Communities

Broadening the reach of financial education in India

“It was very helpful to learn about how to save money, achieve our financial goals, get success, get motivated, and learn from other people’s stories.”

In 2021, ANZ’s flagship financial wellbeing program MoneyMinded was delivered to more than 2,572 participants across 102 sessions in India, with many of the sessions made available through digital channels due to the significant impacts of COVID-19.

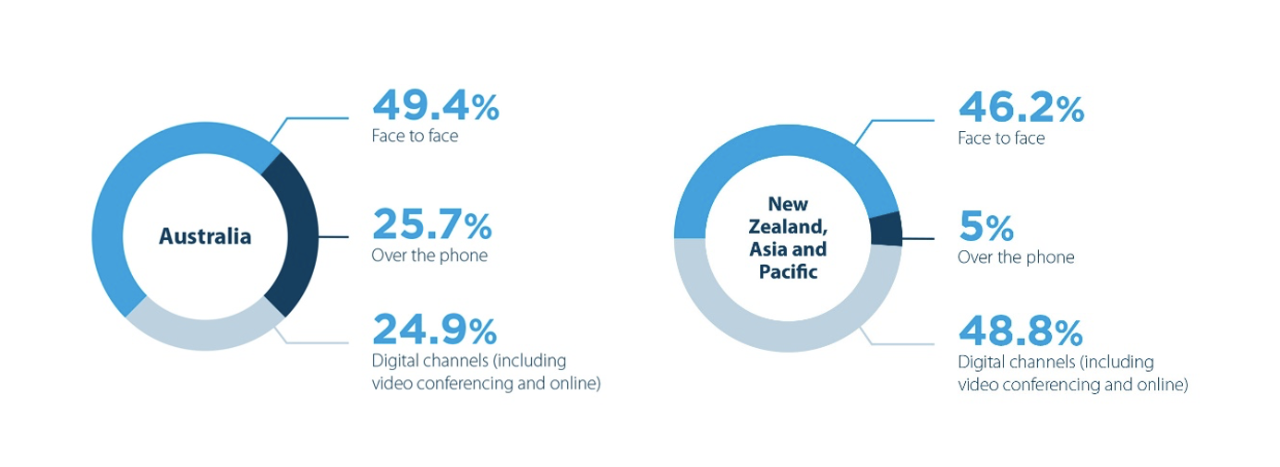

In 2019-2020, only 10.7 per cent of facilitators in New Zealand, Asia and the Pacific reported using phone or digital channels to delivery MoneyMinded during COVID-19 restrictions.

While there were some challenges with technical difficulties, MoneyMinded facilitators ensured the sessions ran as smoothly as possible by pre-empting technical issues and ensuring there were two facilitators in each session in case one was disconnected.

Feedback from participants showed regardless of the delivery method, the program continues to deliver significant value.

“It was very helpful to learn about how to save money, achieve our financial goals, get success, get motivated, and learn from other people’s stories,” says one MoneyMinded participant. “It was very inspirational. We hope we get invited for another session soon.”

“Even though we know our goals, sometimes we don't achieve them. With MoneyMinded, I learnt about making SMART goals, vision boards, budgets and learning to say no. Then we are coached about building a savings habit and how to spend money wisely. These factors will definitely help me achieve my goals.”

Diversity and inclusion

This year MoneyMinded has also been integrated into a training program for the transgender community in India though ANZ’s partnership with social enterprise PeriFerry, reaching 85 participants in 2020-2021.

PeriFerry creates employment and upskilling opportunities for the transgender community in India. The ‘hire ready’ program focuses on building participants’ skills when applying for jobs and improving their financial wellbeing.

RELATED ARTICLES

Customers

Engineering customer success

Communities