Community & Purpose

Older Australians begin to bridge the digital divide

“Most older people like and accept the online banking environment. Older people are not frightened to change with the times including how they do their banking.” – UniSA’s Braam Lowies.

-3082x2055%20crop.jpg/_jcr_content/renditions/cq5dam.web.1331.1024.jpeg)

New research by ANZ and UniSA debunks some of the myths and assumptions about older Australians’ experiences of the digital environment and their day-to-day banking.

The development of digital services has transformed the way customers interact with businesses across industries. The introduction of internet and digital banking is no exception with increasing adoption as customers conduct more of their business online.

One group affected by this digital switch is older customers, some of whom are perhaps less proficient users of technology. However the report – ‘Exploring Digital Capability in Older Australians’ – found the uptake of online banking among older Australians is perhaps not what many people would expect.

“Contrary to popular belief that older people are hesitant to use digital technologies, we found that most older people are reasonably happy to do their banking online,” says Director UniSA AHURI Research Centre Braam Lowies.

The research by Lowies and UniSA researchers Dr Ary Suryawathy, Professor Christine Helliar and Professor Kurt Lushington explored experiences through a series of telephone and face-to-face interviews and focus groups.

They found that Australians (over 65) are responding in line with the national average when it comes to embracing digital banking including how they do their banking,” says Lowies.

The research also reflects what ANZ is seeing in it’s customer base with increasing uptake in services including internet banking, according to ANZ’s Managing Director of Retail Katherine Bray. Almost half a million ANZ customers over 65 years of age are digitally active.

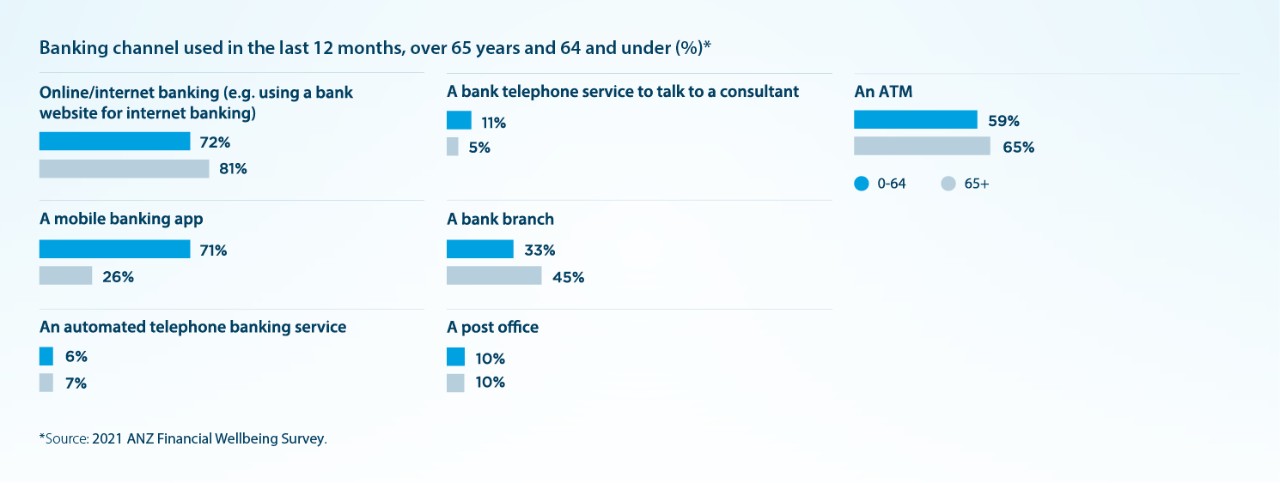

“It suggests the digital medium is as relevant for older people as it is for younger people.” she says. “While more customers in this age group are regular users of internet banking than mobile banking via the ANZ App, the gap is rapidly closing.”

Exploring Digital Capability in Older Australians

A series of telephone interviews and focus groups asked 46 older Australians about their experience of the digital banking environment. The research explores the views of older Australians with hearing loss and vision impairments. Three key questions were considered:

- What are the perceptions of older people regarding the use of technology (including devices) in managing their day-to-day finances?

- What is the level of information available to guide older Australians through the digital banking environment?

- What gaps exist in visual (words and text) and hearing (call centers and recorded messages) difficulties that older people may experience in the digital banking environment?

While some older Australians are becoming increasingly comfortable with online banking the report also includes candid feedback from focus groups where respondents expressed their frustrations and insecurities about new technology. A minority of respondents explained why they refuse to adapt to digital banking.

“I’m finding that I’m being made to do things on computer that I don’t want to do,” said one participant. Respondents were also advocates for other older Australians who do not have access to a computer or do not have the technical skills to transition to day-to-day digital banking.

“There is a small group of older people that do not use digital devices, making them vulnerable if they need to rely on the assistance of others (such as friends and family members) and reliant on a diminishing pool of bank branches,” says Professor Kurt Lushington, Professor of Psychology at UniSA.

Compared to younger adults, where digital banking penetration is close to a 100 per cent, digital banking is still much lower in older adults but higher than researchers expected.

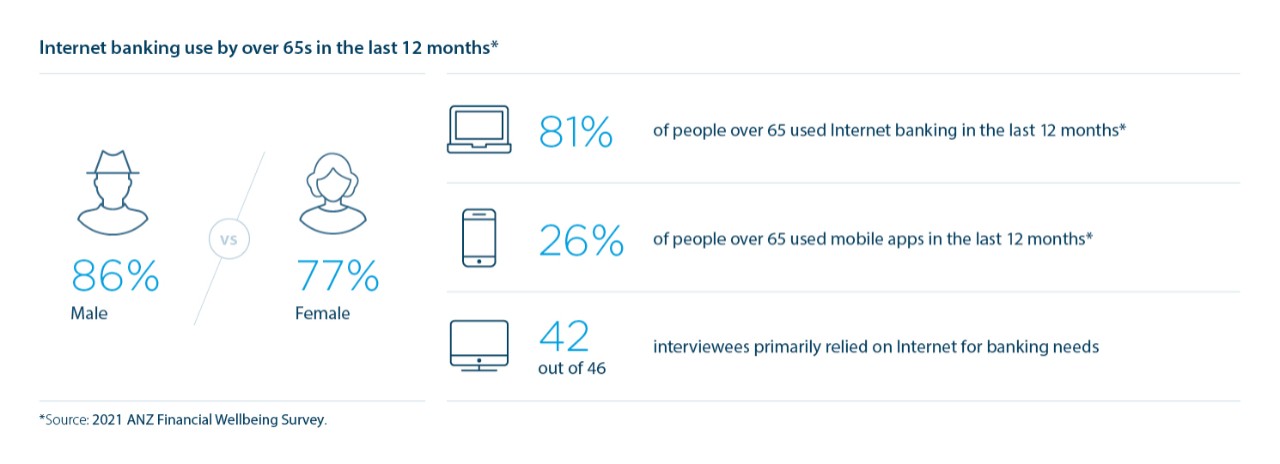

The 2021 ANZ Financial Wellbeing Survey also found 79 per cent of older Australians surveyed said they could manage their money online securely using websites or apps – with 86 per cent of males and 77 per cent of females having used internet banking in the last 12 months.

Ninety per cent of interviewees primarily relied on the internet for their banking and 81 per cent of people over 65 having used the internet for banking over the past 12 months.

Only 26 per cent of people over 65 years old used an internet app for banking in the last 12 months, with older Australians surveyed strongly preferring laptops, PCs and tablets to access digital banking.

According to the research the COVID-19 pandemic and associated lockdowns did not cause a significant spike in the use of digital banking because older Australians were already engaged in online banking, in particular embracing tap and go services.

The report also relied on interviews with older Australians with hearing loss and vision impairment. Interviews focused on people with age-related hearing loss who discussed difficulties with voice communications and the consequences this has for their day-to-day banking.

Barriers including banking staff who do not have clear diction and risks associated with correctly identifying numbers that sound acoustically similar were raised.

Banking difficulties

An estimated 575,000 people are blind or vision impaired and currently live in Australia, with more than 70 per cent over the age of 65 with 66,000 of these people who are blind.

Seventy-three percent of Australians aged over 70 have a mild to severe hearing loss. This percentage rises as age increases. As many as 85 per cent of people in ‘nursing homes’ typically have hearing loss.

SOURCE: Vision2020, Deaf Forum

According to the UniSA research, older Australians with hearing loss are embracing online banking, rarely using local branches for transactions. Interestingly, participants discussed how accessing digital banking is a “two-way responsibility”.

One interviewee talked about how hearing loss can be a “hidden disability” because many hearing aids are not easily noticeable therefore it can be difficult for customer service staff to know when a person has hearing loss.

“Part of the solution lies in training staff to recognise from their interaction with a customer that they have hearing loss and approach it sensitively,” said the interviewee, who shared his strategy for better telephone conversations with hearing loss. “It is not so much that I want people to speak more loudly but to speak more slowly. I can increase the volume on my phone, but I can’t stop them speaking fast.”

The research highlights the importance of age-related impairments being considered in the design of online banking products. “Many of us will experience more physical challenges as we age,” says Natalie Paine, ANZ’s Social Impact Research and Reporting Lead.

“A change in mindset is needed. This isn’t just about a generation of people who haven’t taken up online banking, all of us are likely to struggle as we age if the functionality isn’t supportive.”

ANZ’s retail banking team have been working on an outreach campaign for older Australians experiencing challenges around digital banking and the impact of branch closures. The team has made more than 60,000 calls to customers aged over 65 years, according to ANZ’s Bray.

“Through those calls we have identified that more than 90 per cent of these customers use at least one self-service option to do their banking, such as our ANZ App, internet banking or ATMs,” she says.

Change can be difficult but the UniSA research highlights that many more older Australians than you might think are accepting the challenge and finding new ways to access services, including banking.

Emily Ross is a content producer and director of Emily Ross Bespoke

RELATED ARTICLES:

Community & Purpose

Digital capability expands reach to inspire a new generation

Community & Purpose