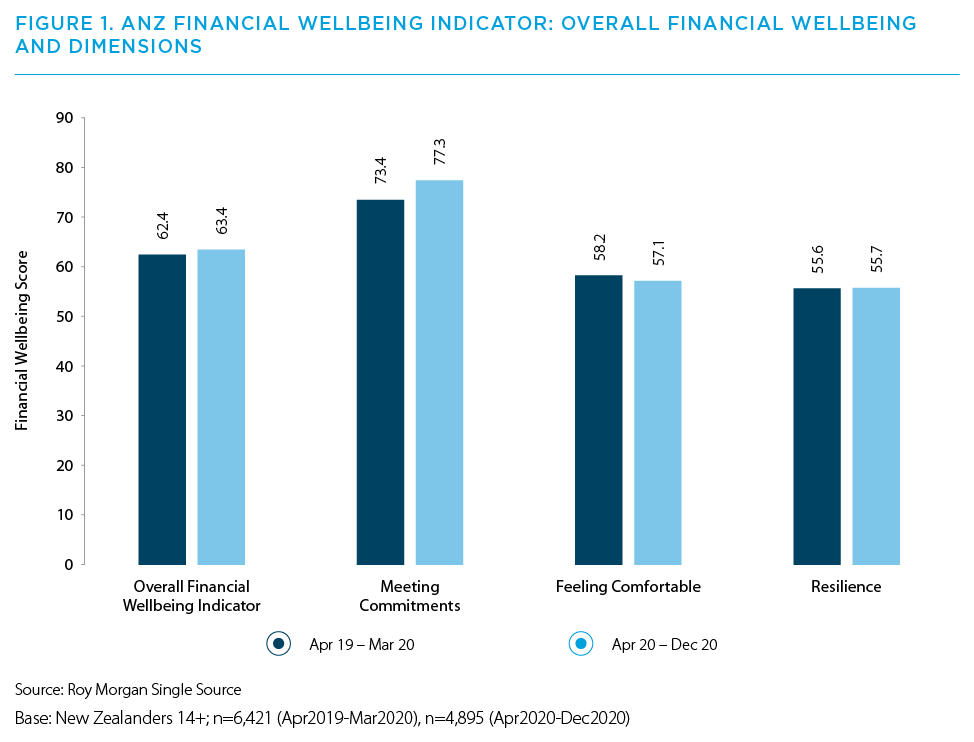

The research, conducted by Roy Morgan, found that at the end of December 2020, New Zealand’s financial wellbeing indicator stood at 63.4 out of 100. That compares to 62.4 at the end of March 2020.

However the report also found that almost ten percent of people have no savings and an even larger number feel it’s a challenge to make ends meet.

"The overall improvement in financial wellbeing was due to a noticeable increase in the number of people who felt they could meet their financial commitments."

Ben Kelleher, Managing Director, Personal Banking, ANZ NZ

The Financial Wellbeing Indicator has three components that make up the overall score. These are: meeting everyday commitments, feeling comfortable, and resilience for the future.

The overall improvement in financial wellbeing can be attributed to a noticeable increase in the number of people who felt they could meet their financial commitments in regards to bills and payments. That score improved from 73.4 in March 2020 to 77.3 in December.

“We believe this is due to two main factors,” says Ben Kelleher, Managing Director, Personal Banking.

“First, despite the pandemic, many people were not directly impacted in terms of a reduction in their income.”

“The unemployment rate stayed lower than had been predicted, and the wage subsidy helped many people who were impacted by lockdowns.”

The second element was a fall in spending by many people. Interest rates fell, benefiting the many households who pay a mortgage. Overseas travel was no longer an option, and for some of the time many retailers and businesses were closed.

Feeling comfortable. This measure fell from 58.2 to 57.1, reflecting the degree of uncertainty people experienced in the wake of COVID-19.

The pandemic impacted job security for many people. There was also ongoing uncertainty about the potential negative impacts of the pandemic on the economy. This is likely to have made people feel uncertain, even if their own circumstances haven’t changed a great deal.

The third component is resilience for the future – the capacity to cope with significant unexpected expense or loss of income. This metric increased slightly from 55.6 to 55.7.

“Interestingly, it did decline in the last three months of the survey” says Mr Kelleher. “Many people lifted their savings during the early months of the pandemic, as they cut back on their spending. But as life started to return to something more like normal, we saw that the level of saving hasn’t been maintained.”

FINANCIAL WELLBEING SEGMENTS

The research divides people into four segments, according to their overall wellbeing score.

The four groups are:

Struggling: 9.4% of people are struggling, compared to 10.1% in the previous survey.

This group have a financial wellbeing score of 30 or less. A majority of those who are struggling have no savings and say it’s a constant struggle to pay their bills; often running short of money for food and other regular expenses. 32% always or often lack the money to pay a bill at the final reminder.

Getting by: Those who are ‘getting by’ dropped from 17.6% in the previous survey to 16.4%. Their financial wellbeing scores range from 31 to 50, out of 100.

For many people in this group it is a challenge to make ends meet. They could meet current financial commitments to a greater extent than those who are struggling, but their position overall is significantly worse than the population overall.

Doing ok: 48.7% of people are in this group. They have above average financial wellbeing, linked to secure employment and steady household income. Their financial wellbeing scores range from 51 to 80, out of 100.

Nearly all could meet their current financial commitments (only 3% regularly or often ran short of money for food and other regular expenses, compared to 14% of those who are getting by).

They had higher levels of resilience for the future (only 8% said they did not have any savings, compared with 37% of those who were getting by). They were more comfortable with their financial situation (8% described their financial situation as ‘bad” compared to 38% of those who were getting by).

No worries: 25.5% said they had ‘no worries’, compared to 24 percent in the previous survey. People in this group tend to have large amounts in savings, investments and superannuation.

There are two key drivers of financial wellbeing: active saving and not borrowing for everyday expenses.

Active saving is one of the most important elements of financial wellbeing.

The Roy Morgan survey found the media savings figure stood at $5,220 per person in December 2020, up from $4,400 in March 2020.

Not borrowing for everyday expenses is another essential behaviour for good financial wellbeing. It ensures people do not live beyond their means and accumulate unmanageable debt.

New Zealanders appear to have reduced their reliance on credit cards. From March 2020 to December 2020, credit card use fell from 56.9 percent to 51.5 percent. The incidence of debit cards has increased from 38.6 percent to 40.7 percent.

However the report notes there is concern that some of this change has been driven by the rise of ‘buy now, pay later’ schemes, rather than a reduction in the habit of spending money we don’t have. Instead, these schemes have made it easier to borrow for everyday expenses.

Even a small amount of savings can have an outsize impact on improving our sense of financial wellbeing.” says Mr Kelleher.

People with less than $1,000 in savings are very likely to have a low level of financial wellbeing. But as people begin to save more, their financial wellbeing improves.

“It doesn’t have to be tens of thousands of dollars. Just having a ‘rainy day’ fund can help, so that when the car breaks down or the washing machine stops, we have some money to use so that we don’t have to go into debt.”

RELATED ARTICLES

NZ Business

Sweet Deal – NZ-EU FTA a win for primary producers

NZ Insights