NZ Insights

Agri Focus - Reaping the Rewards

ECONOMY ON THE IMPROVE

Global economic growth remains constrained due to the ongoing challenge of combating COVID-19.

Many economies are, however, faring better than expected, largely due to the sizeable portions of ‘recovery pie’ dished out by central banks and governments.

The monetary stimulus, along with government initiatives, has mitigated some the impact of the fact that economies are not running at full strength, allowing more jobs to be retained.

How economies perform in 2021 is highly dependent on the course the pandemic takes, how quickly vaccines can be rolled out, and how well they work.

New Zealand is doing better than most at this point, but herd immunity remains a relatively distant prospect with vaccinations yet to start.

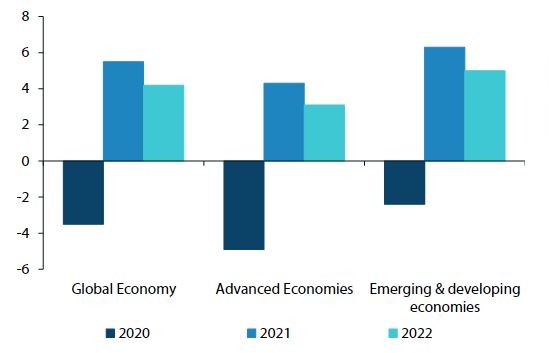

GLOBAL ECONOMIC FORECASTS UPGRADED

The International Monetary Fund (IMF) has upgraded its economic forecasts for 2021. The global economy is now expected to grow at 5.5% this year and 4.2% in 2022, having entered 2021 in a stronger position than previously anticipated.

The major risks for the global economic recovery are a renewed surge in infection rates, possibly due to new strains of the disease, resulting in additional or prolonged lockdowns, and/or a delay in the rollout of the vaccine programs, or a decline in the vaccines’ effectiveness as the virus evolves.

The rollout of vaccines is occurring at differing rates, with most countries targeting frontline health workers and vulnerable people first.

Vaccines are expected to become more widely available in developed countries and some developing nations later this year, whilst other countries won’t be able to obtain sufficient quantities to allow for an extensive vaccination programme until 2022.

WORLD ECONOMIC OUTLOOK GROWTH PROJECTIONS

Source: IMF World Economic Update

NO MORE CUTS

Central banks are expected to maintain their accommodative policy settings well into 2022.

We anticipate the Reserve Bank of New Zealand (RBNZ) will no longer feel the need to add further stimulus, as recent economic data has been better than anticipated.

Growth in the housing sector has largely offset falls in tourism and service sectors, in an aggregate sense.

We expect the RBNZ will continue to fund the Large Scale Asset Purchase (LSAP) program for some time. At this stage we see no need for the RBNZ to lift interest rates anytime soon – rather, it can be patient and see where the economy heads from here.

ECONOMIC HEADWINDS REMAIN

While New Zealand has enjoyed a V-shaped recovery, it won’t necessarily be plain sailing from now on. Headwinds to the economic outlook, especially related to the closed border, are expected to weigh on employment this year.

The unemployment rate is expected to peak near 5.5% in mid-2021 (see labour market preview). But this is much better than was originally feared.

Many tourism-related businesses are currently struggling and this will only get worse when schools reopen and domestic tourism slows.

Improvements in the labour market are expected to be gradual until herd immunity is reached and the border opens, with faster declines in the unemployment rate possible once economic activity normalises and the recovery accelerates and evens out.

While business sentiment and activity have improved, costs are also starting to rise. Inflationary pressures are expected to erode business margins, which will in turn impact business confidence.

COMMODITY PRICES RISING

Inflation remains subdued in most countries but commodity prices are starting to rise. Oil prices are forecast to lift 20% this year, while the IMF estimates non- fuel commodities will increase by 12.8% in 2021.

Fruit and dairy products have generally increased in value, and forestry products have also recovered very well. Returns for meat and wool have been more subdued depending on their main consumption channel.

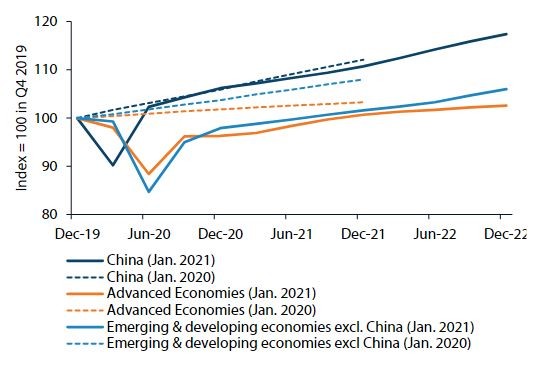

CHINA RECOVERING QUICKLY

China continues to be a significant driver of global demand for commodities. Its economy has recovered extremely quickly from the challenges thrown at it by the pandemic.

DIVERGING ECONOMIC RECOVERY

Source: IMF World Economic Update

China’s economy is virtually back on track, whereas the economies of other countries remain well behind pre-pandemic forecasts.

The rapid recovery of China’s economy bodes well for our primary sector exports given China is a major purchaser of nearly all of our primary products.

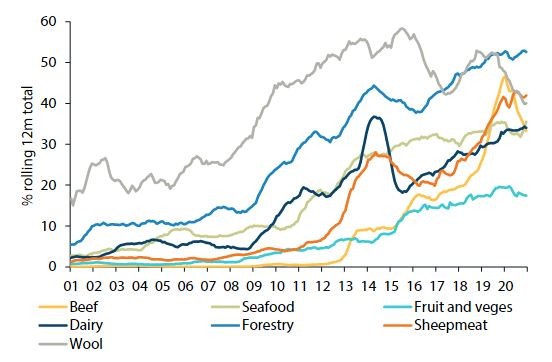

SHARE OF NZ EXPORTS TO CHINA

Source: StatsNZ

China was one of just a few countries who managed to grow its economy in 2020, albeit at a modest pace, and it is forecast to expand by 8.1% in 2021.

Demand from this country for timber products has improved significantly, resulting in a partial recovery of log prices. China also has an insatiable appetite for food products and feed for livestock.

New Zealand is a relatively small supplier of most commodities to China, but we are a major supplier of dairy products.

LOGISTICAL CHALLENGES TO STICK AROUND

One problem that continues to plague global growth is getting product to where it is needed. These logistical issues show few signs of abating.

Very few planes are flying international routes, meaning the reliance on shipping is higher than ever.

Demand for most goods has remained intact throughout the pandemic; it has been the service sector that has taken the brunt of the pain associated with lockdowns and physical distancing measures.

Shipping costs are rising rapidly. Shipping schedules are constantly changing, with numerous schedules being cancelled or containers being rolled over, ie simply not being collected.

This has left many empty containers stranded well away from where they are most needed, with refrigerated containers particularly difficult to source.

Shipping times are being extended due to delays at ports, resulting in product shortages and buyers bringing orders forward in order to offset the delays.

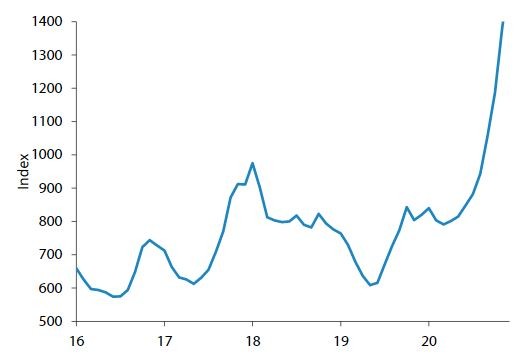

SHIPPING COSTS ON THE RISE

As many international routes are experiencing, the cost of shipping containers between New Zealand and China has skyrocketed.

Shipping lines are ultra-busy and are incurring additional costs due to extended wait times to unload and load goods at ports. Oil prices are also on the rise, which is increasing the cost of fuelling these vessels.

CONTAINER FREIGHT RATE INDEX – CHINA TO AUSTRALIA/NZ SERVICE

Source: RWI, Macrobond, ANZ Research

Competition between shipping lines is also diminishing as companies consolidate. Pacific International Lines (PIL) is in financial trouble and the loss of this shipping company would further reduce competition.

There have also been calls to reduce container loading or reduce shipping speeds following two incidents where large numbers of containers were lost overboard in heavy seas.

If additional safety measures are adopted then this will also add to the cost of shipping goods. Higher costs of shipping show no signs of abating anytime soon.

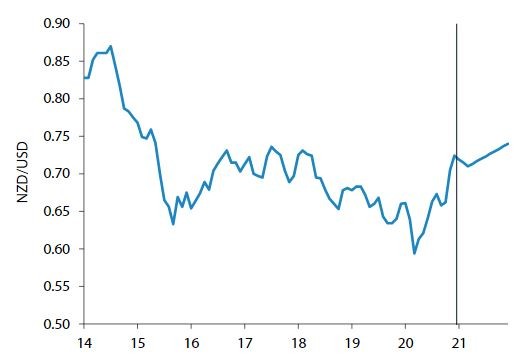

HIGH NZD NOT HELPING

The lift in shipping costs and the strong NZD are eroding returns at the farmgate level. The NZD is anticipated to continue to trend up in the near term, with USD0.74 the level expected to be reached by the end of the year.

No doubt this won’t be a steady climb – currencies don’t do straight lines, as shown in the chart below – but rather a jagged course as the USD fluctuates on economic news.

NZD BUYS USD

Source: Bloomberg, ANZ Research

CHINA FTA UPGRADE

The FTA upgrade is a really positive symbol of the strategic importance of trade between China and New Zealand, and that both countries highly value the trade relationship.

While on the surface it may appear there has been little change to tariff rates or quota-free allowances, what it does provide is an avenue to facilitate the movement of New Zealand goods into China, and access to high-level officials should challenges occur.

Part of the agreement is focused on reducing the time it takes goods to pass through to customs –highly important when trying to get fresh goods through highly congested ports.

Provision has been made for these types of goods to be cleared through customs within six hours. Forestry is one of the industries set to benefit from the upgrade of the trade agreement.

Under the new agreement, 99% of wood products will eventually be able to enter China without incurring a tariff; however, there

is a 10 year implementation period over which tariffs will gradually be removed.

The dairy industry is already nearing the end of scheduled time period when the safeguards are due to be removed on New Zealand product entering China.

At present tariff-free access applies to only approximately 22% of the milk powder exported to China, with the remainder incurring the 10% standard tariff that most other nations pay.

Similarly, New Zealand exports nearly 100,000t of butter and anhydrous milkfat (AMF) to China, but less than 20% of this enters China at the reduced tariff rate.

In 2024 all New Zealand dairy products will be tariff free. It was hoped this date could have been brought forward

in the new agreement but there was also a risk that the Chinese would extend it further.

To mitigate this risk this issue wasn’t brought to the table, which effectively locks in the 2024 date to fully eliminate tariffs on dairy products.

BREXIT

The UK officially left the EU just over a year ago, but it wasn’t until late last year that details of the new relationship were agreed. Under the new rules tariffs are basically identical across both the UK and the EU.

This – in theory – means goods should flow between the two regions as they have in the past. This means there has not been a significant disruption to the flow of sheep meat from the UK to EU, nor beef and dairy products from the EU to the UK.

The extended time it took to negotiate the deal and the uncertainty this caused has seen some European countries start to

diversify into other markets. For example, Ireland has increased its exports of dairy products to China.

One issue yet to be resolved is the meat quota. It has been proposed that the quota available to New Zealand exporters be split between the UK and the EU.

Despite the quota being well under-used in recent years exporters are reluctant to accept this proposal, as it reduces the flexibility they have in accessing each of these markets (high tariffs make it extremely prohibitive to send meat (nto the EU/UK outside of the quota).

Negotiations are continuing to resolve this issue.

RELATED ARTICLES

NZ Business

Sweet Deal – NZ-EU FTA a win for primary producers

NZ Insights