NZ Insights

Unlocking Housing Affordability

Liz Kendall

Senior Economist

ANZ NZ Ltd.

David Croy

Senior Strategist

ANZ NZ Ltd

Sharon Zollner

Chief Economist

ANZ NZ Ltd

Housing unaffordability is an enormous problem in New Zealand, with especially significant consequences for our young and most vulnerable – and trends continue to move in the wrong direction.

Making meaningful progress is urgent, and change needs to be bold to reverse the tide. Broadly, we need to release land, build more houses, and better align supply and demand settings.

Even sustained stabilisation in house prices would require a monumental shift in the market, and would be a vast improvement from the rapid house price inflation we are seeing currently.

But it’s not just policy that needs to change – our expectations need to change too. Policymakers and the public both need to be willing to accept house price stabilisation or even gradual real house price declines.

Not only would this help affordability; a managed supply-induced decline in house prices is a much better outcome than a painful correction, which is a risk under the current market structure.

Although policy change can take time, engineering this sort of response in an orderly way is certainly possible, as shown in Canterbury post-earthquakes.

Housing in crisis

Housing affordability is an enormous problem in New Zealand and has worsened significantly in recent decades.

Houses are “unaffordable” right across the country and in some cases severely so (see our August ANZ Property Focus: Locked out for more details).

Nationwide, the median house price has increased from around $100k in the early 1990s to $730k now. But incomes haven’t increased anywhere near as much.

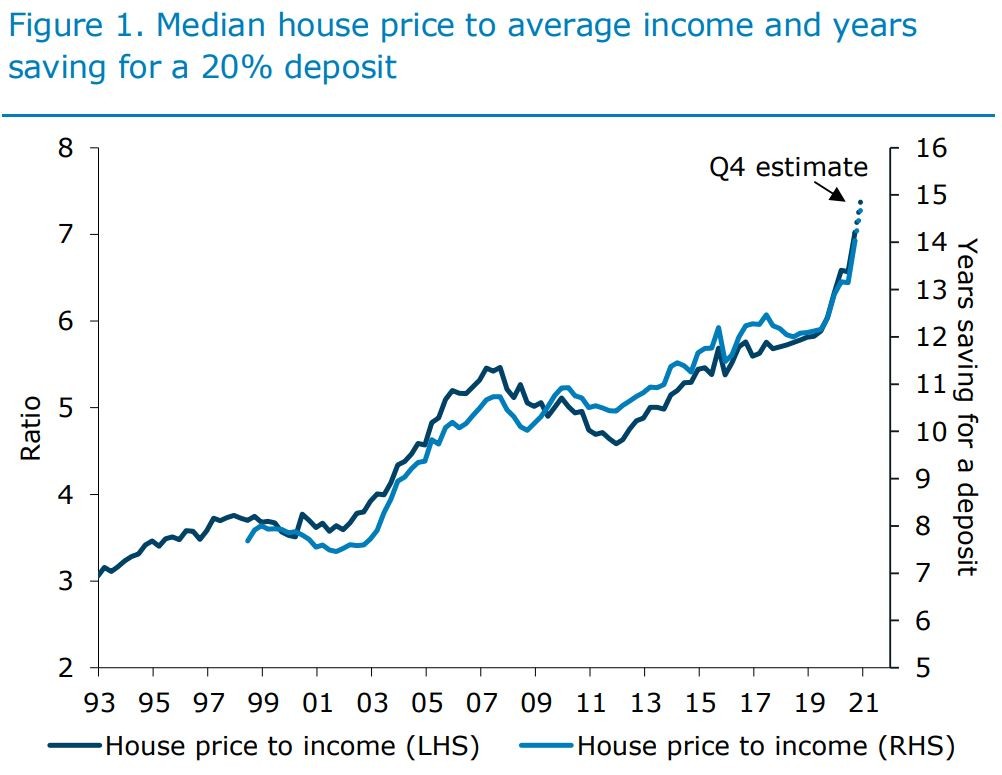

The median house price is now around seven times the average income, compared with three times in the early 1990s (figure 1).

Source: RBNZ, REINZ, Stats NZ, ANZ Research Note: Years to save for a deposit assumes one is on the median income, saving 10% of pre-tax income, based on the current house price.

Mortgage rates have trended down, making debt servicing easier, but it now takes 15 years to save for a 20% deposit even if house prices stand still – about twice as long as a few decades ago.

Not surprisingly, home ownership has fallen for all age groups, but especially for younger people (see NZ Insight: The intergenerational divide).

And it’s not just home ownership that is out of reach. Rents are expensive too and have risen faster than incomes in recent years. Although it’s a complex issue, high housing costs are also an enormous part of the problem of endemic homelessness and deprivation in New Zealand.

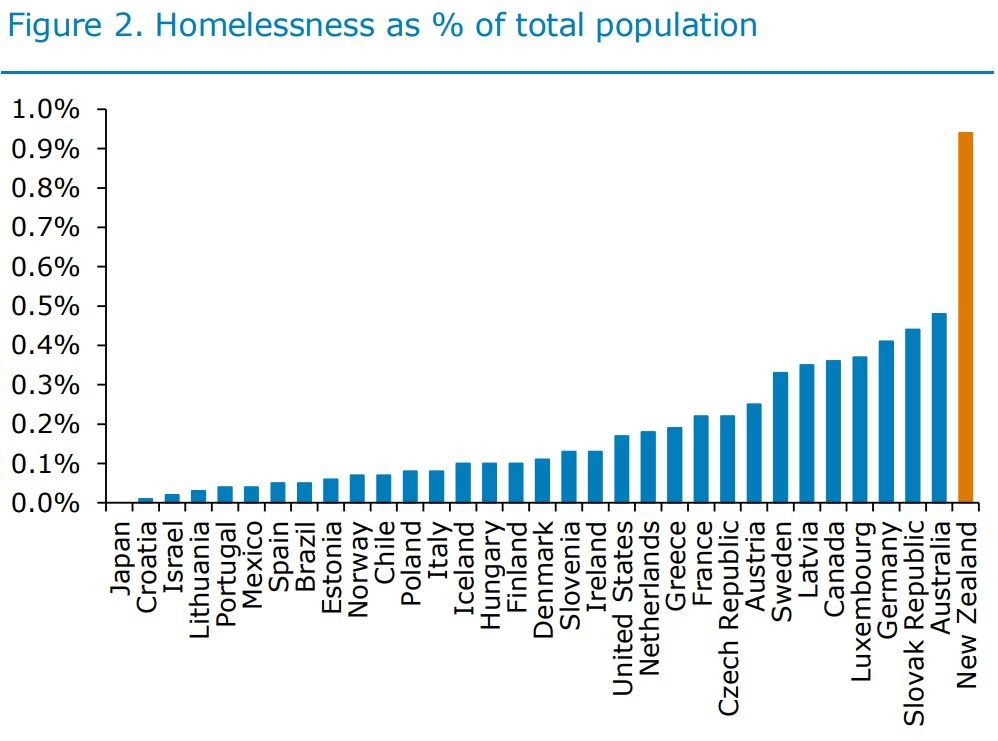

Almost 1% of New Zealand’s population are homeless (or severely housing deprived).

That’s the highest rate amongst OECD economies – almost twice that of the runner up, Australia (figure 2).

The implications of homelessness are significant and distressing, particularly for children and other vulnerable groups.

Source: OECD

The heart of the issue of housing unaffordability is that not enough homes have been built to meet the growth in our population, and housing supply has not been sufficiently responsive to changes in demand, financial conditions – and price.

In recent decades, lower interest rates and increased credit availability have contributed to rising house prices, but the potency of these effects is directly linked to the fact that supply has not been responsive to changing trends.

Reflecting these supply issues, we have an infrastructure deficit and a significant existing housing shortage, which we estimate could be anywhere in the realm of 60-120k homes.

And looking forward, expectations that demand will continue to outstrip supply have been baked into house prices today. Land supply, in particular, is constrained and has not grown with population pressures.

Scarcity of buildable land has been an increasing problem, due to planning and zoning restrictions, land banking, urban-drift, poor infrastructure provision and other land-use pressures.

Meanwhile, population pressures have been very significant, in part due to very strong immigration cycles. Meanwhile, real income growth has been sluggish, in large part due to our poor productivity record.

That has had a myriad of direct consequences:

- House prices have risen significantly, reflecting the scarcity of homes. Homeownership has fallen.

- Homelessness is high and household size is higher than desired (in some cases leading to overcrowding) because housing is unaffordable.

- Housing costs (from owning or renting) take up a significant portion of incomes, even with lower interest rates having kept debt-servicing costs contained.

- When interest rates fall, this pushes up house prices significantly. If housing (and land) were more responsive, more stimulus would be channelled towards home building and improvements instead.

- Large housing cycles are the norm, because building is slow to catch up when demand increases. Internationally, areas with more responsive housing supply have lower rates of house price inflation and smaller cycles.

- Although house prices tend to rise on average, the market is vulnerable to short-term, painful corrections when interest rates rise, income prospects change, supply responds, population adjusts or risk-taking behaviour changes, exacerbated by high debt levels.

- Productivity is weaker than it would otherwise be, with households having to spend more time saving for a deposit, which diverts funds away from business ownership and investment.

"It now takes 15 years to save for a 20% deposit even if house prices stand still – about twice as long as a few decades ago."

Liz Kendall, Senior Economist, ANZ NZ Ltd.

A simple solution, in theory

The solution is simple enough to describe: we need to have a plan to efficiently house and provide infrastructure for our growing population and we need a productive economy so that our incomes can grow.

In practice, that means freeing up land, building many more houses, and aligning demand and supply settings, with a continuous and responsive pipeline to meet population pressures.

We need to make meaningful change to elicit a sustained stabilisation or even gradual decline in real house prices, alongside productivity-enhancing initiatives to boost our real incomes.

But attitudes need to change too

For houses to become more affordable, they need to be cheaper, or at least not appreciate in value while incomes catch up.

That’s the obvious truth that needs to be accepted for the sort of change to materialise that would address our housing affordability and homelessness problems.

Encouraging income growth through productivity-enhancing policies would be helpful, but is challenging to achieve, and on its own is unlikely to be enough to elicit meaningful change in housing affordability.

These underlying issues have been well understood for some time (see Productivity Commission Housing Affordability Inquiry Full Report and A Stocktake of New Zealand’s Housing for discussions).

And to their credit, the Government has been working on these issues for a while, making improvements. But the response needs to be bigger, bolder and more urgent.

To do this, political buy-in for a fundamental change within the housing market is needed. Allowing the market to function more freely would reap benefits, in aggregate and over time, even if some homeowners have to forego something now.

Specifically, we – homeowners, local and central government and the general public – need to be willing to accept a lack of capital gains in housing, or even be willing to stomach a fall in our asset values, while incomes catch up.

That goes against the “Kiwi psyche” and expectations of perpetual house price increases. But it’s absolutely necessary. Stabilisation in house prices would be a vast improvement from the rapid inflation we are seeing currently.

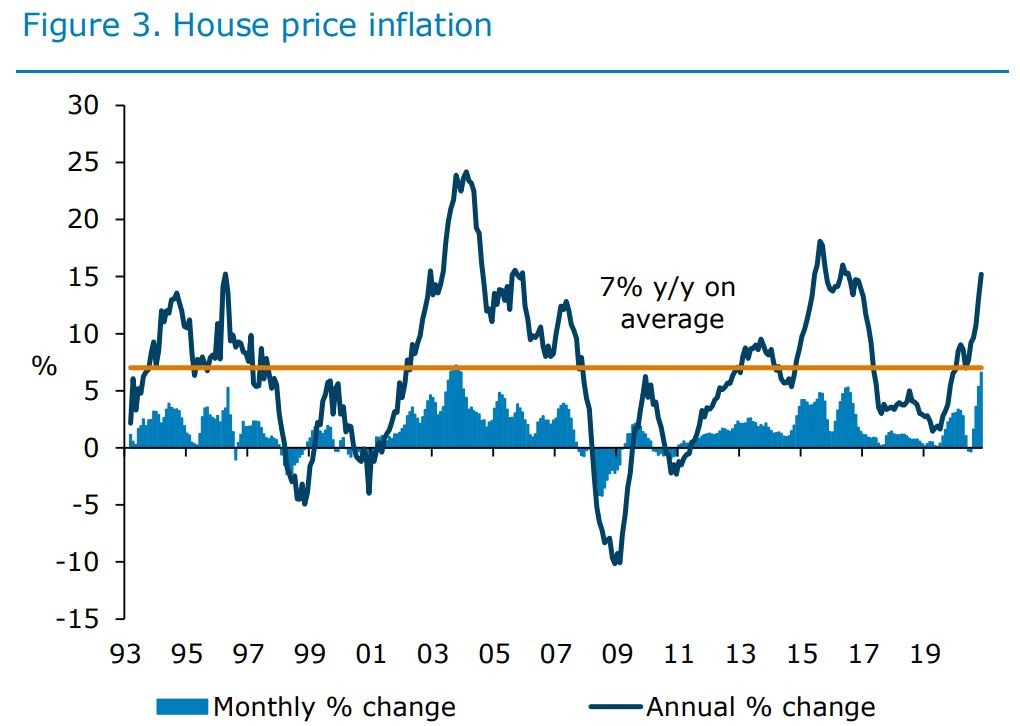

House prices have increased 7% per year on average since the early 1990s (figure 3), with a lot of ebb and flow. Even a sustained stabilisation would require a monumental shift in the market.

On that sort of trajectory, progress to houses being significantly more affordable would still take a long time.

But we have to be willing to reverse the tide. If houses are to become truly more affordable, a decline in real house prices needs to be accepted too. This need not be catastrophic or scary.

A gradual decline engineered out of continuous expansion in construction could lead to increased growth and spending.

Source: REINZ, ANZ Research

By contrast, a disorderly adjustment would have demand-choking effects.

House price declines become problematic when they see households in financial distress or credit contract.

House price falls can and do happen, and the possibility of an eventual painful adjustment if we continue with the status quo should not be downplayed.

We need a responsive market to reduce the sorts of house price swings that are common in New Zealand, and which can pose risks to the economy and financial system.

For owner-occupiers, stabilisation or gentle decline in real house prices doesn’t necessarily mean a material loss in wealth. First, housing is a long-held asset that reaps rental benefits not just capital gains, and over the long term, benefits of home ownership are still enormously significant.

Second, upsizing would be more affordable, neutralising the effect on purchasing power. Nor would it mean a material change in financial prospects for those connected to the market – houses still need to be rented, built and sold, and loans will be required and paid back.

Plus, to the extent that high house prices are hampering our productivity (we think they are), more affordable houses would have long-term real income benefits.

If we did see a gradual decline in real house prices, a drop in returns would be expected for property investors relative to history. But that would be the case for any reduction in house price inflation relative to expectations.

Current rates of house price inflation are unsustainable.

Meaningful, orderly change is possible

Making meaningful change can be challenging and take time to implement. But it is absolutely possible to address housing affordability problems in a way that is orderly.

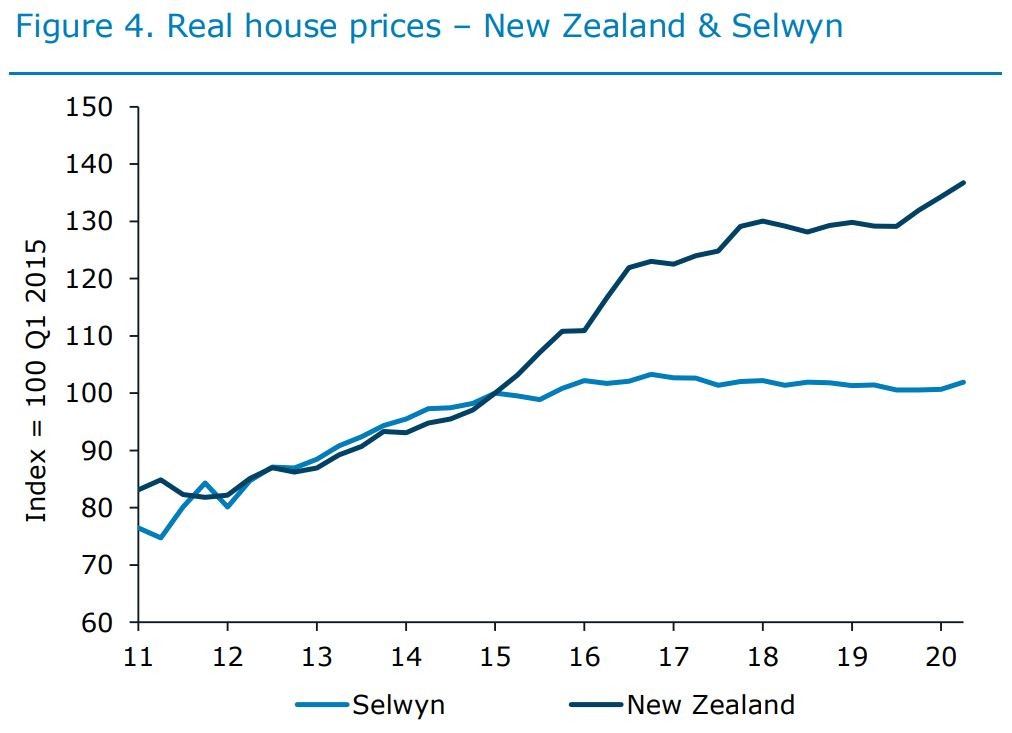

We have seen it done across Canterbury post-earthquakes, with particular success in Selwyn District, where population growth has been very strong, the regional economy is buoyant, and yet housing supply is expanding and real house prices have been pretty flat.

Since 2015, real house prices in Selwyn have risen just under 2%, while across New Zealand they have risen 37% (figure 4).

Given income gains, house prices in Selwyn have been getting gradually more affordable.

This is despite very strong population growth, with the population increasing 60% since 2011.

The crux of the response in Selwyn has been making land available to house the growing population and facilitating new building. Government and local council have worked together to do the following, and have done this efficiently and effectively:

- Release significant parcels of land in accordance with the Selwyn Housing Accord.

- Develop parcels with a minimum net density to use land efficiently.

- Release large parcels under single ownership to encourage building at scale.

- Streamline resource consents to speed up and simplify the process.

- Develop a 30-year infrastructure growth plan.

Source: Quotable Value, Stats NZ, ANZ Research

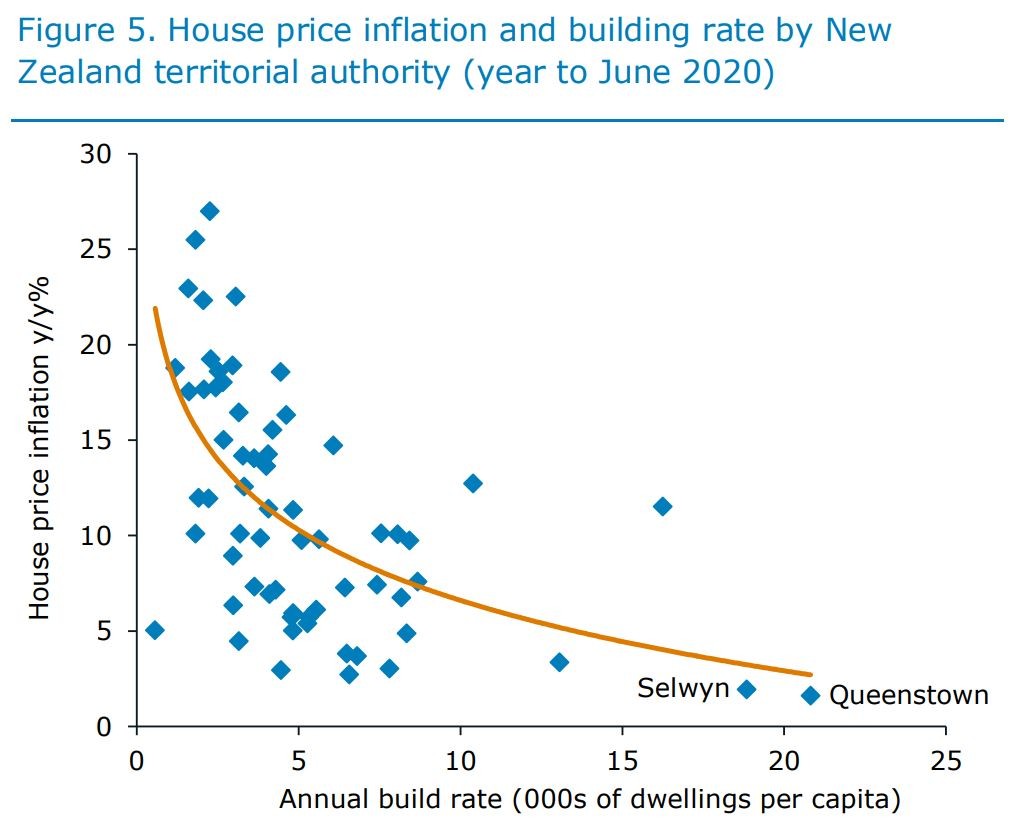

The importance of this housing supply response should not be downplayed, and is borne out when looking at regional data.

The relationship between house prices and lack of building is not always obvious, since building often lags price rises.

But the relationship has been stark recently: areas that have built more have had less rampant house price inflation (figure 5). Selwyn and Queenstown are clear outliers; building has been very rapid to accommodate population growth.

Source: Quotable Value, Statistics NZ, ANZ Research

Unlocking the solution

Broadly speaking, addressing the problem of housing unaffordability has three interrelated parts.

Part 1: Free up buildable land

A fundamental part of the solution to unaffordable housing must be to make land supply more responsive to changing housing demand.

However, this needs to be done in a way that minimises the environmental impacts as far as possible.

Currently, insufficient land is available for construction, reflecting stringent land use restrictions (urban boundaries, size and height requirements, long and difficult consultation processes, and red tape) and few penalties for land banking, where investors or developers lock up large swathes of housing-zoned land and release it only at a trickle to hold prices up and maximise profits.

Many developers release houses in developments only slowly to create the appearance of limited availability when in reality the pipeline is ongoing.

Because buildable land is so scarce and expected to remain so, this has been capitalised into very high land prices. An enormous portion of the cost of a house is the cost of the land it is on – up to 56% in Auckland.

While appropriate land use planning is very important for liveable, sustainable metropolitan areas (and climate change makes long-term planning even more essential), unnecessary land use restrictions need to be relaxed urgently, and penalties need to be introduced for passively holding housing-zoned land for long periods without developing it.

Making land available, in practical terms, takes time, since infrastructure for greenfield development is also required (see Part 2), but it is fundamental to any housing solution – and signalling could make a difference now.

Expectations of tight supply are baked in, so a strong, and binding, commitment that more land will come available in future could help to put a lid on further price rises as expectations adjust.

As part of this, some degree of expansion of urban boundaries is needed to reflect growth in the population.

At the same time, increasing our buildable land means making more efficient use of the land we already have available, meaning more intensification.

Building smarter and more densely around public transport hubs is also crucial to ensure that new-build houses aren’t an ever-longer car drive from where people need to be. It has to be a combination approach.

Not all kiwis want to live in inner city apartments or townhouses, but some do, especially as a first step on the property ladder. Restrictions that inhibit scope for more intensive building are not helpful.

Smaller and less bespoke housing options should be available for those in the market who want them. And let’s be frank, for those who are homeless, a small, homogenous house is much better than none.

Changes to the Resource Management Act (RMA) are a step in the right direction.

The right changes could help to ensure that planning, infrastructure provision, consenting and building become easier and faster, such that supply constraints are relaxed.

But we can’t just tinker at the edges. As a wise person once noted, property owners tend to be raging libertarians as regards their own property rights, and complete socialists when it comes to their neighbours’ – without even recognising the contradiction.

To achieve real change, existing home owners need to be willing – or forced – to embrace some combination of urban expansion and intensification.

That means pushing back against “not in my backyard” thinking, and reducing the power of vested interests.

Work to directly encourage councils and developers to increase buildable land supply would be helpful, perhaps including financial incentives. It’s really hard for local governments to push through changes that are unpopular with current homeowners.

They’re the people who vote. There’s a good argument for central government to play a bigger role - though homeowners vote at much higher rates in general elections as well!

Part 2: Build more houses and infrastructure

Increasing housing supply and making it more responsive isn’t just about freeing up land, although that is key.

It is also about ensuring that conditions are conducive to sufficient infrastructure provision, fast consenting and plentiful and efficient home building in the right places.

To increase home supply meaningfully, incentives need to be aligned to fund infrastructure and encourage property development, including easing financial constraints, potentially using central government funding.

A long-term planning process is also needed to ensure that the civil construction industry doesn’t face a stop-start pipeline that makes it difficult to maintain capacity.

At the same time, work is needed to increase construction industry capacity and reduce costs. Recent initiatives to encourage people to work in trades are definitely helpful.

The industry tends to be dominated by small players, which hampers productivity. Encouraging innovation, scale, better co-ordination of sub-contractors, and building of more homogenous (potentially prefabricated) homes could help.

On construction costs, materials regulation needs to be carefully calibrated.

Building standards absolutely need to be assured through effective regulation, but a common complaint about the current system is that it is an unfortunate mix of highly prescriptive and slow to change, affording a near-monopoly to certain products for which perfectly good alternatives are available.

More competition in building supplies would also help.

Social housing is an important part of the housing solution too, and this may require direct Government intervention.

A radical expansion in available buildable land for new homes and relaxation in red tape to house our homeless population should be high priority.

A central Government-organised build using cheap, mass-produced options to make it happen could be part of the answer. Some good progress has been made in the area of social housing in recent years but much more remains to be done.

Part 3: Align demand and supply settings

Broadly, one of the fundamental issues that has driven worsening housing affordability in New Zealand has been the fact that demand and supply settings have not been well aligned.

We have seen large swings in immigration flows, while housing supply has been constrained.

We need to bring people into the country to meet essential skill shortages, but growing the population in wild surges without a plan to house everyone simply doesn’t work.

In Selwyn, improved housing affordability has been achieved through radical expansion on the supply side.

West Christchurch was blessed with a large supply of flat, accessible, suitable land on their doorstep, which not every city is – indeed the topography of, say, Auckland and Tauranga is extremely challenging.

You could add Queenstown to that list. But it’s not always rivers or estuaries or mountainous peaks that are standing in the way. Often it’s legislation.

And for the country as a whole, supply-side changes are absolutely necessary to combat our existing shortage of buildable land and homes and make supply more responsive.

But the other side of the equation – demand – may need to be considered too if we are to mitigate the extent of future house price rises while supply catches up, not to mention addressing the many issues that climate change is going to unleash – we’re going to have to replace a significant number of houses as time goes on, making growing the housing stock even harder.

Curbing immigration cycles would reduce pressure on the housing stock. It’s still important to meet skill shortages, but with the border currently closed, it’s a good opportunity to take a good hard look at migration settings and what is really best for New Zealand now and into the future.

The composition of demand is relevant too. Initiatives to get first home buyers into the market through the likes of subsidies are well meaning, but have counter-productive effects as higher ability to pay just pushes up house prices further.

Keeping a lid on risky, speculative lending thorough macro-prudential policy is helpful, but changing the RBNZ’s monetary policy mandate is not, since attempting to rein in housing demand with higher interest rates can lead to worse societal outcomes.

We concur with the RBNZ’s assessment that including house prices in their financial policy, rather than monetary policy, remit makes sense.

Adding debt-to-income caps into the RBNZ’s toolkit would also be a good idea to stem financial risks associated with buyers being overstretched.

It could also be worth reconsidering the calibration of bank capital risk weights that tilt the playing field firmly in favour of mortgage lending.

Incentives to reduce the attractiveness of property investment would perhaps be desirable to impact the composition of the market, even if not a game changer for affordability.

The most effective way to reduce the attractiveness of property investment is to reduce the scope for capital gains by increasing supply. But other policy tweaks, such as tax changes, could help at the margin, at least in a one-off fashion.

Changes to tax settings, such as introducing a capital gains tax, are worth considering for broader reasons, like intergenerational equality.

But would only affect housing affordability very slightly, similar to the ban on foreign buyers, which curbed demand in a portion of the market but did not affect overall house prices meaningfully.

And tax changes could have some negative consequences, like discouraging saving and investment.

That said, they could be used as a stopgap to help bring about a pause in the market while other meaningful changes are made.

But the political will for such a broadening of the tax base obviously isn’t there at the moment.

We must act now

Fundamentally, focus needs to be on those changes that will make the biggest difference and lead to significant, sustained impacts. First and foremost, that means tackling the issue of supply constraints.

Sure, it’s complicated and some aspects of the response may take time, but doing nothing simply isn’t an option. The need for action is urgent. There’s potential for meaningful change, but we must act now.

RELATED ARTICLES

NZ Business

Sweet Deal – NZ-EU FTA a win for primary producers

NZ Insights