NZ Consumer

“She’ll be Right” Isn’t Always Right – Thousands Access Free Financial Help

The number of New Zealanders contacting MoneyTalks, one of the country’s leading free financial mentoring services, has almost doubled since last year.

“This year nearly 13,000 people have already taken advantage of MoneyTalks’ free mentoring,” says Rob Egan, MoneyTalks Advisor.

“Covid-19 is having a huge impact on people’s ability to manage their finances,” he says.

Partnering with ANZ New Zealand, MoneyTalks offers customers free access to over 200 financial mentors across New Zealand.

“People need to be confident they are making the right decisions and we are pleased to be able to help them by connecting them with a free and independent financial mentoring service,” says Ben Kelleher, Managing Director - Personal Banking at ANZ NZ.

“With their agreement, we can refer a customer to MoneyTalks and within 24 hours they'lll get a call back from a trained professional who can help,” says Ben.

“The referral partnership with ANZ works well because some people don’t know about us or don’t take that next step to pick up the phone and call us,” says Rob.

“If people seek financial advice early we can help them make any necessary changes with minimum disruption to their lifestyle.”

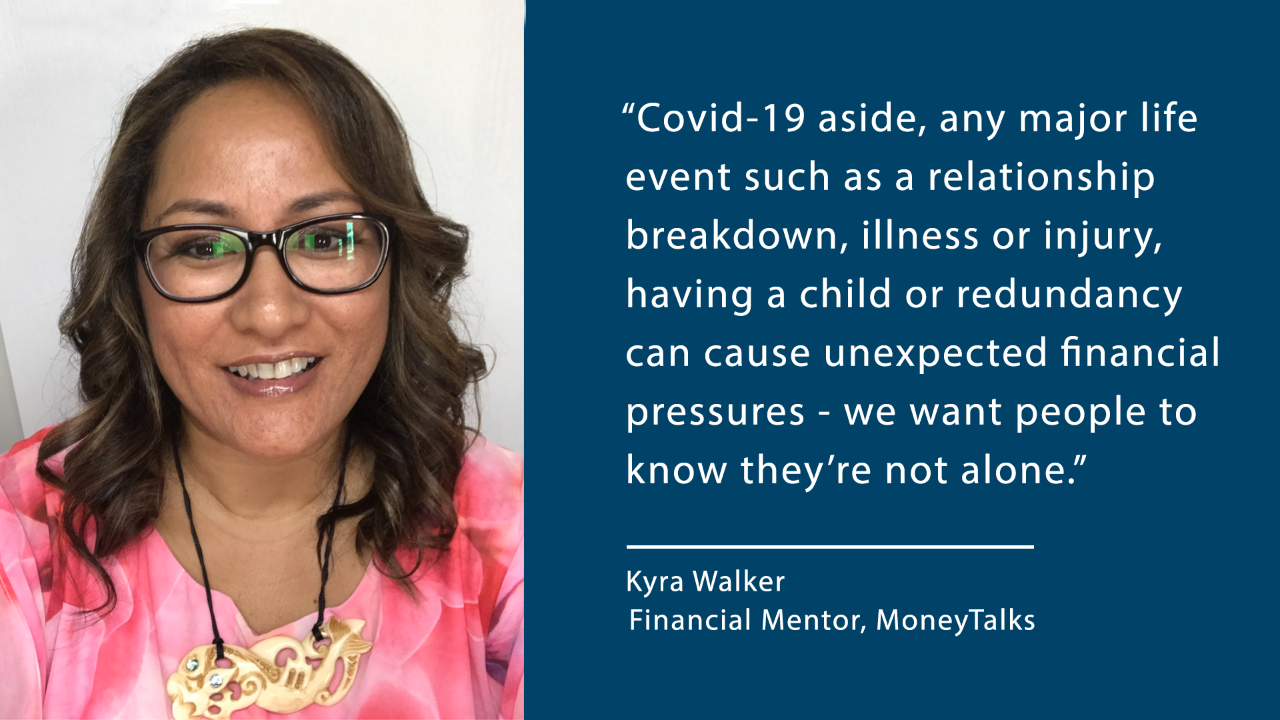

One of MoneyTalk's mentors, Kyra Walker, says a key aspect of the service is that it is non-judgmental.

“There’s never any judgement and all conversations are strictly confidential – all we want is to help people get back to living a good quality life,” she says.

“People are often juggling multiple priorities so to help ease some of the pressure we’ll often sign an agreement with clients meaning we can call creditors or providers on their behalf which frees up their time."

MoneyTalks have financial mentors who are fluent in English, Mandarin, Māori or Samoan.

NEVER TOO EARLY

“One challenge we’re having is people coming to us for advice when they’re already in crisis,” says Rob Egan.

Jake Lilley, who manages the business partnerships for MoneyTalks, agrees.

He says “it’s barriers like the Kiwi ‘she’ll be right’ attitude, cultural stigma and juggling multiple priorities that can get in the way of people seeking advice early.”

“Our Financial Mentors are sensitive to these barriers and the reason some are in the role is because they’ve also faced financial challenges in their lives and they understand how knowing all the options and finding a way forward can relieve so much stress for whānau,” says Jake.

Financial Mentors usually meet in person after an initial phone call and can mentor for a day, a month, a year or longer depending on what the person’s financial situation is.

“Covid-19 aside, any major life event such as a relationship breakdown, illness or injury, having a child or redundancy can cause unexpected financial pressures – we want people to know they’re not alone,” says Kyra Walker, a Financial Mentor at MoneyTalks.

Related articles

NZ Consumer

What would you do if you won Lotto?

NZ Consumer

Survey shows a hint of financial optimism

NZ Consumer

Commerce Commission Market Study into Personal Banking Services

NZ Insights

Navigating the art investment landscape

NZ Consumer

Optimism rises in financial wellbeing survey

NZ Media Releases

ANZ Investments reaches major milestone - over 100,000 KiwiSaver members helped into their first home

NZ Media Releases

Are your retirement plans OK, boomer?

NZ Insights

Strong employment rate helps Kiwis' financial wellbeing

NZ Consumer

"This is Not A Job Interview" with Fiona Mackenzie

NZ Media Releases

ANZ Investments launches High Growth Fund

NZ Consumer

Why can’t I have a 30-year mortgage?

NZ Consumer

Gen Z Revealed as Savvy KiwiSaver Investors

NZ Business

Responsible investment - more than just exclusions.

NZ Consumer

Investing in tech to fight scam 'arms race'

NZ Media Releases

ANZ launches Mother’s Day initiative to raise awareness about financial scams

NZ Media Releases

Let's Talk About Generation X

NZ Consumer

Personal savings are helping Kiwis remain financially resilient

NZ Media Releases

Kiwis wary about future but still feel on top of financial commitments

NZ Consumer

Why are interest rates rising?

NZ Media Releases

Kiwis are wary but keeping up financial wellbeing habits

NZ Consumer

Battening Down The Hatches?

NZ Consumer

Cop this - an arresting talk about money

NZ Consumer

Helping women grow financial confidence and wellbeing

NZ Media Releases

ANZ’s Good Energy Home Loan set to power change

NZ Consumer

Right fund, right contribution, don't panic

NZ Consumer

Interest rates explained - what you need to know

NZ Consumer

How to make 2022 the year you get your finances into shape

NZ Business

Let the capital markets to do the heavy lifting

NZ Business

What we learned from 2021

NZ Consumer

What really matters when it comes to financial wellbeing?

Financial Wellbeing: Why Your Relationship With Money Really Matters

NZ Consumer

Police Warn of Sophisticated New Scam

NZ Consumer

Scams leap during COVID

NZ Consumer

CCCFA law changes: Plan ahead and be patient

NZ Consumer

Interest rates are rising - what should home owners do?

NZ Consumer

Digital Equity For All Ages

NZ Consumer

Essential ANZ workers step up for customers in Level 4

NZ Consumer

Now's a good time to cut thousands off your home loan

NZ Business

Tourism ‘ramp up’ expected as Cook Islands bubble opens

NZ Consumer

ANZ committed to active management following KiwiSaver default provider change

Signs of 'Tentative cooling' in property market

NZ Consumer

Mortgage payments back on track

NZ Consumer

Have you heard the word? ANZ customers embrace Voice ID

NZ Consumer

Financial wellbeing improves despite Covid-19

NZ Consumer

'Stronger together' - ANZ to extend Pacific remittance fee waiver

NZ Consumer

Covid-19 Home Loan Deferral Scheme Ends

NZ Consumer

Debit Card Use On The Rise

NZ Community

Embracing Technology - Helping Seniors Become Tech Savvy

NZ Consumer

Black Friday Sales Boost Spending

NZ Insights

Making Sense of the Reserve Bank's Bag of Tricks

NZ Consumer

Spring Shopping Splurge - the Winners and Losers

NZ Consumer

Could Prefab Solve NZ's Housing Crisis?

NZ Consumer

Tough Times In The Pacific As Customers Rally To Support Friends And Family

NZ Consumer

A Rare and Lucky Escape from Scammers

NZ Consumer

“She’ll be Right” Isn’t Always Right – Thousands Access Free Financial Help

NZ Consumer

Riding High - But Wobbles Expected in NZ Housing Market

NZ Consumer

KiwiSaver in Uncertain Times – Insights from ANZ Experts

NZ Consumer

Property Focus - Lend Me a Hand

NZ Consumer

More Customers Back On Top Of Lending

NZ Consumer

Fees Waived for Online Money Transfers to the Pacific

NZ Consumer

Staying the Course In Volatile Times

NZ Media Releases

ANZIS stops new investment in Bonus Bonds and moves to wind up scheme

NZ Consumer

Locked Out - Covid crisis no game changer for housing affordability

NZ Consumer

Six things you need to know about Kiwisaver

NZ Consumer

What Negative Interest Rates Could Mean for You

NZ Business

Help in a crisis – power up the digital assistant

NZ Consumer

Are you on track for retirement?

NZ Business

Call data reveals NZers lockdown routines

NZ Business

This week at ANZ

NZ Business

In lockdown - this week at ANZ

NZ Business

Tips for Working from Home

NZ Consumer

Here to Help - this week at ANZ

NZ Consumer

KiwiSaver: your questions answered

NZ Business

A week of change at ANZ

NZ Consumer

COVID-19 - Customers' questions answered

NZ Consumer

Winning advice - what to do with your Lotto millions

Loan calculation issue

NZ Consumer

Money mules on the rise

NZ Consumer

ANZ mobile banking app reaches 1 million users

NZ Consumer

Smart Sheep Set for School Trial

New Zealand

ANZ variable home loan rate cut – concern for savers

NZ Consumer

ANZ helps Kiwis into healthy homes

NZ Consumer

ANZ leads $500m Housing NZ Sustainability Bond

New build lending hits four-year high

NZ Consumer

From term deposits to turtles – Jamie’s first 100 days of your questions

Media

Boom in KiwiSaver first home withdrawals

Media

Is your KiwiSaver fund too conservative?

NZ Community