NZ Consumer

Investing in tech to fight scam 'arms race'

Antonia Watson

CEO

ANZ New Zealand Ltd.

It was heart-breaking to read about yet another New Zealander this week having their life savings wiped out by a sophisticated investment scam.

The story is eerily familiar with fancy brochures and a con artist on the end of the line. They have all the angles covered with convincing backstories and a push to get the deal done quickly.

Such stories tear at our heart and undermine trust in the simple functions that help life click along.

And they are increasing. The US’s Federal Trade Commission estimates the global toll to be an eye watering US$8.8 billion, while closer to home it’s reported the losses every year are in the tens of millions but growing rapidly.

How do we beat this?

Banks know a bit about risks and handling cash, they have constantly adapted to new challenges and that is happening now.

As an industry we are investing millions in new technologies but it’s turning into a type of arms race.

As soon as we close one avenue, another opens, and fraudsters use behavioural psychology techniques as a tool to open wallets.

"We are investing more than ever on preventative technology, and we are even testing world-leading biometrics as one way to make sure it’s our customer making a transaction on their device. This may sound incredibly futuristic - and it is - but we plan to have this operational in New Zealand next year."

Antonia Watson, CEO, ANZ New Zealand Ltd.

At ANZ, we are investing more than ever on preventative technology, and we are even testing world-leading biometrics as one way to make sure it’s our customer making a transaction on their device.

This may sound incredibly futuristic - and it is - but we plan to have this operational in New Zealand next year.

While this will help prevent criminals who have tricked you into giving access to your device, it won’t stop customers getting duped by investment or romance scams.

These remain the biggest source of customer losses and it’s the area where we can all do more to protect ourselves. There are few simple things to remember.

Be wary if someone presents you with an investment opportunity from an unexpected phone call, social media chat seeking a relationship, fake websites, or social media posts.

Before investing money, research the company, the investment opportunity, and the people behind it. Look for information from independent sources, including regulatory agencies, financial analysts, and reputable news outlets.

Before making any decisions, consult a licensed financial advisor or investment professional.

It’s important to be cautious when interacting with people online. Be wary if you’re asked for money or personal information, especially by someone you have never met.

Never give somebody access to your accounts. Under no circumstances will a bank ask for your password, PIN, two factor authentication codes or remote access to your devices. Never.

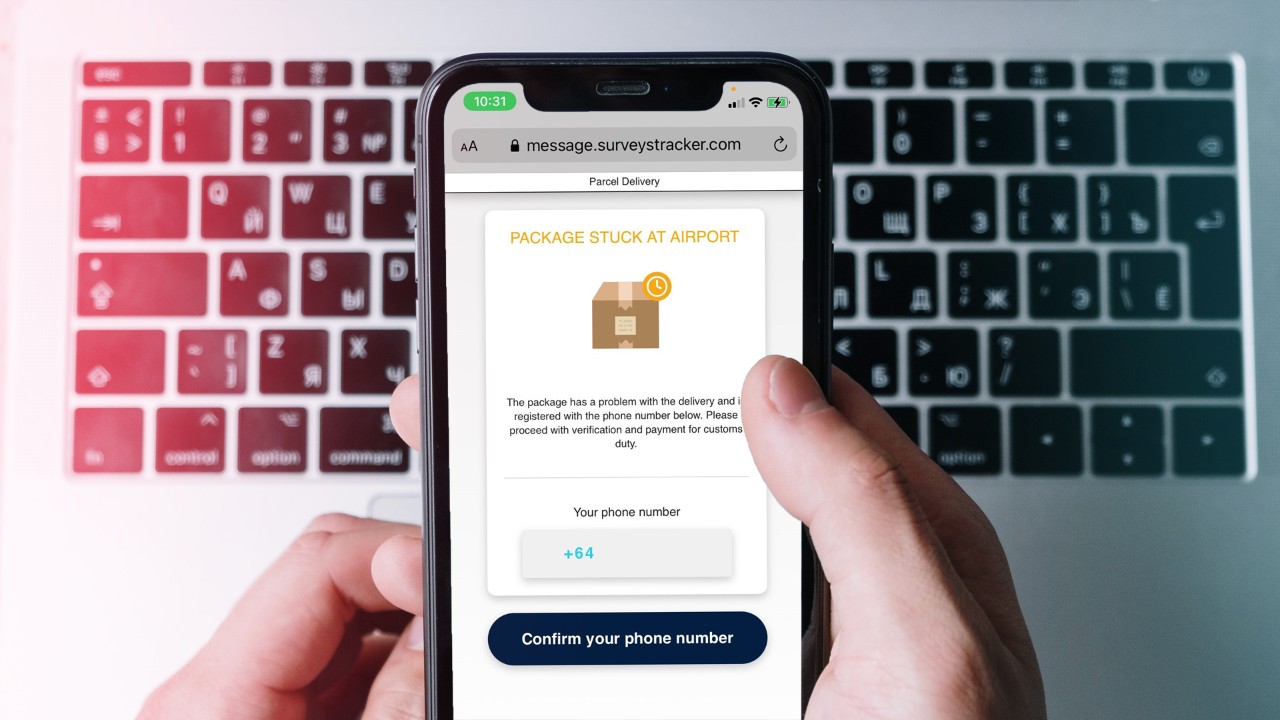

Protect yourself online. Don’t click on links even if it’s from a well-known company as it could be a trick to get you to enter in your credit card or online banking login details.

If in doubt, call the company direct on their publicly listed number and ask to speak with someone.

Hang up on anybody calling asking for private information. Remember, and I can’t stress this enough, a bank will never ask for your banking details, remote access to your device, or things like your two-factor authentication codes, no matter how convincing the person on the other end of the phone.

If you get an unexpected text from a family member asking for money, usually from a new number, ask questions only they would know the answer. Better still, ask them to FaceTime!

This all sounds simple enough, but con artists are skilled at getting you to act quickly. They also prey on those that are less digitally savvy.

To help combat this, we recently launched a campaign to help keep your loved ones safe from scammers by creating a Screen Saver with handy banking safely tips for them.

Basically, you take a photo of your kids holding a sign with one of our tips and apply it to the wallpaper on their device, so they have photos they want with the security advice they need.

While only launched this month, it’s already been incredibly successful with thousands of downloads protecting those New Zealanders more at-risk to scammers.

Possibly the most important thing to remember is if you have doubts to trust your instincts, and if your bank suggests it could be a scam, take a moment and do more research.

If the bank is warning you, it is probably fishy and once you instruct a bank to make a transfer it can be very difficult to recover that money.

And, finally, if you think you have fallen victim to a scam, contact your bank immediately. Don’t be embarrassed, it’s happened to plenty of others, and we can only help if we know about it.

This article was first published in the New Zealand Herald.

RELATED ARTICLES

NZ Consumer

What would you do if you won Lotto?

NZ Consumer