Communities

Financial wellbeing: crossing borders

“[It is] particularly important [for participants] to be able to return to their home country regularly to keep a connection with family and culture.”

MoneyMinded is an adult financial education program that builds knowledge, confidence and skills to help people make informed decisions and manage their money.

Developed by ANZ in 2002 in collaboration with the NSW Department of Education and Training, Financial Counselling Australia, the Financial Counsellors Association of NSW, The Australian Securities and Investments Commission, and community sector representatives, MoneyMinded is delivered in partnership with community organisations and other selected partner organisations in Australia, New Zealand, and 18 countries across Asia and the Pacific and has reached more than 667,000 participants since 2002.

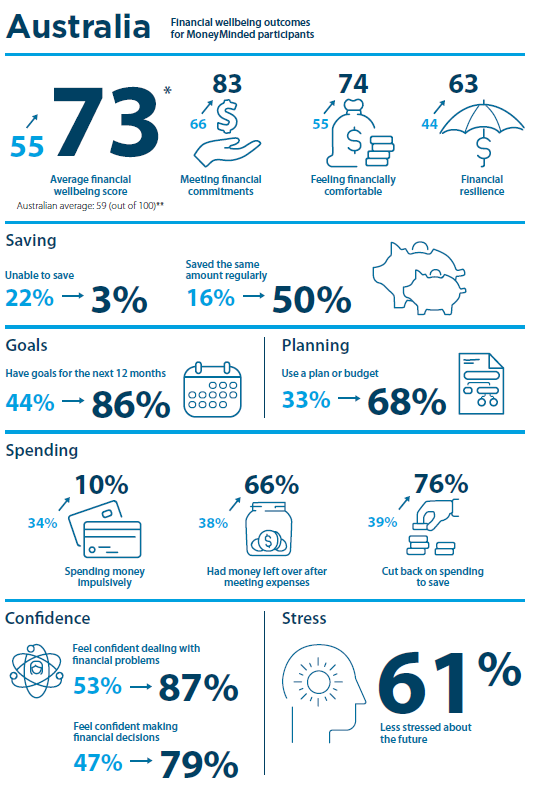

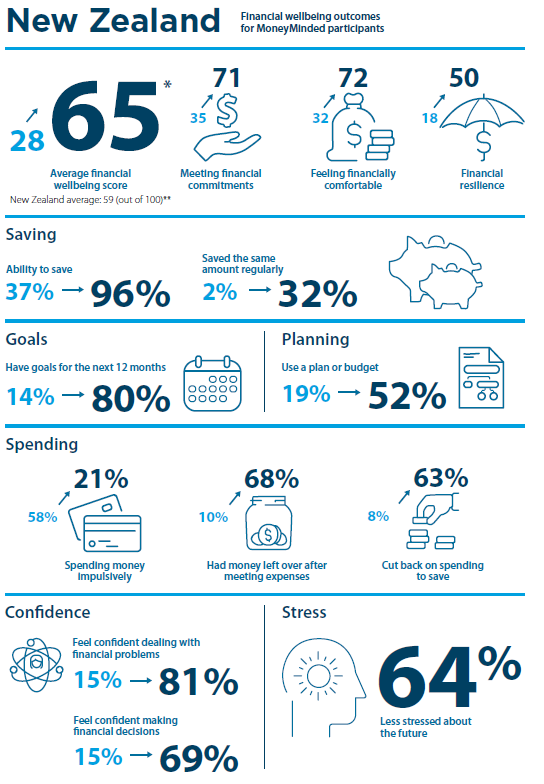

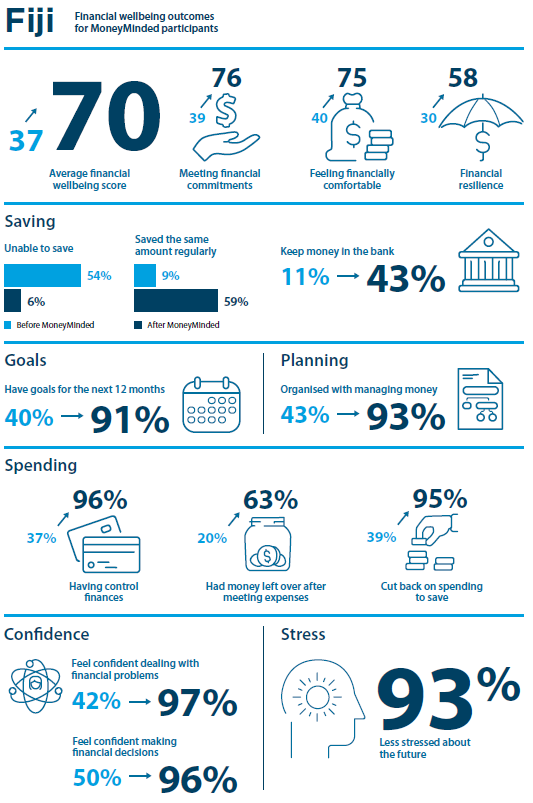

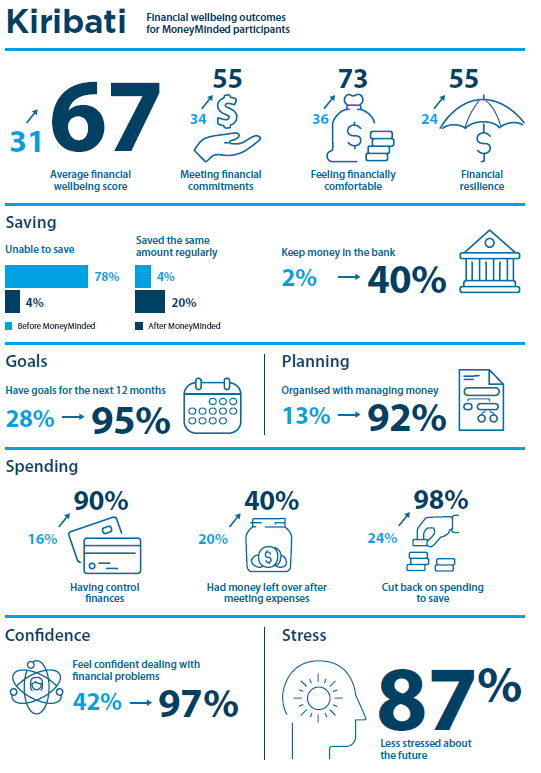

In the latest MoneyMinded impact report, four countries were evaluated to provide a snapshot of financial wellbeing in regions where MoneyMinded plays an important role in the community.

Strategies to assist people in improving their financial wellbeing must consider a range of factors, some of which are particular to the local context and cultural norms, and some of which may be outside the control of the individual.

MoneyMinded participants from migrant communities in Australia spoke of financial commitments to family overseas through sending regular remittances. These commitments were considered very important means of helping and “paying back support” they were given in the past. It was also seen as particularly important to be able to return to their home country regularly to keep a connection with family and culture, which generally had a financial implication to be managed.

All MoneyMinded participants who responded to the survey reported an improvement when retrospectively assessing their financial wellbeing before and after MoneyMinded. This positive outcome was also recorded in the average financial wellbeing scores for participant respondents across all four countries.

Examining the component areas of the financial wellbeing score (meeting commitments, feeling financially comfortable and having financial resilience) provides more detailed information about the types of improvements that contributed to increased financial wellbeing in each country.

Check out the statistics below for each geography and hear from participants about how the program has helped them.

Taghrid - Australia

Taghrid arrived in Australia from Lebanon 10 years ago with her husband and one-year-old daughter. With a university degree in business, she worked in Lebanon for eight years managing a small branch of an accounting firm.

Taghrid described her life in Lebanon as: “middle class, not rich, not poor”. However, conflict in Syria and Lebanon was making life more difficult in Lebanon. The political and economic uncertainty motivated Taghrid and her family to move to Australia.

Taghrid was keen to start her own business making special occasion cakes, and a friend told her about Stepping Stones, a program offered by the Brotherhood of St Laurence. Stepping Stones assists women from migrant, refugee and asylum seeker backgrounds to develop a microenterprise through mentoring, training and other support. In partnership with ANZ, the Stepping Stones program has introduced a MoneyMinded component for participants to build their financial skills.

For Taghrid, completing the MoneyMinded activity on ‘needs and wants’ had the biggest impact. Initially, she categorised all the items as ‘needs’, but after thinking about them in her MoneyMinded group she realised many items were actually ‘wants’ and some were even ‘not important’.

“This activity was a big hit for me. Before, I had been trying to do things but there was something missing. This activity actually made it ‘click’ in my mind,” she says.

The ‘click’ came about, as Taghrid described it, because she was involved in a hands-on activity relevant to her and her life. It wasn’t “listening to someone telling her what to do”. Taghrid now uses the logic of assessing needs and wants in her daily life.

Taghrid also uses these concepts with her husband and her children as part of their financial conversations. She is confident in challenging their requests. Taghrid says, “I actually use this method with my kids now. I ask, “Look, do you need it?””

Taghrid also learned about the value of having emergency money as a buffer. Through MoneyMinded, she was encouraged to transfer $A50 regularly into a specific savings account, ‘just like paying a bill’, which she can only access if she visits a bank branch. With these savings she was able to buy a replacement car when she needed it. Before MoneyMinded, she would have been without a car for several months.

MoneyMinded has also changed Taghrid’s attitudes so she thinks about money in a different way now. She is careful with her money but is also finding alternatives so she and her family are not missing out the things they enjoy.

“I think differently. I’m not cutting anything; I’m not suffering. I cut my coffee, but I enrolled in a gym. I go to the gym seven days a week and gain my health as well,” she says.

Taghrid has developed more confidence in managing her money. This confidence comes from being able to save and achieve her goals. She now also has clear financial goals for the short term (saving for materials for her small business) and longer-term (saving to buy a home for her family).

Maria – New Zealand

Maria*, a Cook Islander from Rarotonga, lives in Auckland with her husband, brother and four of her six children.

MoneyMinded gave her and her family the tools, knowledge and mindset to change how they thought about and used their money.

Maria has two children still in school. While they have always prioritised school costs, they often struggled with other general living costs. Maria finds Auckland to be an expensive city and paying rent and electricity bills were major concerns. Maria’s family struggled with high electricity costs, especially during the winter. They would not use their heater because they could not afford it - Maria says they’d use more blankets and wear warmer clothes instead of risking a higher bill.

For Maria, life became even more stressful when her husband lost his job before Christmas in 2018 and the couple had to draw on government income support to cover bills while her husband looked for work. This event prompted Maria to undertake further education and she enrolled in the Solomon Group’s WAM (Families Moving Forward) course, a free 35-week program that included the MoneyMinded program.

MoneyMinded helped Maria and her husband to pay bills on time, put savings away every week and plan their budgets. Before MoneyMinded, Maria never really thought about saving. Instead, Maria was living day-today with expenses, not pre-planning purchases from the supermarket and buying takeaway meals whenever the family asked for it.

Maria and her husband now sit down together once a week to plan their finances and prioritise their spending for the week. Maria has started including her 18-year-old daughter in this process, as she has recently started working and has her own saving goals.

MoneyMinded gave Maria the skills and knowledge to have conversations with her daughter about money and has been able to help her daughter put a savings plan in place to balance her needs for now while working towards a future goal.

“When my daughter wasn’t working, she would ask for money and she’d just spend, spend, spend. Now that she’s working, she’s saving,” Maria says.

Maria enjoyed MoneyMinded and felt relief from the constant worries she had about money and her family’s debts. The family gets together every Sunday for a special lunch to celebrate the end of the week and spend time together.

“Before, it’s like a stress, bills aren’t paid on time and then you just get angry, then you just share your anger with everyone else. Now that I found MoneyMinded, we’re a lot happier,” she says.

Maria says once their debt is paid off they will have a savings account for a rainy day - a safety net to fall back on. Maria and her family are working hard together and have a long-term plan to return to their home country, the Cook Islands, and buy their own home.

John - Fiji

John* lives with his wife, parents and two uncles. He has a steady job but before MoneyMinded, had not saved or thought about his financial future.

John says although he had a regular income, before doing MoneyMinded his “finances were all over the place”. Doing the program prompted him to develop a budget, examine where his money went and encouraged him for the first time to live within his means.

MoneyMinded helped him to shift his mindset from the ‘now’ to the ‘future’.

Before MoneyMinded, John frequently had to use moneylenders to make ends meet even though he had a regular income. He also used to borrow from family and friends when needing extra money. His dependence on short-term loans worried him. His spending involved buying things often for the sake of appearing to have a certain lifestyle and to meet perceived expectations of his family.

John found it difficult to say no when it came to spending money and this would put a strain on the household budget. MoneyMinded completely changed his attitude towards needing to buy things he couldn’t afford and spending money for the sake of appearances within the community.

After MoneyMinded, John says, “If I cannot afford it, I just cannot afford it and I just live within my means. That is something I have learnt. That big change in me! That big change in me is that I can be more disciplined now.”

MoneyMinded has encouraged John to save money instead of spending it all before next pay. He says before MoneyMinded, if there was any money left he would make sure it was all spent on “having a good time” before receiving his next pay.

John feels empowered now. He has a definite plan, has put “disciplines in place” and a limit he doesn’t go beyond for spending. He now saves for a rainy day and doesn’t have to borrow money to make ends meet.

John is very focused on investing in the future for him and his family. Before MoneyMinded he says he never considered buying a house - he was content to be dependent on his parents because they had a property and he was using his income to live day-to-day. Importantly, since MoneyMinded, John has purchased a house and is renovating it.

He used to have a four-wheel drive car that he had because “he looked good in it” but realised after MoneyMinded it was too expensive to keep, and he didn’t really need it. John sold the car and put the money towards his property. He has shared his plans with his wife and family and they are supportive of his goals for them. He wants his family to be secure for the future.

MoneyMinded has changed how John feels about money and his life. He feels “more mature” and has come to realise feeling financially secure is important to his and his family’s wellbeing. He is less stressed and now has targets and goals.

* Not his real name

Joseph – Kiribati

For Joseph*, MoneyMinded did more than help him improve his budgeting skills. The program gave him a new perspective and attitude towards money – a fundamental change that will have a long-lasting effect on the financial future for him and his family.

Joseph and his wife have two sons, aged 6 and 8. Although he works in a government job which provides a steady income, before doing MoneyMinded, he often found it difficult to make his income last until his next pay. Unexpected expenses were very stressful for Joseph and his family. Sometimes he’d look to buy lunch on credit and borrow from family or friends to make ends meet. Joseph says he never had long-term goals and lamented even celebrations for his son’s birthday, were planned last minute.

Joseph enjoyed every MoneyMinded session, finding them not only interesting, but very helpful. He said of the ‘visioning’ activity: “It triggered my mind in the first place as it gave me a big lesson to always have vision with my money. It was about imagination which will provide a clear motivation and direction on how to spend my money intelligently. It gave me a sense of ownership to my money as well,” he says.

Creating and using a budget helped Joseph meet his family’s needs by knowing what is important to spend money on and to have money left over for unforeseen circumstances. Joseph says his spending behaviour changed since doing MoneyMinded and he has been teaching his sons to save.

He gave his sons a money box and “whenever they do good, I put some coins in their money box”. After two months his son was surprised to find he’d saved almost $A100.

Joseph and his wife now have a longer-term goal to save for a family trip to New Zealand. He says the program has really improved their financial wellbeing.

* Not his real name

Michelle Commandeur is Head of Financial Inclusion (Australia), Vosawale Tamani is Head of Corporate Sustainability and Financial Inclusion (Pacific) and Julia de Blaauw is Government Relations and Corporate Responsibility Manager (New Zealand) at ANZ.

RELATED ARTICLES

Communities