NZ Consumer

Black Friday Sales Boost Spending

Black Friday sales have become an established part of New Zealand’s shopping calendar, the latest ANZ card data suggests.

ANZ’s November card data shows spending was up 4% from 12 months ago, with most of the growth coming in the past week from the Black Friday and Cyber Monday sales.

Spending over the Black Friday/Cyber Monday week increased by 13.3% on the week before.

“We saw a similar impact in 2019. The Black Friday sales, which are spread over several days and have their origins in the US, are now firmly established in New Zealand,” says ANZ Managing Director of Personal Banking, Ben Kelleher.

The increase in spending in the final week included a slight lift in spending on overseas websites, but the great bulk of the spending (90%) was domestic.

“The increase in spending started early, on the Thursday, and was hefty right through to Monday. The single biggest day was Monday, followed by Black Friday,” Mr Kelleher says.

“The overseas spending category increased 17% from the week before, which suggests many people were looking for bargains on overseas websites.”

Total overseas spending was down 22% in November, compared to the same month a year ago.

“That reflects the lack of international travel due to COVID-19. What spending we are seeing is made up of goods ordered from offshore websites, or through the use of apps like Netflix, Spotify and online gaming services,” Mr Kelleher says.

ANZ transactions account for around 30% of all card spending by New Zealanders and are therefore are a good barometer for the economy.

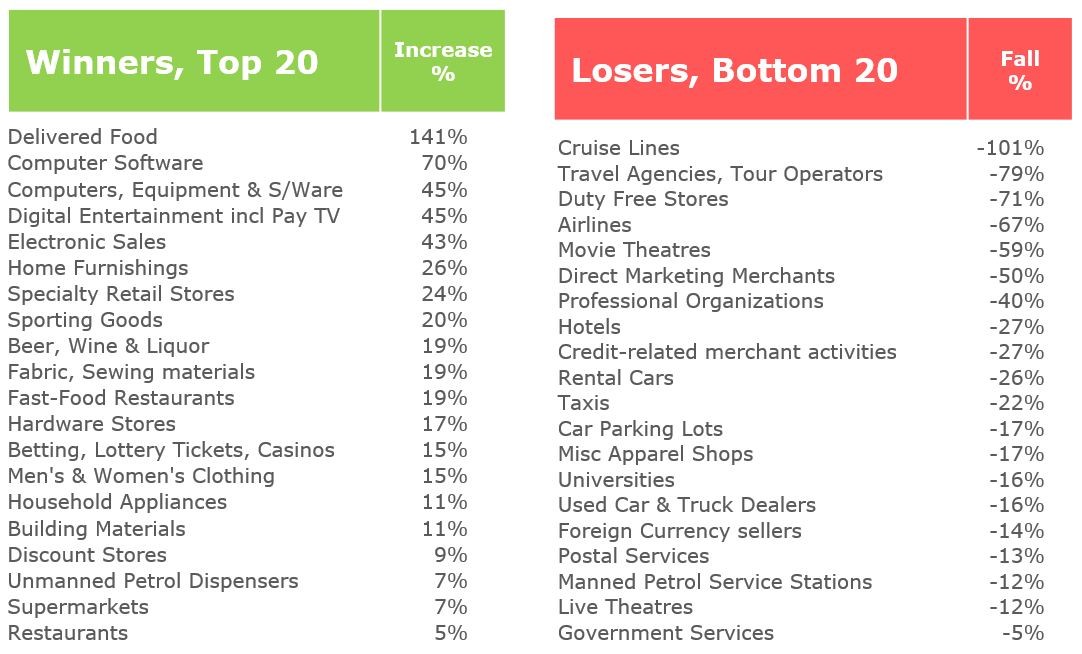

ANZ cardholder spend split by merchant category for Nov-20 vs Nov-19. Note negative spend arises from refunds made from cancellations.

Spending for the entire month was up across many categories, and was particularly strong in the delivered food, computers and digital entertainment categories.

Spending on delivered food rose 141% from the same time a year ago, reflecting the increase in the numbers of people using.

The computer software category leapt 70%, while spending on computers and equipment was up 45% from November 2019, as households continue setting up work from home offices.

Digital entertainment (including pay TV) also rose by 45%, and sales of electronic goods (including computer hardware, TVs, radios, cameras and car stereos) increased by 43%.

“We also saw continued strong sales from categories linked to housing” says Kelleher.

The home furnishings category was up 26% from the same time a year ago, spending at hardware stores rose by 17% from November 2019, while both building materials and household appliances rose by 11%.

This trend has been seen for several months.

Although some categories are doing well, others are sharply down from a year ago, as a result of the COVID-19 pandemic.

This is particularly evident for retailers involved in travel and tourism.

Spending on cruise lines has plunged 101% from November 2019. The negative figure reflects both the drop in spending and the continued processing of refunds.

Travel agencies and tour operators fell by 79% from November 2019, duty free shops are down 71% and airline spending has decreased by 67%.

RELATED ARTICLES

NZ Consumer

What would you do if you won Lotto?

NZ Consumer

Survey shows a hint of financial optimism

NZ Consumer

Commerce Commission Market Study into Personal Banking Services

NZ Insights

Navigating the art investment landscape

NZ Consumer

Optimism rises in financial wellbeing survey

NZ Media Releases

ANZ Investments reaches major milestone - over 100,000 KiwiSaver members helped into their first home

NZ Media Releases

Are your retirement plans OK, boomer?

NZ Insights

Strong employment rate helps Kiwis' financial wellbeing

NZ Consumer

"This is Not A Job Interview" with Fiona Mackenzie

NZ Media Releases

ANZ Investments launches High Growth Fund

NZ Consumer

Why can’t I have a 30-year mortgage?

NZ Consumer

Gen Z Revealed as Savvy KiwiSaver Investors

NZ Business

Responsible investment - more than just exclusions.

NZ Consumer

Investing in tech to fight scam 'arms race'

NZ Media Releases

ANZ launches Mother’s Day initiative to raise awareness about financial scams

NZ Media Releases

Let's Talk About Generation X

NZ Consumer

Personal savings are helping Kiwis remain financially resilient

NZ Media Releases

Kiwis wary about future but still feel on top of financial commitments

NZ Consumer

Why are interest rates rising?

NZ Media Releases

Kiwis are wary but keeping up financial wellbeing habits

NZ Consumer

Battening Down The Hatches?

NZ Consumer

Cop this - an arresting talk about money

NZ Consumer

Helping women grow financial confidence and wellbeing

NZ Media Releases

ANZ’s Good Energy Home Loan set to power change

NZ Consumer

Right fund, right contribution, don't panic

NZ Consumer

Interest rates explained - what you need to know

NZ Consumer

How to make 2022 the year you get your finances into shape

NZ Business

Let the capital markets to do the heavy lifting

NZ Business

What we learned from 2021

NZ Consumer

What really matters when it comes to financial wellbeing?

Financial Wellbeing: Why Your Relationship With Money Really Matters

NZ Consumer

Police Warn of Sophisticated New Scam

NZ Consumer

Scams leap during COVID

NZ Consumer

CCCFA law changes: Plan ahead and be patient

NZ Consumer

Interest rates are rising - what should home owners do?

NZ Consumer

Digital Equity For All Ages

NZ Consumer

Essential ANZ workers step up for customers in Level 4

NZ Consumer

Now's a good time to cut thousands off your home loan

NZ Business

Tourism ‘ramp up’ expected as Cook Islands bubble opens

NZ Consumer

ANZ committed to active management following KiwiSaver default provider change

Signs of 'Tentative cooling' in property market

NZ Consumer

Mortgage payments back on track

NZ Consumer

Have you heard the word? ANZ customers embrace Voice ID

NZ Consumer

Financial wellbeing improves despite Covid-19

NZ Consumer

'Stronger together' - ANZ to extend Pacific remittance fee waiver

NZ Consumer

Covid-19 Home Loan Deferral Scheme Ends

NZ Consumer

Debit Card Use On The Rise

NZ Community

Embracing Technology - Helping Seniors Become Tech Savvy

NZ Consumer

Black Friday Sales Boost Spending

NZ Insights

Making Sense of the Reserve Bank's Bag of Tricks

NZ Consumer

Spring Shopping Splurge - the Winners and Losers

NZ Consumer

Could Prefab Solve NZ's Housing Crisis?

NZ Consumer

Tough Times In The Pacific As Customers Rally To Support Friends And Family

NZ Consumer

A Rare and Lucky Escape from Scammers

NZ Consumer

“She’ll be Right” Isn’t Always Right – Thousands Access Free Financial Help

NZ Consumer

Riding High - But Wobbles Expected in NZ Housing Market

NZ Consumer

KiwiSaver in Uncertain Times – Insights from ANZ Experts

NZ Consumer

Property Focus - Lend Me a Hand

NZ Consumer

More Customers Back On Top Of Lending

NZ Consumer

Fees Waived for Online Money Transfers to the Pacific

NZ Consumer

Staying the Course In Volatile Times

NZ Media Releases

ANZIS stops new investment in Bonus Bonds and moves to wind up scheme

NZ Consumer

Locked Out - Covid crisis no game changer for housing affordability

NZ Consumer

Six things you need to know about Kiwisaver

NZ Consumer

What Negative Interest Rates Could Mean for You

NZ Business

Help in a crisis – power up the digital assistant

NZ Consumer

Are you on track for retirement?

NZ Business

Call data reveals NZers lockdown routines

NZ Business

This week at ANZ

NZ Business

In lockdown - this week at ANZ

NZ Business

Tips for Working from Home

NZ Consumer

Here to Help - this week at ANZ

NZ Consumer

KiwiSaver: your questions answered

NZ Business

A week of change at ANZ

NZ Consumer

COVID-19 - Customers' questions answered

NZ Consumer

Winning advice - what to do with your Lotto millions

Loan calculation issue

NZ Consumer

Money mules on the rise

NZ Consumer

ANZ mobile banking app reaches 1 million users

NZ Consumer

Smart Sheep Set for School Trial

New Zealand

ANZ variable home loan rate cut – concern for savers

NZ Consumer

ANZ helps Kiwis into healthy homes

NZ Consumer

ANZ leads $500m Housing NZ Sustainability Bond

New build lending hits four-year high

NZ Consumer

From term deposits to turtles – Jamie’s first 100 days of your questions

Media

Boom in KiwiSaver first home withdrawals

Media

Is your KiwiSaver fund too conservative?

NZ Community