Financial Wellbeing

Helping people experiencing family violence

“In many cases, a person may not immediately realise they’re experiencing family violence as obvious signs extend beyond physical and emotional abuse.”

MoneyMinded, ANZ’s flagship financial education program, helps empower adults to build essential money management skills, knowledge and confidence.

Over the past year the program has helped almost 84,000 people throughout Australia, New Zealand, Asia and the Pacific. It has reached more than 927,500 people over its 21-year history.

Responding to the growing demand for targeted financial guidance, a specialised module “MoneyMinded for family violence”, was introduced in 2016 and updated last year. Tailored for people experiencing family violence, the module strives to foster financial independence, boost confidence, help participants recognise potential financial abuse and aids in their long-term recovery.

Berry Street, a long-term community partner and leader in this field, played a pivotal role in co-designing and enhancing the specialised module.

The partnership with Berry Street reflects our combined commitment to addressing financial abuse in Australia and ensures MoneyMinded plays an important role in preventing and combating financial oppression.

Financial abuse

It’s not always easy to recognise victim survivors of abuse but we have contact with them every day in our families, workplaces and neighbourhoods.

In many cases, a person may not realise they’re experiencing family violence as obvious signs extend beyond physical and emotional abuse. This can also extend to their financial situation.

Perpetrators of financial abuse may control victim’s finances by restricting access to funds or by creating debt in the victim-survivor’s name. This limits their capacity to meet basic needs, their freedom of choice and influences their actions.

Berry Street works with community professionals and financial counsellors to provide MoneyMinded to their clients, including those experiencing family violence.

MoneyMinded supporting victim-survivors of family violence

Berry Street has accredited over 1,300 community professionals and financial counsellors in MoneyMinded and more than 270 of those have been trained in the family violence module.

Janet, one of Berry Street’s MoneyMinded coaches, plays a key role in training family violence sector workers to use the specialised module with their clients.

“While victim-survivors of family violence are often dealing with the challenge to meet their immediate needs, talking about money and setting goals for the future is important for building confidence and a sense of control,” Janet said.

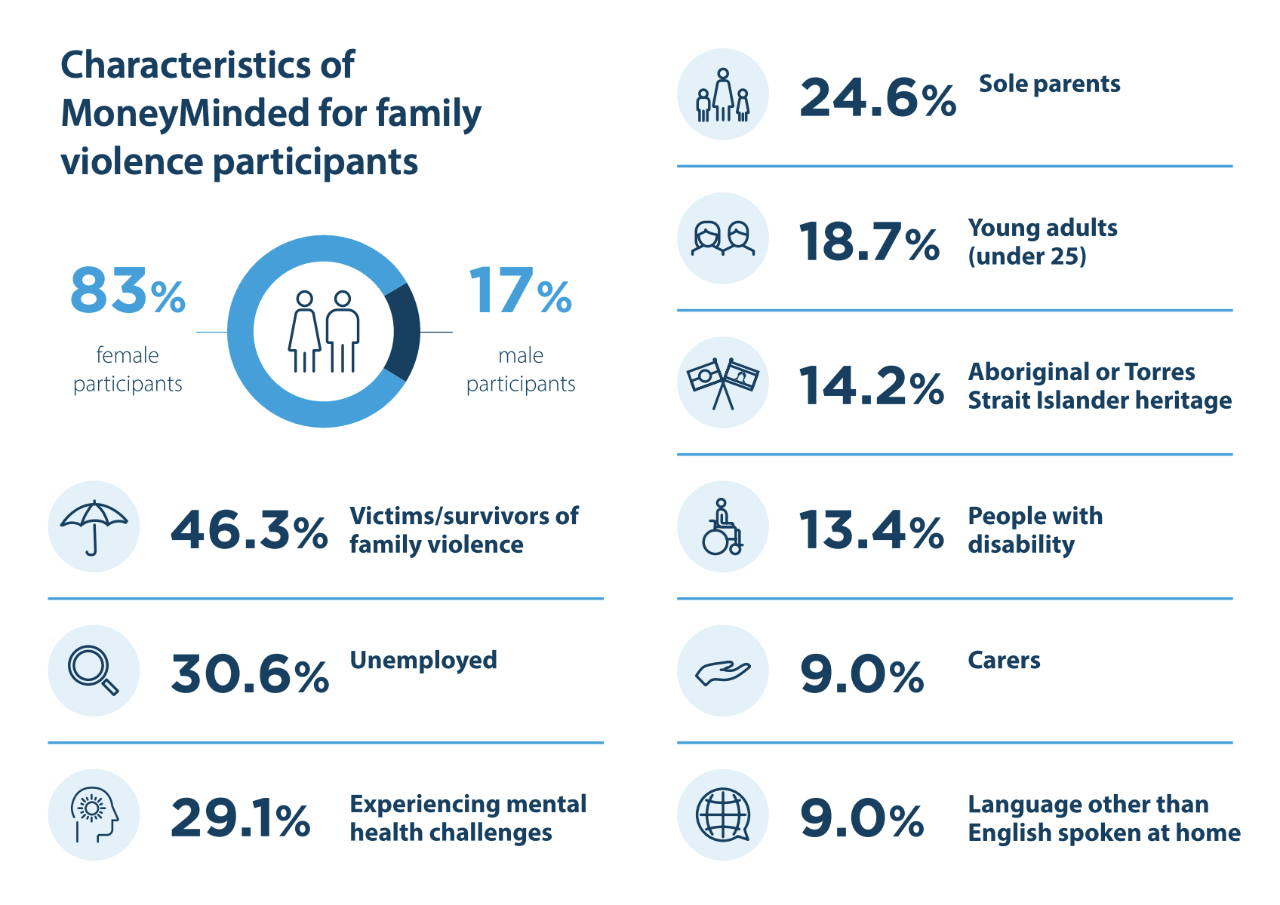

Participants in the specialised program were more likely to be female (82.8 per cent) and almost half (46.3 per cent) were reported as victims-survivors of family violence.

“MoneyMinded for family violence coach training provides workers in the sector with a framework from which to plan and resource how they will support their clients,” Janet said.

Coaches focus on content to help participants tackle their immediate situation and to build confidence managing money day to day.

“People may be managing multiple immediate demands and working towards creating some stability and safety. There can be a benefit in encouraging people to consider the future they want for themselves and their families,” Janet said.

Two-thirds of coaches use the ‘taking the wheel’ module to encourage participants to reconsider their attitude to money, identify warning signs of financial abuse and enable them to regain financial control.

“Financial wellbeing is not just about dollars but also about having a plan B, knowing the resources and services to call upon should the unexpected happen. Any change, no matter the size (ie tracking a spending leak) is evidence of success in developing skills and regaining control,” Janet said.

Increased demand for MoneyMinded helps almost 84,000 people build financial capability

ANZ released its 2023 MoneyMinded Impact Report revealing the financial education program delivered across Australia, New Zealand, Asia and the Pacific supported almost 84,000 people since October last year and more than 927,500 since inception over 21 years ago.

Developed in Australia in 2002, MoneyMinded is an award-winning financial education program for adults seeking to build money management skills, knowledge, and confidence.

In 2024 MoneyMinded will develop further as resources become available in multiple languages in Australia and new content is launched on scams awareness – an increasing challenge for the community, governments and industry.

Read more about the Impact of MoneyMinded in the report.

Investing in the future

For Janet, the coach training sessions provided an opportunity to come together to share their knowledge and experience.

“Having a background in case work, I focus on practical ideas to support clients and appreciate the generosity of workers in sharing their practice knowledge,” Janet said.

We plan to continue our 36-year partnership with Berry Street to invest in future generations of children, young people and families experiencing poverty, violence and abuse. And to help families stay together in safe and healthy homes so they can create the future for themselves.

Shayne Elliott is Chief Executive Officer of ANZ

related articles:

Inside ANZ

How re-purposing our devices is helping save lives

Communities