NZ Business

Renewed COVID restrictions set to hamper recovery

Miles Workman

Senior Economist

ANZ Bank New Zealand Limited

Renewed Alert Level restrictions are going to weigh on activity, prolong the current bout of data volatility, push out the recovery in economic momentum, and keep the dial on monetary and fiscal stimulus turned up to eleven for even longer.

It’s worth remembering that there are three distinct prongs to this economic crisis:

- the initial lockdown, and now renewed measures;

- a closed border that will keep net migration contained and stop international tourism in its tracks; and

- a very sharp and synchronised global slowdown that will impact exports and confidence more broadly.

So far, we’ve only really felt the pointy end of the initial lockdown. The rest (and the recessionary dynamics that will accompany them) are yet to be fully felt.

Not to mention the fact that the economy is yet to be weaned off an unprecedented amount of temporary income support (even if a little more is added in the near term).

When that happens, the deterioration in the data flow could be swift. The recent return of COVID in the community demonstrates that risks to the outlook will remain skewed to the downside for as long as the virus is a threat.

All else equal, we estimate that under Alert Level 3 the economy is able to operate at around 80% capacity and around 90% at Alert Level 2.

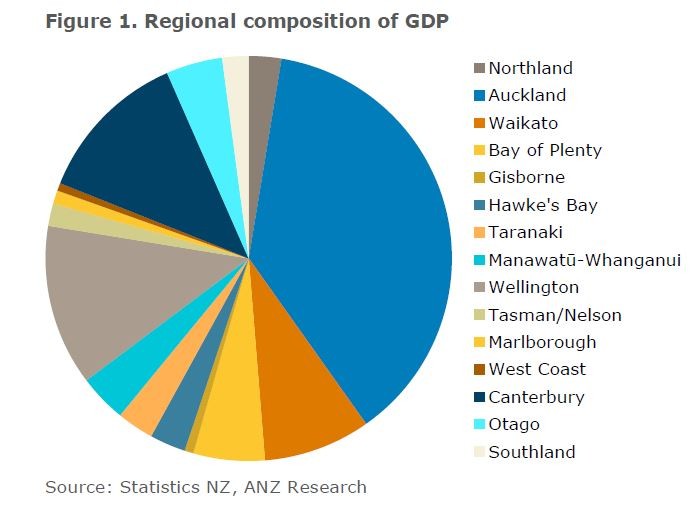

Given Auckland accounts for 38% of GDP (figure 1), we estimate that with Auckland under Alert Level 3 and the rest of NZ at Alert Level 2, nationwide activity can run at around 85% of pre-crisis levels.

For our updated forecast, we’ve assumed that this alert level status is maintained for three weeks, before the whole country returns to Alert Level 1 (where it stays until the end of 2021).

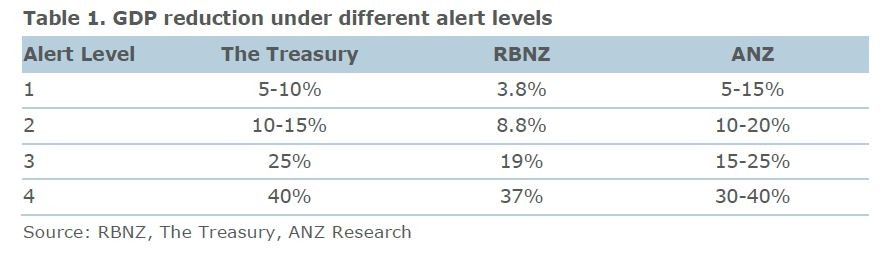

We have mitigated the risk that we phase through alert levels faster than this by assuming the impact is at the lower end of the ranges outlined in Table 1.

Auckland may also spend a couple of weeks in Level 2 as a transition phase.

However, there’s a big difference between what can happen and what will happen. And there are a number of reasons why lockdown may well hinder economic activity by more the second time around, for a given lockdown level that is.

- Many businesses are in a much weaker starting position, having used up what savings buffer they had the first time around. The wage subsidy extension will help, but other operating expenses (such as rents) haven’t gone away. The calls for further fiscal support are expected to be louder the second time around.

- Job losses have also put many households in a weaker position.

- The savings that some households spent on spas and e-bikes in lieu of an overseas holiday this year is now gone. It’s very difficult to know how significant an offset this was the first time around, but it’s fair to say it was a one off.

- It has now been proven without any doubt to all households and businesses that ongoing yo-yoing between Alert Levels is a very real possibility, even if we get more efficient at it. That risk could weigh on confidence, investment and hiring, lead to higher-than-otherwise precautionary savings (reduced consumption), and weaker economic momentum more broadly.

- All those cans of beans from the last lockdown are probably still in the back of the cupboard, and the home office is already sorted.

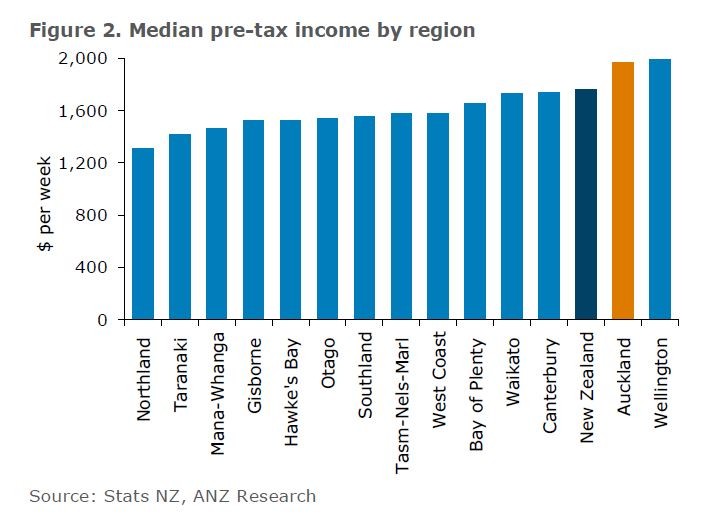

- The Auckland region also has a relatively high median income (figure 2) which combined with its large population makes it a key customer to the rest of the country, particularly when it comes to domestic tourism. Spill-over impacts are likely.

The bottom line is that every time lockdown measures are reimposed, the underlying state of the economy will weaken further because of it, the firepower and in some cases efficacy of fiscal and monetary policy will diminish, and more stimulus will be required.

The example of Melbourne shows why hesitating for these reasons is a bad idea, but the costs are real.

The good news is that renewed lockdown measures are looking like they could be far shorter, and the paralysis of Level 4 looks set to be avoided. And despite all the gloom, there are also a few positive developments to incorporate into the outlook.

- The economy rebounded vigorously out of lockdown 1, which gave some businesses a chance to start rebuilding their balance sheets earlier than expected.

- Housing market activity has also picked up, and prices have been resilient overall. However, we do expect the housing market to moderate as the income shock broadens. We’ll have more to say in our upcoming Property Focus.

- The RBNZ delivered more stimulus than we were expecting in the August MPS, and we think more is on the cards, with a further increase in the LSAP, and a negative OCR in April next year. While a negative OCR is not without risks, the lower NZD and flatter yield curve that’s likely to accompany it will be helpful for recovery.

Forecasting in the current environment is riddled with challenges, the likes of which we have never experienced. Uncertainty is extreme, and typical economic relationships cannot be relied upon to hold – at least in the near term.

We need to account for a number of factors, such as pent-up demand dynamics out of lockdown, the varying impacts of a closed border at different times of the year, temporary income support measures, efficacy of the policy response more broadly, the varying impacts of the initial shock by region and industry, virus developments, and how the economic shock will broaden over time.

Further, renewed lockdown measures are likely to keep the data flow noisy for longer. And even if we pulled off a miracle and managed to forecast everything perfectly, there’s no guarantee that Stats NZ will be able to measure exactly what’s going on out there. They face significant challenges too.

But hey, let’s have a crack.

"The bottom line is that every time lockdown measures are reimposed, the underlying state of the economy will weaken further because of it."

Miles Workman, Senior Economist, ANZ Bank NZ Ltd.

Updated GDP forecasts

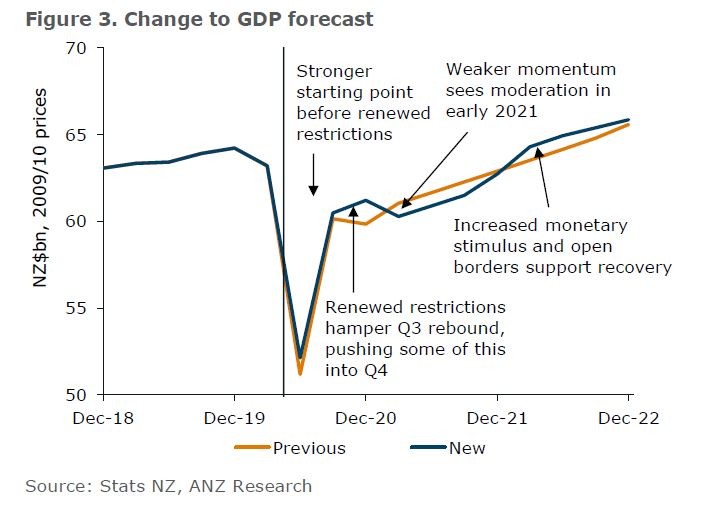

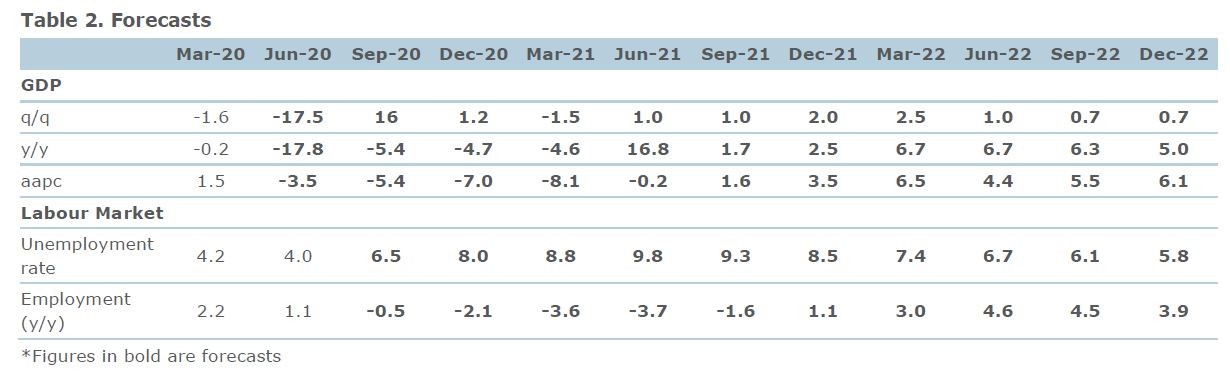

Prior to recent events, Q2 was forecast to bring a very sharp contraction in economic activity (it still is, with data out 17 September), Q3 a very sharp rebound, and Q4 the beginning of the stabilisation in quarterly GDP growth (albeit with a small quarterly fall).

Now, it looks like the Q3 rebound is going to be hampered by renewed lockdown measures, but all going well the recovery will extend into Q4 before the data begins to settle down from Q1 2021, assuming the current outbreak can be contained.

But, as noted above, we’ve had to consider a lot more than the direct impacts of lockdown. We’ve also incorporated more monetary stimulus, a solid starting point for the housing market, the vigorous bounce out of the first lockdown, and unfortunately a very weak global backdrop.

As figure 3 shows, it all nets out in a new forecast that isn’t too dissimilar to our previous view – particularly when you consider the degree of uncertainty and potential scenarios we outlined in our previous Quarterly Economic Outlook.

Conceptually, we can break down the above forecasts into three distinct components:

- The direct impacts of lockdown, which account for the lion’s share of the Q2 contraction (forecast: -17.5% q/q) and subsequent rebound. We estimate that renewed lockdown restrictions will shave a little over 2.5%pts from the Q3 rebound (forecast: +16%) with some of this being pushed into Q4 (forecast: +1.2% q/q). All the while, and throughout 2021, we estimate that closed borders will leave the economy around 5% smaller than otherwise (though of course it isn’t as if we were to open the borders and let COVID run rampant there would be a queue of tourists!).

- Volatility caused by things like pent-up demand and kiwis unable to head for warmer climates during winter. Here we apply a judgement overlay on top of the lockdown impacts. This helps us account for temporary factors that we may otherwise take signal from and regret later.

- Underlying economic momentum, which started deteriorating at the onset of this crisis, and is unlikely to turn until mid- to late-2021 after typical recessionary dynamics have run their course and stimulus begins to support.

All of the above are non-observable factors that will cumulate into the headline GDP figures when they are released. Q2 GDP will be published on 17 September. However, we expect to get more noise than signal from these data given everything that was going on. Weaker (stronger) growth in Q2 than we expect is more likely to see us revise our Q3 forecast up (down) than convince us that the medium-term outlook has fundamentally changed.

Like GDP, there’s a lot to incorporate into the outlook for the labour market. First, there’s the starting point for the unemployment rate, which we see as containing no signal whatsoever for the underlying state of the labour market. Unemployment unexpectedly fell in Q2 on the back of both measurement challenges and a definitional quirk that meant locking down the economy also lowered the unemployment rate because people were unable to look for work during this period (and were therefore classified as being outside of the labour market). While factually correct based on the Q2 survey, the reported 4% number grossly underrepresents the many job losses that have happened and the many lives disrupted by this crisis. We certainly don’t think the Q2 read provides cause for celebration.

Broadly speaking, the labour market generally lags activity, so it’s always been our expectation that deterioration in the labour market will happen later – and wage subsidies are adding an extra delay. As noted above, there’s still a fair way to go in terms of navigating this crisis, and that’s going to keep the labour market weak for a while yet. We expect the unemployment rate to peak a little later than previously assumed, but to recover a little faster as the border reopens and more expansionary policy flows through.

RELATED ARTICLES

NZ Business

Can New Zealand create a new spark with Japan?

NZ Business

Supporting Farmers Through Tough Times

NZ Business

Chatham Islands fishing outfit uses freezer as a solar battery

NZ Business

Bee Better – How Hillside Honey rebuilt after Cyclone Gabrielle

NZ Business

Rural bank lending: ANZ’s submission to the Primary Production Committee

NZ Business

What China’s economic and social transition means for NZ exporters

NZ Business

Korean fried chicken: The ‘secret sauce’ behind Ko Ko Dak’s success

NZ Business

Why all interest rates aren’t the same

NZ Business

Sweet Deal – NZ-EU FTA a win for primary producers

NZ Media Releases

ANZ NZ’s investment in AgriZeroNZ boosts farm emissions reduction research.

NZ Business

New data shows post-Covid start-ups poised to drive recovery

NZ Community

Agri-banker looks back on 50 years of change

NZ Business

Why do banks make such big profits?

NZ Business

NZ tech start-ups attract Māori

NZ Business

ANZ wins Canstar Small Business Bank of the Year Award

NZ Business

Act Now or Pay (Much More) Later: Warning on Auckland’s Water Woes

NZ Consumer

"This is Not A Job Interview" with Fiona Mackenzie

NZ Business

New ANZ loan an ‘enduring solution’ for post-disaster business recovery

NZ Consumer

Why can’t I have a 30-year mortgage?

NZ Business

ANZ launches low interest Business Regrowth Loan

NZ Business

Poultry in motion: Tirau Chicken Farmer Goes Electric

NZ Media Releases

Kiwi businesses power ahead with clean transport

NZ Business

Responsible investment - more than just exclusions.

NZ Business

Building Back Green – Why We Must ‘Let Nature In’

NZ Business

After Cyclone Gabrielle: ‘People Were Our Priority’

NZ Business

`NZ’s next hop model’: Huge hop garden set to bolster industry

NZ Business

Lessons from Rembrandt: How to Survive and Thrive in Difficult Times

NZ Business

Hawke’s Bay producers face uncertain wait while roads are repaired

NZ Media Releases

ANZ donates $3 million to communities affected by Cyclone Gabrielle

NZ Media Releases

ANZ Group to acquire DOT Loves Data, boosting data-led insights

NZ Business

The small data insights company making big waves

NZ Community

Survivor: Matt Chisholm on tour to improve rural mental health attitudes

NZ Business

Solar surges as young Kiwis go green

NZ Business

How Forty Thieves is stealing its share of the global peanut butter market

NZ Media Releases

NZ’s small business owners look to invest but face cashflow squeeze

NZ Consumer

Why are interest rates rising?

NZ Business

Antonia Watson: feeling like a fish out of water

NZ Business

Dining out back on the menu in Auckland as businesses remain cautious

NZ Business

Adapt and thrive – Reducing the cost barrier for a greener world

NZ Media Releases

Big discounts for businesses as ANZ launches Business Green Loan

NZ Media Releases

ANZ offers Nelson -Tasman business flood assistance package

NZ Media Releases

ANZ urges business owners to see potential in Pacific

NZ Business

What farmers need to know about emissions pricing

NZ Media Releases

ANZ and Silver Fern Farms partner to link sustainability targets with financing

NZ Business

Dell: Don’t settle for the status quo, It’s time to change it up

NZ Business

Nigel Latta: Anxiety about return to work is normal - but it will fade

NZ Business

Greenhouse gas emissions – four things farmers should know

NZ Business

Equity markets start the year lower

NZ Business

Government emissions reduction plan not ambitious enough

NZ Business

Will 2022 be the year of the 'next normal'?

NZ Business

Let the capital markets to do the heavy lifting

NZ Business

What we learned from 2021

NZ Business

Shipping costs stabilising - but Omicron could change that

NZ Business

Red, Orange, Green – what does it mean?

NZ Business

New frontier for farmers as low-interest environment starts to turn

NZ Business

Northland geothermal plant powering a sustainable future

NZ Business

Kiwis take backyard trapping to new level through COVID

NZ Sustainability

Going above and beyond carbon neutrality

NZ Business

Building a healthy and balanced economy

NZ Business

Beard Brothers: Small goods, big dreams

NZ Business

‘Making a difference and feeling proud’

NZ Business

Much more than just a ‘farmer’s wife’

NZ Business

Lofty ambitions

NZ Business

Challenge to Kiwi farmers to think 100 years ahead

NZ Business

Summerset in sustainability-linked loan first

NZ Business

Fiji's Covid-19 outbreak prompts a new way of leading

NZ Business

ANZ partners with GirlBoss New Zealand

NZ Business

Sustainable Finance - Moving Into The Mainstream

NZ Business

From Rarotonga to the world

NZ Business

Māori employment resilient after COVID lockdowns

NZ Business

Deer to be different: Award-winning farmer’s approach paying off

NZ Business

Smaller exporters hardest hit by rising shipping costs

NZ Business

Fair price for wool key to furniture giant’s ambitions

NZ Business

With wool prices at rock bottom, the only way is up

NZ Business

$500m ANZ Green Bond project wins industry award

NZ Business

Sustainable Finance A Force For Good

NZ Business

Smart new billing service wins top award

NZ Business

Tourism ‘ramp up’ expected as Cook Islands bubble opens

NZ Business

ANZ stands ready to help farmers through drought

NZ Business

Why Sir John Key Is Bullish On New Zealand

NZ Business

Green apartment delivers first-class option for renters

NZ Business

Antonia Watson: Economic recovery supports half-year result

NZ Business

Young Farmer finalist grabs Ashburton banking role 'with both hands'

NZ Business

Coconut Biofuel Key to Vanuatu's Energy Future

NZ Business

"Stay Open-Minded" - Psych Grad Finds her Way at ANZ

NZ Business

Covid Challenge Serves Up New Opportunities For Fijian Kitchen

NZ Business

Staying Grounded, Dealing with Criticism and Feeling an Imposter

NZ Business

A New Leaf for Auckland's Leafy Suburbs

NZ Business

Making the Most of It - One Grad's Story

NZ Business

Covid a catalyst for New Kiwi Businesses

NZ Business

Sustainability Key to Funding Farming's Future

NZ Business

'This is Not a Job Interview' with Sharon Zollner

NZ Business

'This is Not a Job Interview' with Sharon Zollner

NZ Consumer

Black Friday Sales Boost Spending

NZ Business

In a New Start-Up Age, Aider Leads the Pack

NZ Consumer

Spring Shopping Splurge - the Winners and Losers

NZ Consumer

Could Prefab Solve NZ's Housing Crisis?

NZ Business

Could Infrastructure be the Vaccine for Our Ailing COVID-19 Economy?

NZ Business

Māori Direct Investment – Picking the Right Opportunities

NZ Business

'This is Not a Job Interview' with Stewart Taylor

NZ Insights

Why Almost Three-quarters of Lost Jobs are Women's

NZ Business

Social Bonds in Demand Amid Covid Pandemic

NZ Business

Resilience Reflected in Annual Results - Antonia Watson

NZ Business

Hanging In There – NZ Business Outlook

NZ Business

Wind Farm Funded by NZ's Largest Green Bond Issue

NZ Media Releases

Iwi Businesses Enter Covid World with $1 Billion Investment Capacity

NZ Business

Business and the Economic Impacts of COVID-19

NZ Business

NZ’s New Fresh Water Rules – What Every Farmer Needs to Know

NZ Business

Renewed COVID restrictions set to hamper recovery

NZ Business

Covid-19 pathway towards unconventional policies

NZ Business

After COVID-19 contactless is key

NZ Business

Pasture summit focus on basics in wake of Covid

NZ Business

Future Focus - ANZ backs Techweek 2020

NZ Business

Covid sinks small firms’ confidence

NZ Business

Thriving through lockdown – towards a sustainable future

NZ Business

Infrastructure projects set to play key role in post-Covid recovery

NZ Consumer

What Negative Interest Rates Could Mean for You

NZ Business

COVID-19 - Looking Beyond the Subsidies

NZ Business

Rising to the Covid Challenge

NZ Business

Help in a crisis – power up the digital assistant

NZ Business

Light speed disruption will bring opportunity

NZ Business

NZ property market in question

NZ Business

Budget 2020 - Rebuilding in the wake of Covid-19

NZ Business

9 ways COVID-19 has re-shaped NZ's economy

NZ Business

The story behind our half year result

NZ Business

Call data reveals NZers lockdown routines

NZ Business

A month of lockdown at ANZ

NZ Business

This week at ANZ

NZ Business

In lockdown - this week at ANZ

NZ Business

ANZ NZ raises limit for contactless purchases

NZ Business

Tips for Working from Home

NZ Consumer

Here to Help - this week at ANZ

NZ Business

Support available for business banking customers

NZ Business

Options available for NZ home loan customers

NZ Business

A week of change at ANZ

NZ Business

Customers' questions - Loan payment deferral

NZ Media Releases

ANZ extends drought assistance package further

NZ Business

Building a better city in a better way

NZ Business

Building strong sustainable farms - the shakedown from new capital rules

NZ Business

‘This is Not a Job Interview’ with Antonia Watson

NZ Media Releases

ANZ announces drought assistance package for Northland farmers

NZ Business

Solar power driving a sustainable Pacific

NZ Business

5 things to watch in 2020

NZ Business

RBNZ’s finalised capital proposals give industry clarity

NZ Business

All New Zealand stands to gain from addressing the waterways challenge

NZ Business

Getting down to grassroots

NZ Business

A sustainable first - Synlait inks NZ's first ESG-linked loan

NZ Media Releases

ANZ finances trans-Pacific subsea internet cable

NZ Community

ANZ leads Housing NZ Wellbeing Bond

NZ Business

Focus of iwi investment shifting

NZ Business

Smart water investment produces a rosé result

NZ Business

ANZ wins Canstar Agribusiness Bank of the Year

NZ Business

Investing makes an impact

NZ Business

Māori playing increasing role in Kiwifruit industry

NZ Media Releases

Growing smarter; wine survey reveals profit, innovation and price on the up

Media

Investment in innovation driving higher returns

Farmers investing in the environment – ANZ survey shows

NZ Media Releases

Booming tourism sector drives growth in hospitality

Agri-tech investment – adopt or risk being left behind

NZ Business

Smart new feature helps consumers stay on top of their bills

NZ Business

What’s up, brew?

NZ Business