MoneyMinded makes an impact

"Since September last year MoneyMinded has supported almost 55,000 people with building money management skills, knowledge and confidence, and nearly 850,000 people since its inception 20 years ago."

As households struggle with the rising cost of living and the ongoing disruption in a post-pandemic environment, ANZ’s flagship adult financial education program ‘MoneyMinded’ is more important than ever.

Developed in Australia in 2002, MoneyMinded is now delivered across Australia, New Zealand, Asia and the Pacific.

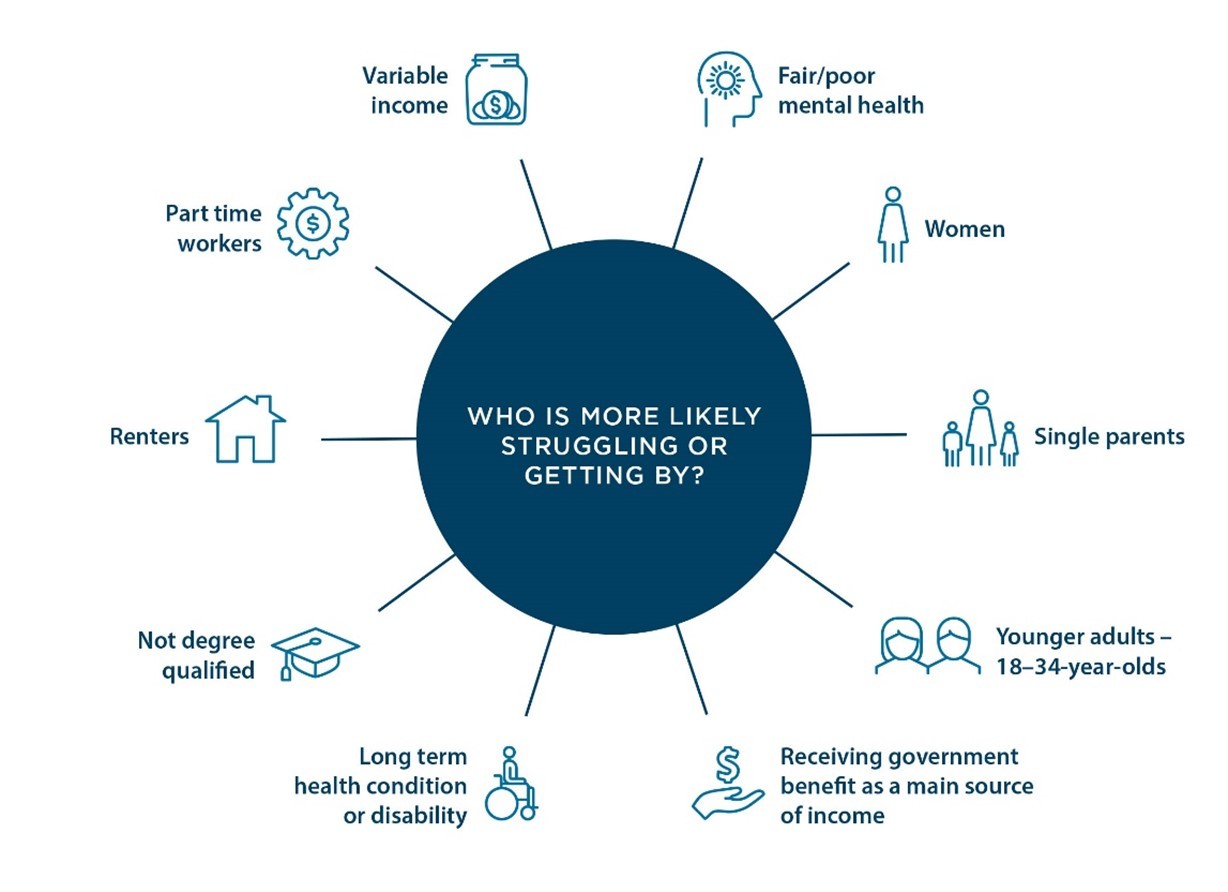

The 2021 Financial Wellbeing Survey found while most people were doing OK, more than one quarter of Australians and New Zealanders said they were either ‘struggling’ or just ‘getting by’, leaving them more vulnerable to financial shocks and the rising costs.

Almost one-fifth of Australians and New Zealanders said they sometimes, often or always need to borrow money or go into debt to pay for food or expenses because they ran short of money.

This was much higher for people with low financial wellbeing, with one-third of all people ‘getting by’, and 70 per cent of people who were ‘struggling’ in Australia and 55 per cent of people ‘struggling’ in New Zealand.

Since September last year MoneyMinded has supported almost 55,000 people with building money management skills, knowledge and confidence, and nearly 850,000 people since its inception 20 years ago.

As cost-of-living pressures increase in many parts of the world, it is clear many people are feeling uneasy about their finances.

ANZ has been exploring the financial literacy, capability, attitudes and behaviours of Australian adults for 20 years. This research informed MoneyMinded two decades ago and subsequent insights continue to inform program delivery and improvements in 2022.

Marie making her mark on financial wellbeing

For 20 years MoneyMinded has been building the capacity of community workers to support their clients. Marie has been involved in MoneyMinded for the majority of that time and over the last decade as The Smith Family’s MoneyMinded trainer.

Since 2007, Marie has seen the program evolve and believes the key to MoneyMinded’s success is it’s easy-paced, conversational style.

Marie says “community workers who complete MoneyMinded training are very excited to see how easy it is to talk about finances with a positive ‘I can do this’ attitude!”

While MoneyMinded involves broad conversations around managing money day-to-day, reducing debt and planning for the future, there’s a need to stay on top of new topics such as ‘Buy Now, Pay Later’, which has had increasing interest from participants over the last 12 months.

Marie says ‘Buy Now Pay Later’ is marketed so well, targeting people’s emotions and the feeling they need to have something now. “Clients are needing information that highlights the actual costs and traps behind the amounts they sign up for,” she says.

Marie says if there were three things she wanted people to take away from MoneyMinded sessions right now they would be the importance of:

- Money Chat – have positive conversations about reducing debt and making plans for your money to work for you;

- Money Awareness – know what money is coming in and what money is going out; and

- Money Kindness – set a money goal for yourself. It’s okay to start small and grow your goals as your money skills grow.

Over 7,000 community professionals have been trained in MoneyMinded, growing their capacity to help clients build financial resilience and wellbeing.

The impact of MoneyMinded

Increased cost of living and economic inflationary pressures globally haven’t made it easy for people to ‘get by’ in 2022 and this is even harder for people who are already experiencing financial hardship.

Programs like MoneyMinded have been pivotal in providing financial guidance during times of need to some of our most vulnerable communities.

MoneyMinded has a proud history for attracting large diverse cohorts to take part in the program due to its flexibility to suit learning, context and cultural needs of participants.

In 2022, more than one third of MoneyMinded participants in Australia were sole parents, 24 per cent were unemployed and 20 per cent spoke a language other than English at home.

Students made up a significant proportion of participants in Australia (19.3 per cent) as did people from Aboriginal or Torres Strait Islander backgrounds (11.0 per cent), people with disability (10.0 per cent) and carers (8.8 per cent).

Half of all participants in New Zealand, Asia and the Pacific spoke a language other than English at home. More than one-third were seasonal workers and almost one-quarter (23.6 per cent) were students.

The unemployed, small business owners (particularly in Asia Pacific) and sole parents were all significant participators in MoneyMinded.

MoneyMinded coaches are equipped to work with vulnerable families and individuals. Most of the time participants involved in the program have had negative past experiences with money and have low confidence in managing it.

One coach said “being able to assist them to budget/identify where they could make changes can sometimes have a huge impact on how the family is able to cope and feel more in control of their situation.”

After participating in the program people feel more confident and in control of finances. This is key to developing positive saving and spending habits and improving overall financial wellbeing.

MoneyMinded continues to empower communities to take hold of their financial future.

Read the full report 2022 MoneyMinded Impact Report here

Brianne Keogh is Social Impact Manager at ANZ