NZ Media Releases

ANZ urges under-40s to be on watch for online scams

Younger people are falling victim to a surprising amount of online fraud, according to analysis of ANZ customer data.

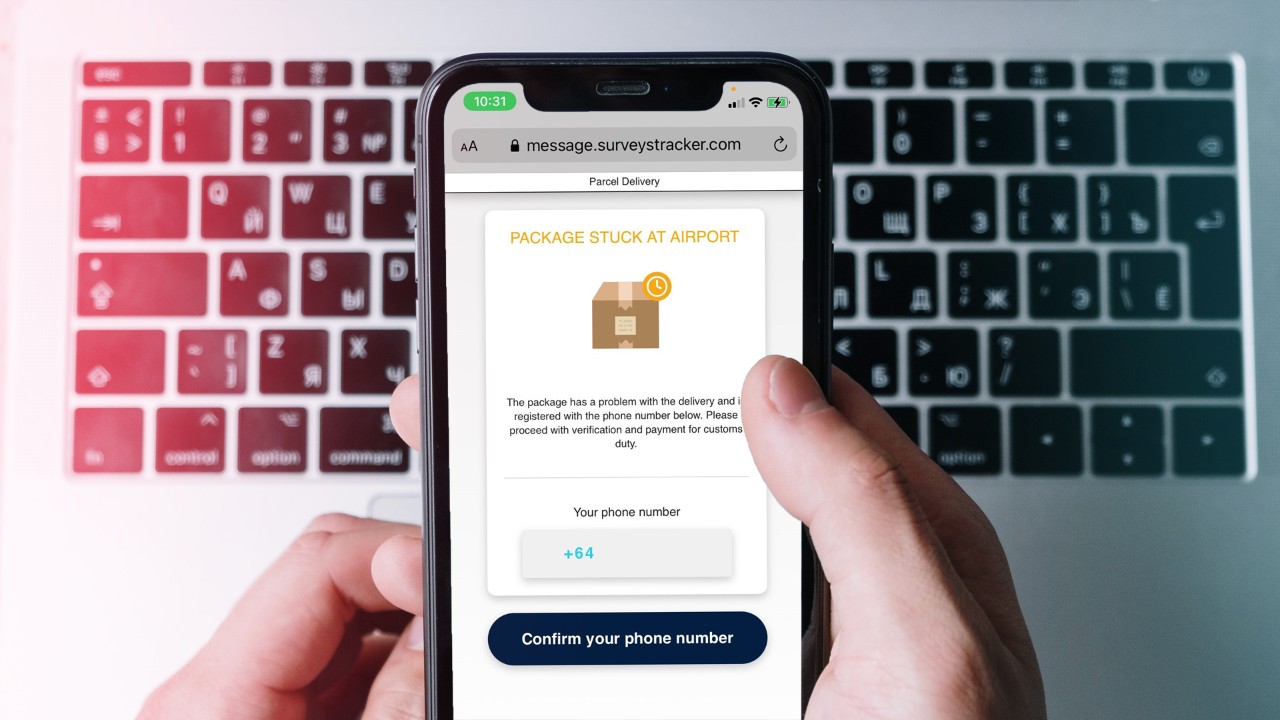

The data shows younger people are more likely to fall victim to email or text phishing scams that target their digital banking, whereas retirees are more likely to fall victim to scams that start with a call to a landline.

The data shows that sixty per cent of digital banking phishing victims are under the age of 40, and in many cases, the fraud originates from a text message.

ANZ Senior Manager for Fraud Strategy Natasha McFlinn said younger people might feel more confident with their ability to detect scams and were more trusting of information presented to them on their devices.

“It’s a reminder that any of us can fall victim to a scam.

“We all use technology in different ways and the way we interact online now means personal information like email addresses, mobile phone numbers and social media account details are often publicly available.

“While this type of information would be insufficient by itself to access a customer’s banking, it is the type of information that can be used by scammers to target individuals,” Ms McFlinn said.

The data also reveals that 45 per cent of the victims of cold call and remote access scams were over the age of 70.

A quarter of all scams involved customers who were 70 years or older, another 25 per cent were aged between 55 and 70 years old.

ANZ has also seen a 72 per cent increase in cases of card fraud, compared to the same time a year ago, with more than 35,000 cases reported.

“Often the fraudsters pretend to be from legitimate and well-known companies like banks, telcos and government departments,” Ms McFlinn said.

“You’d be amazed at how convincing they can be. They win people over, and convince them to give them their card details.

“They’ll often start with a phishing attack and then follow up with a phone call. The phone call seems extra convincing because they already have information about the customer from the previous attack.”

Sometimes, while the fraudster may not have the physical card, they can make use of a customer’s details, including their card number, card expiry, PIN, CVV number and two factor authentication codes to commit fraud.

In these cases the card details may be obtained through data breaches, phishing, skimming, or scams in which people give away their card details over the phone, or on a fake website.

“Where a customer reports to us that they have lost money to a scam we will make every effort to recover funds,” Ms McFlinn said.

“However the speed that transactions often move, combined with the fact that fraudsters will generally remove funds as soon as they hit the recipient account, means this can be very difficult.”

That is why ANZ is reminding customers to be careful with their private information.

“It is not a good idea to write passwords or other sensitive information down or share it with anyone, including family members and friends,” Ms McFlinn said.

“It’s really important to make sure you protect your bank cards by only using them in places you trust, whether that is online or in the real world.

“People should also avoid saving their details on websites or browsers; as well as making sure you don’t leave them somewhere the cards or the information on them can be stolen.”

ANZ Managing Director for Personal Banking Ben Kelleher said people should not feel embarrassed or ashamed if they have been scammed.

“It’s really important to let us know if you think you have been the victim of a scam, or if you spot anything that seems suspicious.”

Scam incidents reported to ANZ rose 19 per cent in the twelve months to September 30 2022, compared to the previous financial year.

However, despite the increase in incidents, ANZ’s Customer Protection team increased the amount of fraud it prevented or detected by 45 per cent meaning the amount of money lost by customers was at the same level as the previous year.

Mr Kelleher said the bank has increased the resources available to its dedicated fraud team, who review banking activity around the clock for anything potentially suspicious or fraudulent.

“We have expanded our team by 25 percent in the past year and will soon be implementing new technology that will enable us to automate our fraud alerts so they can be resolved more quickly,” Mr Kelleher said.

ANZ is implementing a new system where if the bank spots a suspicious transaction an alert can be sent to the customer; they can then respond with a “Y” if they made the transaction and “N” if they didn’t.

ANZ has released the data as part of Fraud Awareness Week, a global effort to minimise the impact of fraud by promoting fraud awareness and education.

“Fraud Week is a good reminder to all of us to remain vigilant, be alert to scams, and careful with our private information,” Mr Kelleher said.

Staying safe from scams

- Avoid using your internet banking password for anything else and make sure you do not save it to your browser.

- Keep your device operating system, apps and anti-virus software up to date and ensure all your devices are protected with a PIN, password or biometric.

- Report any scam calls you receive directly to your telecommunications provider.

- Always access Internet Banking through the banks website, not from links in text messages or emails.

- Never allow anyone who calls you out of the blue to have remote access to your devices

- Never provide or confirm your credit card details, Internet Banking log in details, PINS and two factor authentication codes in response to a phone call you’ve received out of the blue, even if they say they are from the bank or the Police.

- If you think you have been the victim of a fraud or scam contact your bank immediately.

For media enquiries contact Tony Field 021 220 3152

RECENT MEDIA RELEASES

NZ Consumer

What would you do if you won Lotto?

NZ Media Releases

ANZ New Zealand delivers solid first half year result in challenging conditions

NZ Media Releases

ANZ Investments to exit Wholesale business and focus on better outcomes for everyday Kiwi investors

NZ Media Releases

ANZ NZ’s investment in AgriZeroNZ boosts farm emissions reduction research.

NZ Media Releases

Beware of phishing scams - they open the door to more serious crimes

NZ Media Releases

Don't become a money mule - ANZ warns criminals are targeting young New Zealanders with the promise of easy money

NZ Media Releases

ANZ NZ welcomes ideas to further enhance competition

NZ Media Releases

ANZ reports gender and ethnicity pay gaps for 2023

NZ Media Releases

Changes to ANZ Boards

NZ Media Releases

BLACKCAPS and WHITE FERNS surprise community cricket group with limited edition shirts

NZ Media Releases

ANZ Investments reaches major milestone - over 100,000 KiwiSaver members helped into their first home

NZ Media Releases

ANZ appoints new Head of Investment Partnerships

NZ Media Releases

ANZ appoints new Chief Investment Officer

NZ Media Releases

ANZ warns of rise in cold call scams

NZ Media Releases

ANZ’s Tūrangānui-a-Kiwa l Gisborne branch opens

NZ Media Releases

ANZ New Zealand 2023 full year results

NZ Media Releases

Are your retirement plans OK, boomer?

NZ Media Releases

Quarter of Kiwi women say menopause symptoms halve work efficiency

NZ Media Releases

ANZ partners with Age Concern New Zealand on scam protection

NZ Media Releases

ANZ submission to market study

NZ Media Releases

Grant Knuckey to step down as Chief Risk Officer

NZ Media Releases

ANZ Investments to explore strategic investment partnerships

NZ Media Releases

ANZ Investments launches High Growth Fund

NZ Media Releases

Astrud Burgess appointed ANZ Group Chief Marketing Officer

NZ Business

ANZ launches low interest Business Regrowth Loan

NZ Media Releases

ANZ boosting customer protection against card fraud

NZ Consumer

Gen Z Revealed as Savvy KiwiSaver Investors

NZ Media Releases

ANZ comments on competition study into personal banking

NZ Media Releases

Kiwi businesses power ahead with clean transport

NZ Media Releases

ANZ makes changes to savings and floating home loan rates

NZ Media Releases

Responsible investment - more than just exclusions.

NZ Media Releases

ANZ launches Mother’s Day initiative to raise awareness about financial scams

NZ Media Releases

Solid first half year result for ANZ New Zealand

NZ Media Releases

Changes to ANZ savings and lending rates

NZ Media Releases

Watch Wāhine Win: Research reveals role ethnicity and gender play in women's success

NZ Media Releases

Wellington Airport announces $100M sustainability-linked lending

NZ Media Releases

Let's Talk About Generation X

NZ Media Releases

BLACKCAPS to “Pitch In” with autographed shirts from epic Test

NZ Media Releases

ANZ commits to reporting Māori and Pasifika pay gap

NZ Media Releases

ANZ donates $3 million to communities affected by Cyclone Gabrielle

NZ Media Releases

ANZ confirms support available for customers affected by Cyclone Gabrielle

NZ Media Releases

ANZ Bank widens support for customers affected by flooding

NZ Media Releases

ANZ to donate $100,000 to the Mayoral Relief Fund

NZ Media Releases

Support available for customers affected by North Island weather events

NZ Media Releases

ANZ offers assistance for customers affected by Cyclone Hale

NZ Media Releases

ANZ Group to acquire DOT Loves Data, boosting data-led insights

NZ Media Releases

Kiwis wary about future but still feel on top of financial commitments

NZ Media Releases

ANZ NZ to report annually on accessibility and inclusion

NZ Media Releases

ANZ extends support for netball and Silver Ferns

NZ Media Releases

ANZ changes rates for home loan, savings and term deposit accounts

NZ Media Releases

More than $100 million loaned to 2,500 Kiwi households for Good Energy upgrades

NZ Media Releases

ANZ urges under-40s to be on watch for online scams

NZ Media Releases

Strong full year result for ANZ New Zealand

NZ Media Releases

NZ’s small business owners look to invest but face cashflow squeeze

NZ Media Releases

ANZ lifts rates on some lending and savings accounts

NZ Media Releases

ANZ’s Card Tracker gives customers greater visibility

NZ Media Releases

Kiwis are wary but keeping up financial wellbeing habits

NZ Media Releases

Big discounts for businesses as ANZ launches Business Green Loan

NZ Media Releases

ANZ lifts floating home loan rates and rates on some savings accounts

NZ Media Releases

ANZ offers Nelson -Tasman business flood assistance package

NZ Media Releases

ANZ to help get kids to the crease with cricket fee subsidy

NZ Media Releases

Jason Murray appointed ANZ Country Head, Cook Islands

NZ Media Releases

ANZ urges business owners to see potential in Pacific

NZ Media Releases

ANZ waives fees to promote digital banking across the Pacific

NZ Media Releases

ANZ lifts rates on some lending and savings accounts

NZ Media Releases

ANZ’s Good Energy Home Loan set to power change

NZ Media Releases

Ignore the noise - KiwiSaver members urged to focus on their long-term investment goals

NZ Media Releases

ANZ names Chief Financial Officer

NZ Media Releases

ANZ and Silver Fern Farms partner to link sustainability targets with financing

NZ Media Releases

Sarah Stubbings appointed ANZ Regional Executive, Pacific

NZ Media Releases

ANZ introduces six weeks’ paid gender affirmation leave

NZ Media Releases

ANZ lifts rates on some lending and savings accounts

NZ Media Releases

KiwiSaver Reflects Changing Face of Retirement

NZ Media Releases

ANZ first to issue recycled plastic cards in seven Pacific markets

NZ Media Releases

ANZ Pacific Leadership Team Updates

NZ Media Releases

Solid first half year result for ANZ New Zealand

NZ Media Releases

Resignation of director

NZ Media Releases

ANZ to strengthen focus on core Pacific markets

NZ Media Releases

Stewart Taylor to leave ANZ New Zealand

NZ Media Releases

ANZ Appoints New Head of Responsible Investment

NZ Media Releases

ANZ backs ambitious sustainability commitment for Tāmaki Makaurau

NZ Media Releases

ANZ NZ commits to reporting gender pay gap

NZ Media Releases

ANZ Marama Championship kicks off a new era in rugby for Fiji

NZ Media Releases

ANZ lifts rates on some lending and savings accounts

NZ Media Releases

ANZ backs sport in Fiji through Fijian Drua sponsorship

NZ Media Releases

David Wilson appointed ANZ Chief Risk Officer, Pacific

NZ Media Releases

ANZ search for next female cricketing talent

NZ Media Releases

ANZ donates AUD$50,000 towards Tonga rebuild

NZ Media Releases

ANZ supports NZ's largest-ever sustainable re-financing worth NZ$1.25 billion

NZ Media Releases

ANZ donates to Solomon Islands rebuild

NZ Media Releases

ANZ lifts floating home loan rates, saving accounts and holds some rates for small business

NZ Media Releases

ANZ to pause some lending to those with less than 20% deposit

NZ Media Releases

ANZ welcomes Government’s Green Bond move

NZ Media Releases

ANZ offers flood assistance package for Gisborne businesses and farmers

NZ Media Releases

ANZ waives fees for contactless debit payments

NZ Media Releases

ANZ to sponsor ICC Women's Cricket World Cup 2022

NZ Media Releases

Home loan demand, resilient economy drive ANZ NZ full-year result

NZ Media Releases

ANZ announces launch of global listed infrastructure fund

NZ Media Releases

ANZ Lifts floating home loan rates

NZ Media Releases

ANZ removes KiwiSaver membership fees

NZ Media Releases

ANZ’s International Money Transfer fee waiver to Pacific here to stay

NZ Media Releases

Bonus Bonds investors donate more than $100,000 to Cancer Society

NZ Media Releases

Fiona Mackenzie appointed Managing Director of ANZ Funds Management

NZ Media Releases

Sending money home to the Pacific more often

NZ Media Releases

ANZ to re-open some branches for essential banking services

NZ Media Releases

ANZ reintroduces Covid relief measures for business customers

NZ Media Releases

Kiwis encouraged to make Daffodil Day donations online with offer to match $2 for every $1 donated

NZ Media Releases

Rediscovered painting casts new light on NZ’s Hine-o-te-Rangi

NZ Media Releases

ANZ ready and willing to help Pacific through Covid-19

NZ Media Releases

ANZ changes rules on small apartment lending

NZ Media Releases

ANZ announces 1.68% floating rate on new builds

NZ Media Releases

Scott St John appointed to the ANZ New Zealand Board

NZ Media Releases

ANZ appoints new Head of Te Ao Māori Strategy

NZ Media Releases

ANZ offers flood assistance package for Canterbury businesses and farmers

NZ Media Releases

ANZ and Kathmandu partner on A$100 million sustainability loan

NZ Media Releases

Faster than expected economic recovery reflected in ANZ NZ half-year result

NZ Media Releases

ANZ supports Fiji communities through Covid-19 lockdown

NZ Media Releases

Research reveals under-30s feel wealth is mostly about family

NZ Media Releases

Rabih Yazbek appointed ANZ Country Head, Fiji

NZ Media Releases

ANZ donates USD$50,000 to Red Cross to support Timor-Leste’s flood recovery

NZ Media Releases

Craig Mulholland to leave ANZ NZ

NZ Media Releases

Bonus Bonds Financial Statement

NZ Media Releases

ANZ supports Community Finance bond pledge to fund affordable housing

NZ Media Releases

ANZ Support Band helps Kiwi fans reach out to athletes in Tokyo

NZ Media Releases

Statement on ANZ Investments

NZ Media Releases

Lorraine Mapu to replace Mark Hiddleston in senior ANZ role

NZ Media Releases

ANZ Bank NZ appoints new Treasurer

NZ Media Releases

ANZ moves to 60% LVR for residential property investors

NZ Media Releases

ANZ offers flood assistance package for Hawke’s Bay businesses

NZ Media Releases

Bonus Bonds scheme now in wind-up

NZ Media Releases

Full-Year Result Shows COVID-19 Challenge And Strength Of Business

NZ Media Releases

ANZ Investments Appoints Northern Trust

NZ Consumer

Fees Waived for Online Money Transfers to the Pacific

NZ Media Releases

Iwi Businesses Enter Covid World with $1 Billion Investment Capacity

NZ Media Releases

UDC Finance sale to Shinsei Bank completes

NZ Media Releases

ANZIS stops new investment in Bonus Bonds and moves to wind up scheme

NZ Community

ANZ to match $500k in donations after Daffodil Day hit by COVID-19

NZ Media Releases

Third quarter results reflect impact of COVID-19

NZ Media Releases

Flood assistance package for Northland and Coromandel businesses

NZ Media Releases

Pacific women receive training boost through new partnership

NZ Media Releases

Stuart McKinnon appointed MD Institutional ANZ NZ

NZ Media Releases

Credit card repayment insurance issues

NZ Media Releases

ANZ NZ announces sale of UDC

NZ Media Releases

ANZ announces special one-year fixed home loan rate

NZ Media Releases

ANZ NZ gives $1m to grassroots cricket and netball

NZ Media Releases

ANZ NZ increases support for Community Law

NZ Media Releases

ANZ NZ reports 2020 half-year result

NZ Media Releases

ANZ NZ donates $2m to local & Pacific charities

NZ Media Releases

ANZ NZ opens applications for Gov’t-backed business loans

NZ Media Releases

ANZ to offer six-month mortgage loan deferrals

NZ Media Releases

ANZ NZ services available during lockdown

NZ Media Releases

ANZ NZ cuts 1 and 2-year fixed rates

NZ Media Releases

ANZ appoints Head of Sustainable Finance - New Zealand

NZ Media Releases

ANZ lowers rates to support businesses

NZ Media Releases

ANZ extends drought assistance package further

NZ Media Releases

ANZ NZ reduces variable home loan rates 0.75%

NZ Media Releases

ANZ Investments wins Morningstar’s NZ Fund Manager of the Year award

NZ Media Releases

Further payments for loan calculator error

NZ Media Releases

Paul Goodwin appointed ANZ US Country Head

NZ Media Releases

Ben Kelleher named new NZ Retail & Business Banking MD

NZ Media Releases

ANZ announces drought assistance package for Northland farmers

NZ Media Releases

Flood assistance package for Southland business customers

NZ Media Releases

ANZ waives Money Transfer fee to Australia to help with fire crisis

NZ Media Releases

RBNZ section 95 review

NZ Media Releases

ANZ NZ removes international money transfer fee to Samoa

NZ Media Releases

ANZ update on RBNZ capital requirements

NZ Media Releases

ANZ donation to help fight measles in Samoa

NZ Media Releases

ANZ receives Living Wage accreditation

NZ Media Releases

ANZ honoured at global private banking awards

NZ Media Releases

ANZ NZ reports 2019 full-year result

NZ Media Releases

ANZ finances trans-Pacific subsea internet cable

NZ Media Releases

Operational Risk Capital non-compliance

New Zealand

ANZ staff give back - ten years work volunteered in three months

NZ Media Releases

ANZ home loan rates further reduced after OCR cut

NZ Media Releases

ANZ NZ reports steady half-year result

New Zealand

ANZ wins Canstar 2019 Innovation Excellence Award for Home Insulation Top-Up

New Zealand

Perfume keeps war veteran’s memories alive

NZ Consumer

ANZ helps Kiwis into healthy homes

NZ Media Releases

ANZ’s commitment to achieving a low carbon economy

NZ Consumer

ANZ leads $500m Housing NZ Sustainability Bond

NZ Media Releases

Growth mindset for rural sector

NZ Media Releases

Growing smarter; wine survey reveals profit, innovation and price on the up

Media

ANZ Staff Foundation reaches milestone

New build lending hits four-year high

NZ Consumer

From term deposits to turtles – Jamie’s first 100 days of your questions

A journey back into Te Ao Māori

Media

Investment in innovation driving higher returns

Media

Tauranga local shines for Matariki

Media

Boom in KiwiSaver first home withdrawals

Farmers investing in the environment – ANZ survey shows

NZ Media Releases

Booming tourism sector drives growth in hospitality

Media

ANZ helps women confronting domestic violence establish financial independence

Media

NZ’s largest ATM network now features Te Reo Māori

Agri-tech investment – adopt or risk being left behind

NZ Media Releases

ANZ reaffirms commitment to Samoa and Pacific

Media

Is your KiwiSaver fund too conservative?

NZ Community