Communities

Supporting young people on their journey to improved financial wellbeing

“MoneyMinded is fundamental to giving people a hand up and educating them about finances.” - MoneyMinded facilitator

ANZ’s flagship financial wellbeing program MoneyMinded has reached more than 789,000 people across Australia, New Zealand and Asia Pacific since 2002.

Over the past year more than an estimated 64,000 people participated in the program across Australia, New Zealand, Asia and the Pacific through face-to-face training as well as via digital and online channels.

“MoneyMinded is fundamental to giving people a hand up and educating them about finances,” says one MoneyMinded facilitator. “We use the program to add value to our training courses. We also offer it as part of our suite of community courses.”

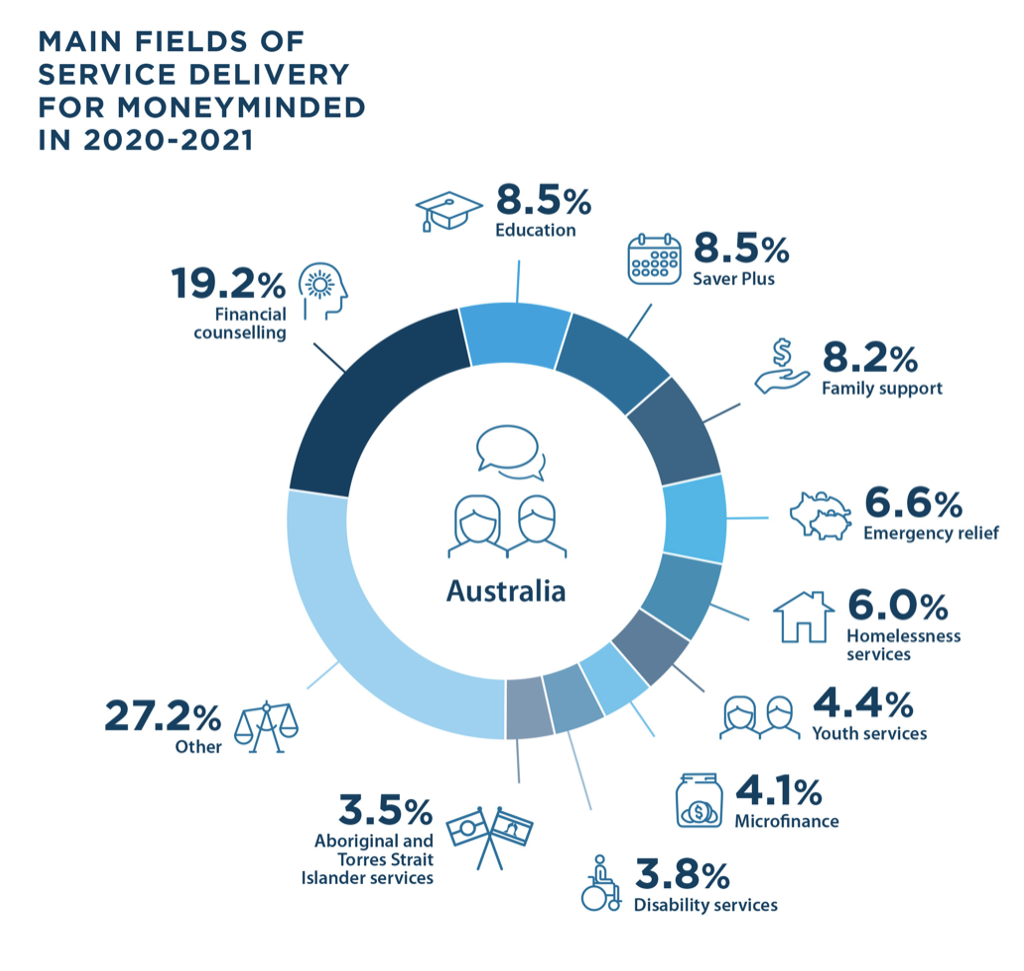

The value of MoneyMinded continues to be evident across a wide range of organisations in their work to support the financial capability needs of people who are facing a variety of life challenges. Many facilitators find it to be a valuable complementary resource to the support frameworks they provide in the community. The adaptability and wide range of situations in which they can use MoneyMinded continues to be cited as one of the most valuable aspects of the program.

Anglicare Victoria was among the first organisations in Victoria to be trained in the refreshed MoneyMinded program in 2021. The Better Futures team located in Bendigo embarked on a financial capability project using the MoneyMinded program.

Better Futures aims to improve outcomes for young people transitioning from out-of-home care (OoHC) to supported independence.

MoneyMinded sessions were offered to 15-21 year old participants of the Better Futures program as well as through Youth Justice and the Homelessness teams. Through the project, three community professionals were trained to deliver MoneyMinded sessions, covering a wide range of financial topics.

Education Specialist in the Transforming Educational Achievement of Children at Risk (TEACHaR) program at Anglicare Victoria Anthony has been a MoneyMinded Coach since June 2021, delivering online MoneyMinded sessions alongside two peer coaches.

Through these sessions, Anthony has seen how important it is for people to have a feeling of control over their money. He says many participants indicated they felt overwhelmed by what was happening to them financially in their lives.

All young people in the program have experienced a range of challenging life events including homelessness, contact with police and the justice system, victims of crime or transitioning from out-of-home-care (OoHC).

Photo: MoneyMinded Coaches Anthony and Caitlin deliver MoneyMinded sessions to young people as a part of financial capability project for Better Futures at Anglicare Victoria.

One of the most rewarding phrases Anthony heard consistently was, “I didn’t know that” as participants learnt new information.

“In the tenancy section, for example, none of the participants knew real estate agents often keep a database shared with other agents,” he says. “Likewise, few knew what a credit schedule was and how that is often shared between lending institutions.”

Similarly, hearing participants make comments like, “I need to deal with that” or “I should do this” was clear evidence the MoneyMinded sessions were helping young people to focus on personal money issues and what they need to do to sort them out.

Related Articles

Customers

Free of charge, free of judgement

Communities