NZ Community

Tough Times In The Pacific As Customers Rally To Support Friends And Family

As many Pacific countries start to feel the economic burn of Covid-19, ANZ customers in New Zealand and Australia have rallied to send money home to family and friends.

With borders still shut across the Pacific, the tourism economies of Fiji, Cook Islands, Vanuatu, Samoa and to a lesser extent Tonga have not had any leisure travellers since April.

Several income streams have collapsed to zero; including the in country spend by tourists on domestically produced goods and national airlines revenue from leisure travellers. The stimulus from consumer demand, investment and government expenditure, which is supported by tourism activity, has been significantly impacted.

News of a vaccine brings hope, but naturally, the duration of the international border shutdown is the key. The longer it lasts, the deeper the pain will be.

“With the impacts of Covid-19 really starting to take effect, it’s important that we keep costs low to encourage money flows into the islands."

Tessa Price, ANZ Regional Executive for the Pacific.

One small beacon of light has come in the form of remittances – the money that families and friends abroad send back home.

“Private inward transfers to Fiji and Samoa for the first seven months of this year is holding at the 2019 levels and this is supporting household disposable income and consumer demand”, says ANZ Pacific Economist Kishti Sen.

“Given that remittances can sometimes account for up to 25% of a households’ income in the Pacific, this flow of money becomes even more significant.”

“Remittances don’t only support household budgets, they help pay for imports and as a result, ease the pressure on a nation’s foreign reserves.”

“In 2019 for example, 12,200 Pacific people worked in Australia under the Seasonal Worker Program remitting nearly AUD110m back to their families. For some countries such as Tonga, the net income remitted rivalled the direct aid provided by the Australian government.”

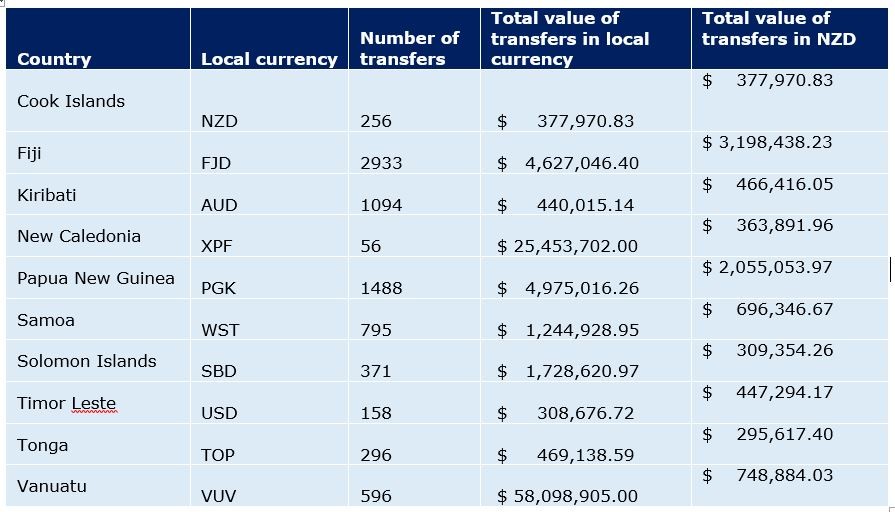

Payments made from Australia and New Zealand to the Pacific Islands using ANZ Internet Banking (NZ and Australia) and ANZ goMoney (NZ only)

In an effort to encourage these money flows into the Pacific, ANZ introduced a temporary waiver of its $7 international money transfer fee for online foreign currency payments made from Australia and New Zealand into ten Pacific countries.*

The results of the fee waiver have been encouraging.

In the first month since introduction of the fee waiver, ANZ customers made more than 8,000 transfers, totalling almost NZ$15m.

In that same month, the number of online money transfers from New Zealand to the Pacific increased by 86 percent and transfers from Australia increased by 77 percent, compared to the same period last year.

“With the impacts of Covid-19 really starting to take effect, it’s important that we keep costs low to encourage money flows into the islands”, said ANZ Regional Executive for the Pacific, Tessa Price.

“I encourage our Pasifika customers in Australia and New Zealand to take advantage of the fee waiver which will run until the end of February 2021.”

In 2019, ANZ customers in Australia and New Zealand made over 40,000 online transfers to the Pacific in 2019, totaling more than NZD$85 million.

* ANZ customers in Australia and New Zealand can send money electronically with no ANZ transfer fee, using ANZ Internet Banking (from both Australia and New Zealand) and the ANZ GoMoney App (from New Zealand only), until the end of February 2021.

The waiver applies to any foreign currency international money transfer sent from Australia and New Zealand to the following Pacific countries: Cook Islands, Fiji, Kiribati, New Caledonia, Papua New Guinea, Samoa, Solomon Islands, Tonga, Timor Leste and Vanuatu. Usual foreign exchange rates and terms and conditions will still apply. For certain currencies, a correspondent bank may charge a fee for processing the payment to the beneficiary bank and the beneficiary's bank may charge the beneficiary fee(s) for receipt of the payment. Additional fees may also apply when using an ANZ Credit Card. For more information and full terms and conditions, please visit www.anz.com/imt

RELATED ARTICLES

NZ Consumer

New Matariki bank card designs inspired by Silver Ferns

NZ Community

The school garden charity growing a tonne of produce per year

NZ Community

Cyclone-hit kumara growers grateful for support

NZ Community

Agri-banker looks back on 50 years of change

NZ Community

Outstanding in her field: Rural ambassador considers next move

NZ Sustainability

ANZ NZ’s Voluntary Climate Report

NZ Community

A friend for life: Waitlist for assistance dogs ‘growing every day’

NZ Media Releases

BLACKCAPS and WHITE FERNS surprise community cricket group with limited edition shirts

NZ Community

Bowel cancer survivor sees scars as badges of honour

NZ Community

Bridging the Digital Divide, One Laptop at a Time

NZ Community

An Insight Into Kiwis' Financial Wellbeing

NZ Community

Cut-off farmers give thanks for Gabrielle relief donations

New Zealand

Embracing Māori culture delivers ‘amazing’ results, ANZ manager says

NZ Community

Finding Their Voice - the charity helping students boost their confidence through public speaking

NZ Community

A lasting gift - the charity supporting young people through illness and grief

NZ Sustainability

The Pāua Research That Could Change Finance

NZ Community

‘The Comedy Treatment’ – Dai Henwood All-In For Daffodil Day

NZ Community

It Takes a Village - Science charity inspires the next generation

NZ Media Releases

ANZ boosting customer protection against card fraud

NZ Community

Study helps reveal diet of threatened birds of prey

NZ Business

Building Back Green – Why We Must ‘Let Nature In’

NZ Business

After Cyclone Gabrielle: ‘People Were Our Priority’

NZ Media Releases

ANZ launches Mother’s Day initiative to raise awareness about financial scams

NZ Community

Dunedin workshop confronting 'elephant in the room' of textile waste

NZ Community

Kāpiti Coast youth full of beans thanks to funding grant

NZ Community

ANZ's Watch Wāhine Win Report

NZ Media Releases

Watch Wāhine Win: Research reveals role ethnicity and gender play in women's success

NZ Media Releases

BLACKCAPS to “Pitch In” with autographed shirts from epic Test

NZ Media Releases

ANZ commits to reporting Māori and Pasifika pay gap

NZ Community

Almost $130k raised for charity at ‘Shear4U’ event

NZ Media Releases

ANZ donates $3 million to communities affected by Cyclone Gabrielle

NZ Te Ao Maori

'Heartwarming' to see Te Reo Māori thriving in Aotearoa

NZ Community

Coastguard rescue results in radio upgrade

NZ Community

Survey of rare wildlife aims to help boost biodiversity

NZ Community

Regaining health - one step at a time

NZ Community

Survivor: Matt Chisholm on tour to improve rural mental health attitudes

NZ Community

Small dogs removing big learning barriers for kids

NZ Community

'Our Health Journeys' - the online museum showcasing our healthcare history

NZ Community

More than 1300 Kiwi kids receive ANZ cricket grant

NZ Community

Bringing peace to a storm nobody wants to address

NZ Business

Antonia Watson: feeling like a fish out of water

NZ Community

Mum's Te Reo Māori journey inspired by tamariki

NZ Community

Aniwaka Haumaha rises to challenge for World Cup

NZ Community

Meet the artist behind ANZ’s Te Tohu o Matariki

NZ Community

Alex – My gender affirmation story

NZ Media Releases

ANZ introduces six weeks’ paid gender affirmation leave

NZ Business

Nigel Latta: Anxiety about return to work is normal - but it will fade

NZ Community

In the Saddle - Improving health and wellbeing through horse riding

NZ Community

NZ youth need voyages ‘more than ever’ after COVID

NZ Community

'Thank you, ANZ' - Fully-paid parental leave policy gives growing family the best start

NZ Community

Wild Whiskers - the charity giving wild kittens and stray cats a second chance

NZ Community

No place to hide: Expert sees growing threat to godwits

NZ Community

Arts for health and friendship

NZ Community

A gold medal for confidence

NZ Community

Woven Earth - the charity helping survivors of domestic abuse

NZ Community

Health Expert Answers Common Questions About The Omicron Variant

NZ Community

What does Waitangi Day mean in 2022?

NZ Community

“Like an apocalyptic movie” - living through Tonga’s eruption

NZ Business

What we learned from 2021

NZ Community

Taking time out with bats and balls

NZ Insights

ANZ's Watch Women Win Report

NZ Community

ANZ New Zealand's ESG progress at a glance

NZ Business

Northland geothermal plant powering a sustainable future

NZ Community

Health expert answers common Covid-19 vaccine questions

NZ Community

‘Cinderella Experience’ giving women confidence to succeed

NZ Community

Talking openly and honestly about menopause

NZ Business

Much more than just a ‘farmer’s wife’

NZ Community

Te Wiki o te Reo Māori - Māori Language Week

NZ Community

‘Where your talents and what the world needs cross; there lies your vocation’

NZ Community

The delicious Daffodil Day fundraiser helping families through cancer

NZ Community

ANZ Graduate being the change she wants to see

NZ Community

ANZ data grad tells the stories behind the numbers

NZ Community

'These boys carry dreams' - Olympic gold fills Fiji rugby manager with pride

NZ Community

ANZ staff get behind our athletes in ‘Olym-Pic’ photo booth

NZ Business

Māori employment resilient after COVID lockdowns

NZ Community

ANZ's Jake Jarman wins FMG Young Farmer of the Year 2021

NZ Community

Taking everyone on the digital journey

NZ Community

Support means life-changing injury won't keep Jane from her job

NZ Community

Paralympian Holly Robinson on turning ‘failures’ into gold

NZ Business

Green apartment delivers first-class option for renters

NZ Community

‘There were tears’ – ANZ staffer faces her fears during adventure race

NZ Community

‘Sister in Arms’ - NZDF veteran calls for support ahead of Poppy Day

NZ Consumer

'Stronger together' - ANZ to extend Pacific remittance fee waiver

NZ Community

ANZ marks Earth Hour while making strides on uniform sustainability

NZ Community

Moving On From Cheques, Younger Generation Can Help

NZ Community

Cyclone rebuild an ongoing challenge in the Pacific

NZ Community

Embracing Technology - Helping Seniors Become Tech Savvy

NZ Community

Towards Healthy Waterways – Playing our Part

NZ Community

How Covid-19 Made Women’s Refuge Stronger

NZ Consumer

“She’ll be Right” Isn’t Always Right – Thousands Access Free Financial Help

NZ Community

Funding Boost Benefits West Coast School Penguin Programme

NZ Community

Top Chefs and Business Leaders Cook for City Mission Fundraiser

NZ Community

Working From Home - Antonia Watson

NZ Community

Need for Urgent Technology Education Amid Covid-19

NZ Community

'Kia Kaha te Reo Māori’

NZ Community

Staying Positive to Enjoy the 'Small Beauties of Life'

NZ Community

Putting food first – Fiji Staff respond to Covid and cyclone twin hit

NZ Community

ANZ to match $500k in donations after Daffodil Day hit by COVID-19

NZ Community

"Helping people is in my blood" - Civic Award for Top ANZ Fundraiser

NZ Community

Q&A: How Covid-19 affected The Salvation Army in New Zealand

NZ Community

Changing lives - Changing generations

NZ Media Releases

Pacific women receive training boost through new partnership

NZ Community

Demand triples for Wellington charity during lockdown

NZ Community

ANZ NZ receives Rainbow Tick for another year

NZ Media Releases

ANZ NZ gives $1m to grassroots cricket and netball

NZ Media Releases

ANZ NZ increases support for Community Law

NZ Media Releases

ANZ NZ donates $2m to local & Pacific charities

NZ Community

ANZ NZ's Financial Wellbeing Indicator

NZ Community

Christchurch shootings - reflections a year on

NZ Community

International Women's Day

NZ Media Releases

ANZ announces drought assistance package for Northland farmers

NZ Media Releases

ANZ waives Money Transfer fee to Australia to help with fire crisis

NZ Community

The Wellington charity tackling inequality

NZ Media Releases

ANZ donation to help fight measles in Samoa

NZ Community

Helping seasonal workers unpack their finances

NZ Community

Money course halves reliance on payday lenders

NZ Business

All New Zealand stands to gain from addressing the waterways challenge

NZ Community

Volunteers plant thousands of trees along NZ waterways

NZ Community

ANZ leads Housing NZ Wellbeing Bond

NZ Community

Business embraces kaupapa Māori

NZ Community

More staff taking parental leave for longer

NZ Business

Focus of iwi investment shifting

NZ Community

Volunteers vital for Daffodil Day

Communities

Matariki - in my own words

New Zealand

ANZ staff give back - ten years work volunteered in three months

New Zealand

Perfume keeps war veteran’s memories alive

Media

ANZ Staff Foundation reaches milestone

A journey back into Te Ao Māori

Media

Tauranga local shines for Matariki

Media

ANZ helps women confronting domestic violence establish financial independence

Media

NZ’s largest ATM network now features Te Reo Māori

NZ Community

Reimagining wāhine leadership

NZ Community

Clucky new residents settle in at Linwood Resource Centre

NZ Community

The importance of diversity, inclusion & respect at work

Media

Mentors hear messages from the heart

NZ Community

ANZ launches interest-free home insulation loans

NZ Community